- Forex Weekly Outlook May 15-19

The US economic data released last week showed the economy is growing at a steady pace ahead of the next Federal Reserve meeting in June.

However, there were noticeable weaknesses in the figures. For instance, while the Producer Price Index rose 0.5 percent in April, the inflation rate rose less than projected –up 0.2 percent from plunging 0.3 percent in March. Suggesting, perhaps the inflation is not rising as previously anticipated by policy-makers.

Similarly, retail sales climbed 0.4 percent in April. Also, below the 0.6 percent expected by experts but more than the 0.1 percent increase recorded in March.

This shows that while consumers are optimistic as shown by the University of Michigan consumer sentiment (97.7), inflation is hardly breaking out and wage remains soft. Therefore, it is unlikely that the Federal Open Market Committee (FOMC) will feel pressure enough to raise rates in June as that would impact wage and hurt consumer spending substantially.

In the U.K, factory production plunged further by 0.6 percent in March after declining 0.3 percent in February. Indicating that rising inflation has started affecting the manufacturing sector.

Also, the Monetary Policy Committee members voted to keep asset purchase at 435 billion with the official bank rate at 0.25 percent ahead of June 8 election.

Overall, the US economy remains resilient ahead of FOMC meeting in June, however, few inconsistencies may hamper June rate hike and possibly put a temporary stop to the current dollar rally as the market looks to the U.K. for clues on the possible direction of the Brexit.

This week, USDJPY and EURGBP top my list.

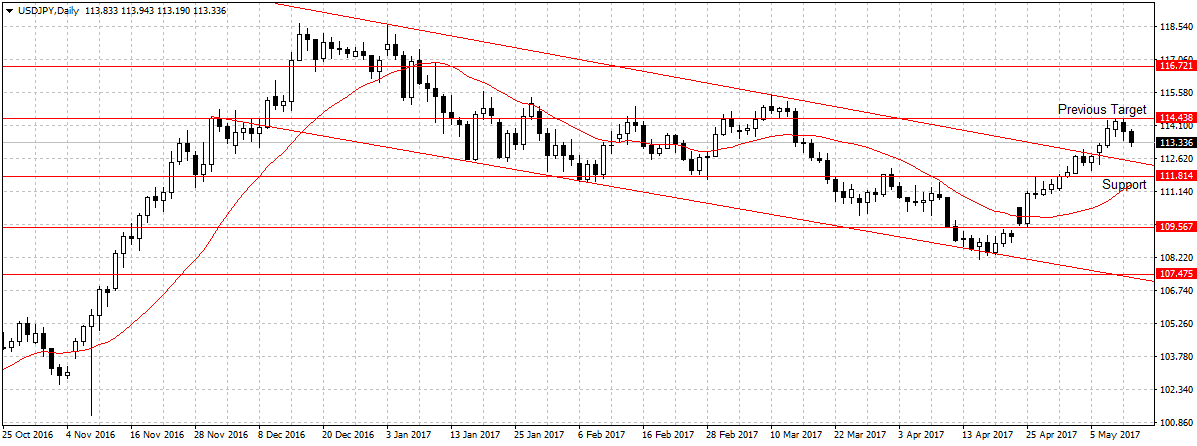

USDJPY

Last week this pair gave us 156 pips but was 8 pips short of our target 114.43. While I am not convinced that USDJPY would break 114.43 resistance, given current economic data, there is a probability of price hovering between 112-114 price level before a possible break below the descending channel. A sustained break below 112.47 support levels should increase sell orders and pressure price below 111.81 support levels.

Therefore, this week I will be looking to sell this pair as the market looks to decipher FOMC stance ahead of June rate decision. An optimistic outlook would boost this pair rally and vice versa.

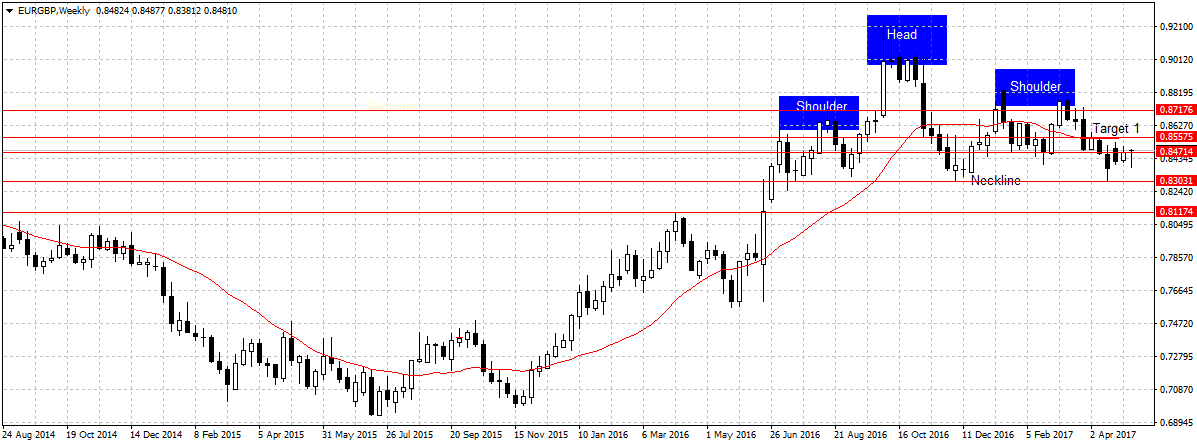

EURGBP

This pair closed as a dragonfly doji on weekly candlestick after data showed the U.K. factory output plunged for second consecutive month.

While this pair has failed to honor the head and shoulders formation shown in the chart, it should also be noted that price has remained above the neckline for the past 5 weeks and closed above 0.8471 resistance level for the first time last week.

Again, with inflation rate rising and manufacturing sector slowing down, consumer spending that contributes about 70 percent of the economy would likely start reflecting those weaknesses. Therefore, this week I will be looking to buy this pair above 0.8471 support level with my target 1 at 0.8557 resistance, the 20-day moving average. A sustained break should attract enough buyers to open up 0.8717 resistance.