- Yuan Strengthens Amid Dollar Drop and as Xi Visits Hong Kong

China’s yuan climbed, heading for its biggest quarterly gain in more than six years, amid speculated state intervention at the start of President Xi Jinping’s landmark visit to Hong Kong and as the dollar weakened.

The exchange rate strengthened 0.3 percent to 6.7793 per dollar as of 12:26 p.m. in Shanghai, bringing the advance in the past three months to 1.5 percent. That would be the best quarter since 2010. Traders said they saw heavy flows in dollar-yuan on Thursday morning, with large Chinese banks among those selling the U.S. currency. That followed similar signs of intervention in the last two days.

“Both a broad dollar decline and possible central bank intervention are behind the rally,” said Irene Cheung, Singapore-based currency strategist at Australia & New Zealand Banking Group Ltd. “It looks like the central bank wants to guide the yuan higher amid dollar weakness to show the currency could trade both ways.’

The past six months have seen a turnaround for the currency, which plunged the most since 1994 last year. Propping up the yuan has become a policy priority as Chinese authorities try to stem capital outflows and prevent financial shocks before an important leadership reshuffle in the ruling Communist Party in late 2017.

The People’s Bank of China raised the daily yuan fixing by 0.17 percent to 6.7940 Thursday, the highest level in two weeks. The Bloomberg Dollar Spot Index fell 0.1 percent to 1,183.19, set for its lowest level since September and heading for a second consecutive quarterly drop.

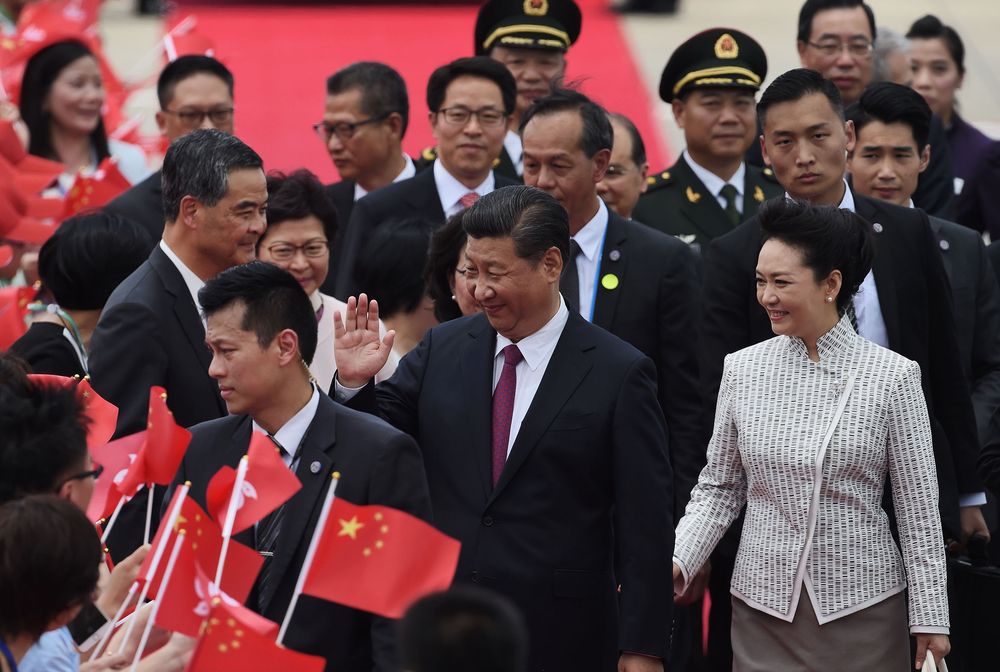

China’s President Xi Jinping and his wife Peng Liyuan arrive in Hong Kong on June 29. Photographer: Anthony Wallace/AFP via Getty Images

Xi arrived in Hong Kong Thursday to mark the 20th anniversary of Chinese rule over the former British colony. China’s yuan will be generally stable with a “slightly stronger” bias in the second half, supported by “sound economic fundamentals,” the China Securities Journal said in a front-page commentary.

After climbing 0.9 percent in the first quarter, the currency was little changed in April and for most of May amid dollar weakness, until a downgrade of China’s sovereign rating by Moody’s Investors Service in late May triggered suspected intervention.

Apart from dollar weakness, “some intervention cannot be ruled out, especially as we see the onshore yuan starting to trade persistently stronger than onshore,” said Fiona Lim, senior currency analyst at Malayan Banking Bhd. in Singapore. “The PBOC has also stated no further tightening in the second half. So, to keep the yuan stable, they seem to be using the fixing to support it as we move into the next half of the year.”

The onshore yuan has strengthened about 1 percent in the past three days, and touched the highest level since November on Thursday. In Hong Kong’s offshore market, the currency also climbed for a third day, rising 0.26 percent to 6.7861, set for a quarterly gain of 1.26 percent.