- Forex Weekly Outlook March 20-24

The US dollar declined against most currencies last week following the Federal Reserve decision to raise rates by 25 basis points for the first time this year and third time in the last 10 years.

The greenback uncertainty was further compounded by Trump’s proposed budget released on Thursday, which proposed $54 billion increase in defense spending and equal amount of spending cuts from the smallest part of the Federal budget.

While, Trump won’t be adding to the next year’s projected $487 billion deficit. He won’t be reducing it either.

According to experts, Trump’s proposed budget would worsen things for lower-income Americans and hurt the very people that voted en masse for him.

“This isn’t a budget that will make America great again. It’s a budget that will increase hardship and poverty,” said Robert Greenstein, president of the liberal Center on Budget and Policy Priorities.

However, the complete budget would be presented in May for better analysis. This month, as the world looks to the U.K. to trigger article 50 amid France populist uprising. Both the Euro single currency and pound sterling are expected to dip as investors look to manage risk exposure and avert erosion of profits.

This week, CADJPY and GBPJPY top my list.

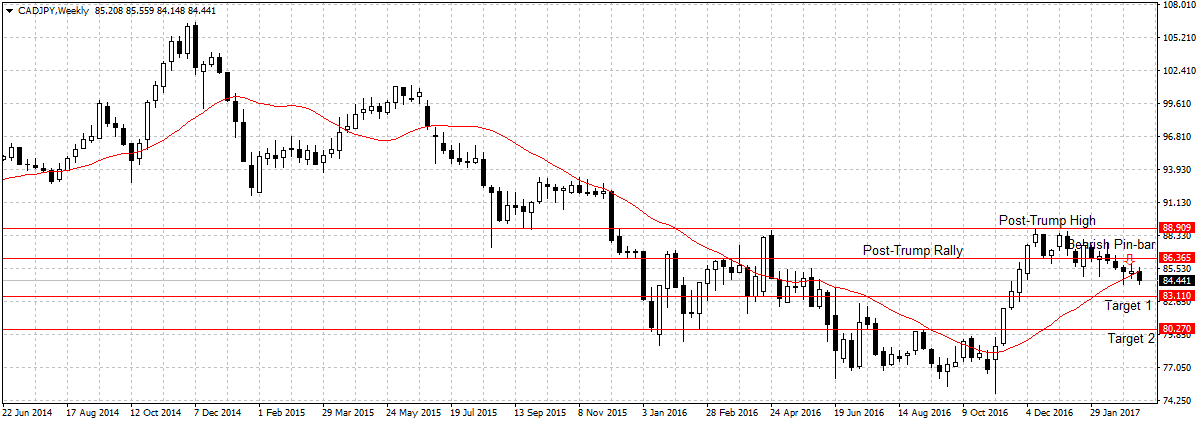

CADJPY

This pair has lost about 200 pips in the last one month, and last week closed below 20-day moving average for the first time since October 2016. However, apart from the surge in global oil prices that has aided Canadian dollar, the United States’ broad proposed increase in productivity and the seemingly friendly relationship between the two nations since Donald Trump won the election has bolstered the loonie attractiveness as shown in the chart below.

Accordingly, perceived setback to the U.S economy impacts the Canadian dollar outlook, so is the change in commodity prices. While the Japanese Yen on the other hand, gained increased order flow due to the US uncertainty. Therefore, I am bearish on this pair this week as long as 85.61 resistance levels that double as 20-day moving average holds. Also, I expect a sustained break of 83.11 that double as target 1 to open up 80.27 support, target 2.

Accordingly, perceived setback to the U.S economy impacts the Canadian dollar outlook, so is the change in commodity prices. While the Japanese Yen on the other hand, gained increased order flow due to the US uncertainty. Therefore, I am bearish on this pair this week as long as 85.61 resistance levels that double as 20-day moving average holds. Also, I expect a sustained break of 83.11 that double as target 1 to open up 80.27 support, target 2.

GBPJPY

The consumer spending that has been supporting the U.K economy has started slowing and so is the retail sales. However, the uncertainty surrounding article 50 of the treaty of Lisbon top global headlines and projected to hurt the U.K long term investment and business outlook.

Similarly, the surge in consumer prices and declining profits of businesses would likely hurt new job creation in the region and further affect the pound sterling attractiveness in the foreign exchange market.

Again, this particular pair has been on the decline since January 29 after the weekly bearish engulfing pattern was formed, and has since lost 528 pips. Hence, this week I am bearish on this pair as long as 142.42 resistance holds with 139.90 as my first target. A sustained break should open up 129.85 in days to come.

Last Week Recap

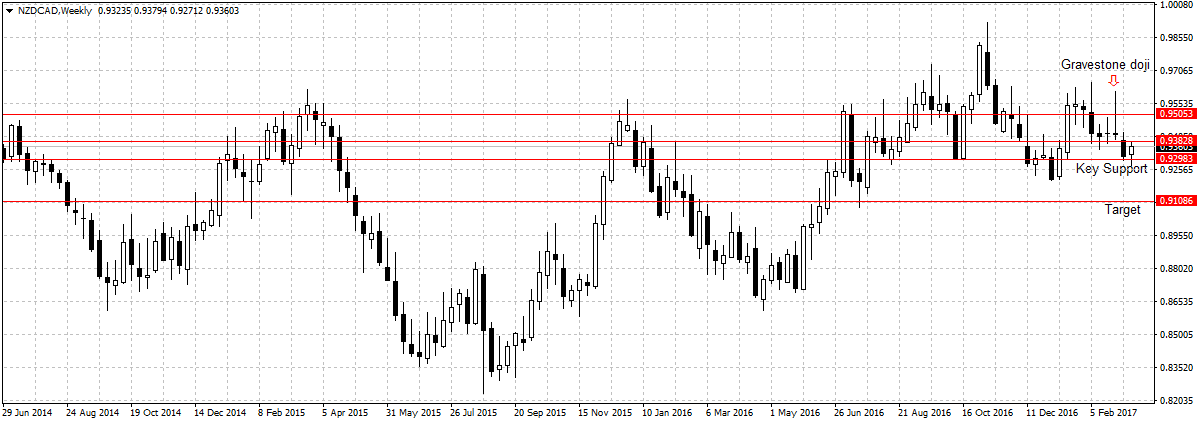

NZDCAD

This pair has explained last week lost about 608 pips since November but rebounded after global oil prices plunged to over 3-month low last week. While I doubt the downside movement is over considering New Zealand economic outlook, I am equally wary of OPEC and Shale differences. Therefore, I will step aside to monitor price action and see if 0.9382 resistance level would be breached. But as long as 0.9505 resistance holds, I am bearish on this pair and will look to sell at first signal of bearish continuity.

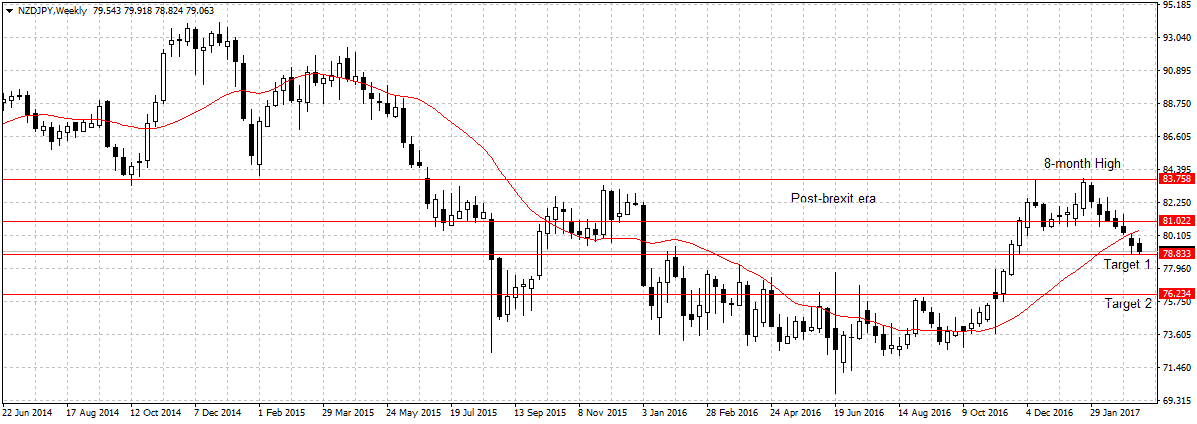

NZDJPY

NZDJPY continued its downward trend and hit our first target last week.

This week, I remain bearish on this pair and will look to add to my position below 78.83 support for one main reason, the Japanese Yen attractiveness increased after the U.S dollar plunged last week, and projected to continue as investors and businesses struggle to decipher proposed 2018 budget amid other uncertainties and how these could impact current economic outlook.

EURNZD

The Euro-single currency plunged last week against most currencies except the US dollar and Canadian dollar. This week I will be standing aside to monitor EURNZD price action and Euro-area unfolding political conundrum ahead of France election and Brexit.

Even though, I am still bullish bias as long as 1.5038 holds. I will need a sustained break of 1.5469 to confirm bullish continuation.

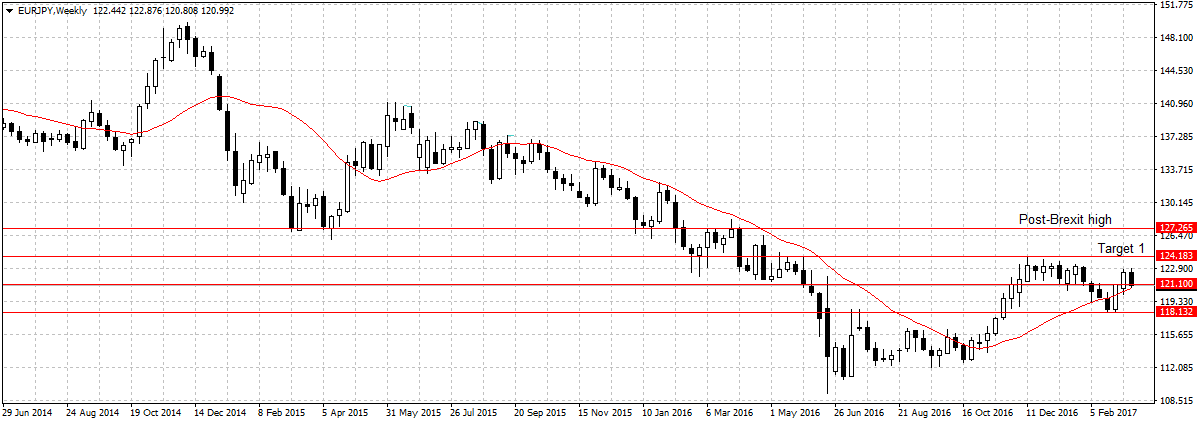

EURJPY

EURJPY failed to hit our first target after gaining about 80 pips two weeks ago and plunged last week to close below 121.10 support levels. Also, last week’s candlestick closed as a dark cloud pattern but above 20-day moving average.

This week, I will be stepping aside for further clarification.

This week, I will be stepping aside for further clarification.