- Forex Weekly Outlook June 5-9

The U.S. dollar declined against all the 16 major currencies on Friday after data showed the economy added fewer jobs than projected in May. Employers added 138,000 jobs last month, which is below 182,000 jobs expected by economists. This brings the monthly average payroll gains this year to 162,000, a step below the 187,000 recorded in 2016.

Even though, the unemployment rate improved to a 16 year low of 4.3 percent. Wage rise remains stagnant and participation rate continues to drop amid political uncertainty in the world’s largest economy.

Therefore, while most experts believed this is a temporary dip and not enough to stop the Fed from raising rates this month, it is highly unlikely that the Fed will hike rates amid moderate pricing and an okay labor market with a weak participation rate. Hence, one of the reasons stocks surged after the data were released, signalling a lack of conviction among investors that the Fed will raise rates this month.

Also, the market has started pricing in the infrastructure plan and privatisation due to be announced tomorrow by the President. This is expected to boost the outlook of those stocks even more.

In the U.K., the Labour party has substantially closed the gap between Theresa May’s Conservative party ahead of June 8 election. Creating uncertainty in the financial markets and further plunging the embattled pound against major currencies.

Accordingly, the housing price declined (0.2%) for third consecutive month in May, making it the worst longest streak for the housing market in 9 years.

However, the strong domestic demand continued to aid manufacturing activities, especially with the steady earnings. But considering the percentage contributed by the manufacturing sector to the entire economy its performance may not be enough to boost weak growth during Brexit discussion.

Oil, the OPEC and non-OPEC were able to extend production cuts by 9 months but the oil prices continued to decline as the U.S. production grows. Accordingly, the decision of President Donald Trump to pull out from Paris Climate agreement would aid shale producers and it is expected to further disrupt OPEC strategy going forward. Likewise, OPEC is expected to react with an appropriate strategy, possible a 3 months rollover.

Generally, the political uncertainty in the U.S continued to weigh on business sentiment ahead of former FBI director, James Comey, testimony on Thursday. While, the U.K.’s June 8 election is expected to increase the volatility of pound pairs and provide a clue of possible Brexit direction.

This week, GBPJPY and USDJPY top my list.

GBPJPY

The pair closed below key support, 142.42, price levels last week. This just doesn’t signify the continuation of the bearish trend started a month ago but also a reflection of the pound struggle ahead of June 8 election.

On the other hand, the Japanese Yen outlook remains positive with the economy growing for a fifth consecutive quarter, its longest expansion in 10 years. Also, exports and job creation continued to strengthen, even though consumer spending and wage growth remain low. The economic outlook is stable.

Therefore, this week I will be looking to sell below 142.42 for 134.90 targets. But if Theresa May’s Conservative loss to Labour Party I will expect a mild-strong outlook of the pound. A sustained break of 134.90 support levels should attract enough sellers to open up 129.85 support.

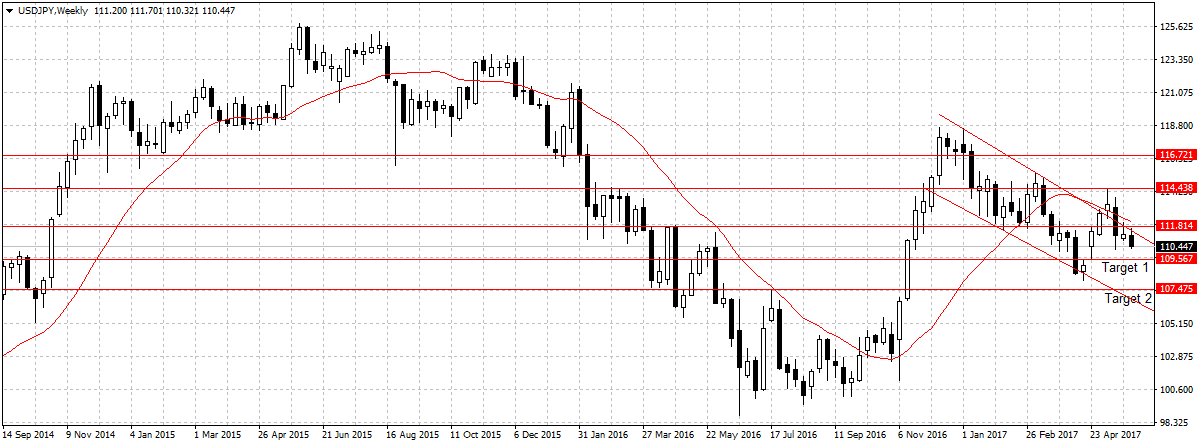

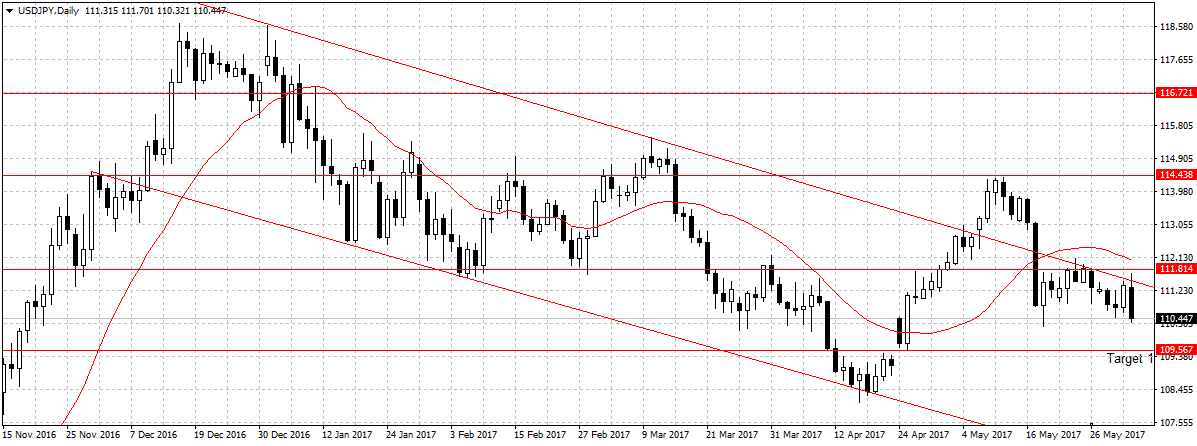

USDJPY

The pair has lost about 411 pips since President Trump sacked FBI director, James Comey a month ago. Dropping below the 111.81 psychological levels deep into the descending channel as shown below.

However, with the uncertain in the U.S. and strong Japan’s economic data, there is a possibility of the Yen gaining once James Comey testimony started this. Also, the U.K. uncertainty is expected to increase demand for safe haven assets and further bolster the Yen strength.

Therefore, this week, I will be selling the pair below the bearish engulfing pattern completed last week for 109.56 support. A sustained break would open up 107.47.