- Forex Weekly Outlook June 19-23

Despite the weak job data and inflation rate, the Federal Reserve raised rates by 25 basis points to 1.25 percent. Creating further uncertainty amid political investigations in the U.S. and weak global growth.

Even though, the Fed committee was optimistic about pricing and job creation, the foreign exchange market responded differently to the U.S. dollar after retail sales figure showed another 0.3 percent decline. Suggesting consumers are wary of the political tension and uncertainty.

In the UK, the inflation rate jumped 2.9 percent, while retail sales declined 1.2 percent in May. The broad decline was as a result of drop in earnings and rising consumer prices that eroded consumers’ buying power. Plunging the pounds against majors.

CADJPY

The Canadian dollar gained against most of its counterpart last week after Bank of Canada signals that higher rate is possible later in the year with solid job data released two weeks ago and surge in oil prices. This bolstered the attractiveness of the loonie and the odds of a rate hike to 90 percent.

While on the other hand, the Japanese yen declined following the decision of Haruhiko Kuroda led Bank of Japan to maintain current stimulus level without an exit strategy, citing weak inflation, lacklustre wage and slow consumer spending.

Technically, CADJPY closed above 83.11 resistance for the first time in almost 3 months, and above 20 days moving average for the first time in almost 4 months last week. Indicating market has started pricing in potential rate hike and a series of positive economic data coming out of Canada of late.

Therefore, the pair is expected to attract enough buyers this week to boost it towards 86.36 resistance levels. Hence, I will be looking to buy this pair above the new support, 83.11 for 86.36 targets.

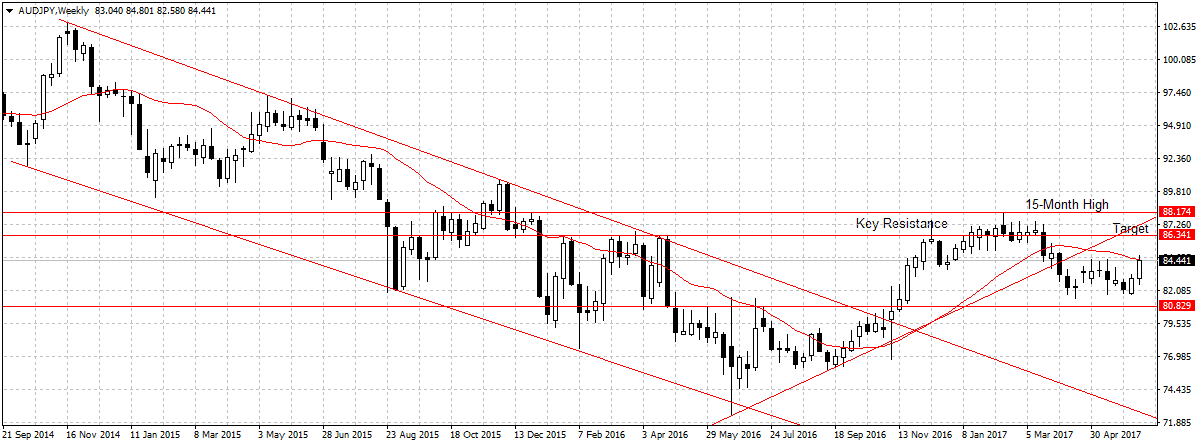

AUDJPY

After the Reserve Bank of Australia tightened lending rate amid fear of housing bubble. The house prices declined for the first time in 17 months and the unemployment rate improved to 5.5 percent, a 4 year low.

While, the strong labour market boost Aussie dollar’s attractiveness, the Japanese Yen dipped as explained above.

Given Australian dollar the edge to gain about 200 pips last week. Accordingly, I am expecting Australia’s positive data and renewed interest to aid AUDJPY rally further this week. Therefore, this week, I will be looking to buy this pair above 84.44 levels for 86.34 targets.

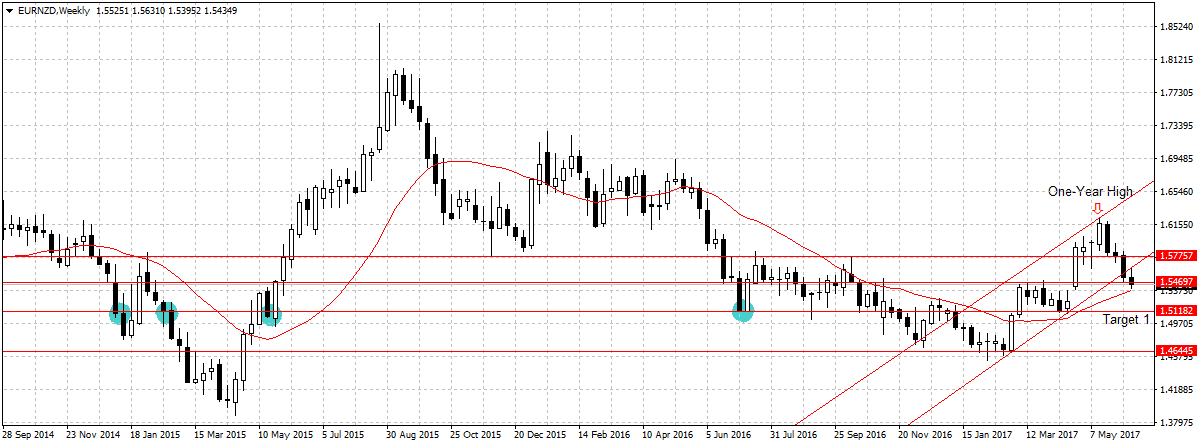

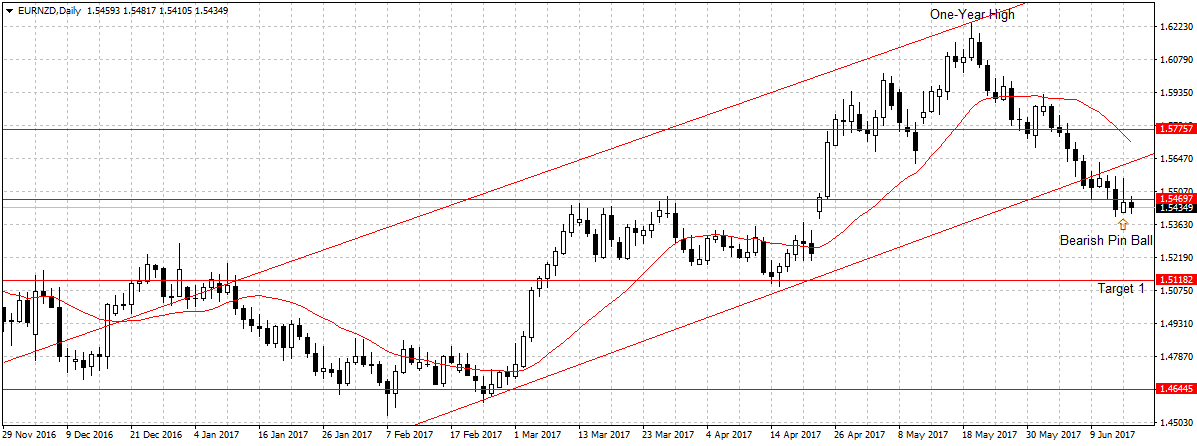

EURNZD

The failure of the European Central Bank to state its exit strategy and get its inflation up, even though the economy is growing at a healthy pace has dampened its outlook and demands among investors.

However, the New Zealand dollar on the other hand, continued to attract buyers after data showed the economy expanded 0.5 percent in the first quarter and current account surplus stood New Zealand $240 million.

From the chart above, this pair dropped 800 pips in the past one month but last week closed below the 1.5469 support for the first time in two months. Indicating the strength of the bearish movement established a month ago.

Again, EURNZD daily candlestick of Thursday confirmed bearish continuation by closing as a bearish pinball. Also, below the 1.5469 price levels. Therefore, this week as long as 1.5469 holds I am bearish on this pair and will be looking to sell for 1.5118 targets.

Last Week Recap

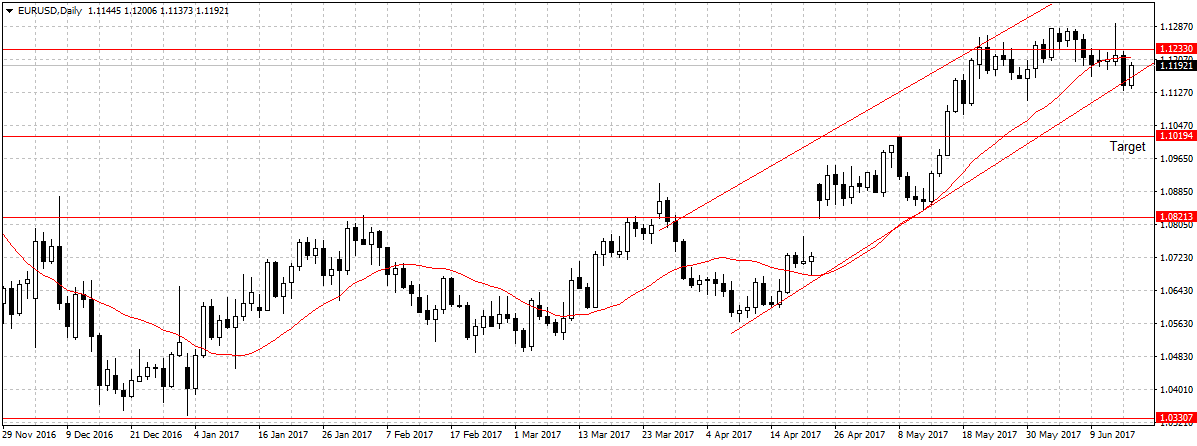

Last week, the EURUSD was 20 pips short of our 1.1117 targets. The rebound is largely due to poor economic data released on Friday as explained above. But the bearish pinball established 3 weeks ago remained valid and as long as 1.1233 resistance holds I remain bearish on this pair. This is because the US economic data is solid when assessed from on a long-term perspective and in line with Fed targets.

Again, the Euro single currency is overpriced without substantial data to sustain current gain. Therefore, a sustained break below the ascending channel should reinforce sellers’ interest and open up 1.1019 targets in days to come.

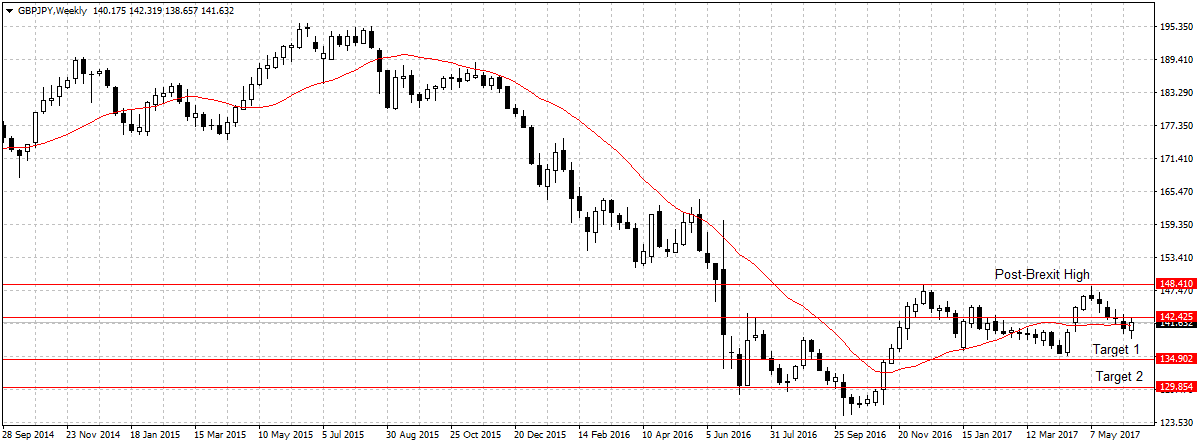

GBPJPY

The pound gained against the Japanese Yen despite its negative economic data and political issues because the Yen was dumped by investors last week after BOJ failed to succinctly state its exit strategy and raise rates.

As long as 142.42 holds, I am bearish on this pair and will be looking to add to my position.