Banking Sector

Adaora Umeoji Highlights Zenith Bank’s Robust Financial Metrics: Says Bank is Poised to Cross The N1 Trillion Mark in Profit in 2024

Published

6 months agoon

Zenith Bank Plc, Nigeria’s leading financial institution, held its Capital Markets Day last week to showcase the bank’s inherent values as it embarks on its recapitalisation journey.

The event, which brought together key market players, focused on the bank’s growth trajectory, strategic objectives, market performance, and consistent, robust dividend payout over the years.

It also provided an opportunity for the bank to inform capital market stakeholders about its robust risk management culture, adherence to regulations, capital adequacy, and maintenance of low non-performing loan levels.

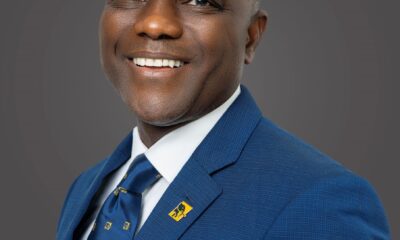

Addressing capital market stakeholders, investors, and analysts at the event in Lagos, the Group Managing Director/Chief Executive Officer, Dame Dr Adaora Umeoji, highlighted the financial institution’s tier-1 capital of N1.8 trillion, shareholders’ funds of N2.3 trillion, market capitalisation of N1.3 trillion, a profit before tax of N796 billion, and a dividend of N4 per share for the year ended December 2023.

Providing guidance for 2024, she noted that, given the trend of the bank’s performance and having achieved a profit before tax of N796 billion in 2023 and N320 billion in the first quarter of 2024, the bank is on track to deliver over N1 trillion in profit before tax in 2024.

She expressed confidence that, with the quality of the board and management and a strong corporate culture, the bank is well-positioned to deliver superior value to investors and other stakeholders and to navigate the recapitalisation process successfully.

She also disclosed some of the bank’s future plans, which include driving financial inclusion, expanding corporate and retail banking through technology and other state-of-the-art digital platforms, and establishing a fintech subsidiary, ZenPay, to drive profitability.

Also, the bank intends to expand to France and other Francophone African countries.

Dr Umeoji explained, “For us at Zenith, we won’t be left out. We are planning to go to the market to raise capital, and as it stands, Zenith Bank has the least amount of capital to raise. We are looking to raise N230 billion because we are already at N270.7 billion.

That is the least capital to raise among our peers. We believe that Zenith Bank has what it takes. We have the capacity, the network, the balance sheet, the human capital, and the track record to achieve that.

We are planning for the future, and the technology we have now is the best in the entire industry. It will help us to have a seamless process and integrate.”

Also speaking, the Chief Financial Officer/General Manager, Dr Mukhtar Adam, pointed out that in the last five years, the bank’s Compound Annual Growth Rate (CAGR) in revenue has grown by over 27 per cent.

“This continues to grow year-on-year. Within this period, at some point, Nigeria went into recession, but we forged ahead, worked very hard, and continued to deliver growth. Within the last five years, our profit before tax has also grown cumulatively by about 28 per cent. This is a market where, at some point, government instruments – treasury bills – were paying one per cent, two per cent, three per cent. But we forged ahead to grow the numbers and provide stable returns of at least 28 per cent.”

Zenith Bank recently emerged as the Best Commercial Bank, Nigeria, in the World Finance Banking Awards 2024, retaining the award for the fourth consecutive year.

The bank was also named Best Corporate Governance, Nigeria, for the third year running in the World Finance Corporate Governance Awards 2024.

The awards, published in the Summer 2024 issue of World Finance Magazine, recognise the bank’s robust financial performance, superior customer service, sustainability initiatives, and corporate governance practices.

Commenting on the dual honours, Dr. Umeoji said, “These awards highlight our steadfast dedication to excellence, adherence to global best practices, and our persistent effort to deliver superior value to all stakeholders through innovative products and services. Receiving these awards consecutively for multiple years signifies the commitment of our staff, the loyalty of our customers, and the support of our shareholders. We remain devoted to setting industry benchmarks and driving excellence across all aspects of our operations.”

Dr. Umeoji also expressed delight at the recognition and dedicated the awards to the Founder and Chairman, Dr. Jim Ovia, CFR, for his impactful leadership in establishing a robust and flourishing institution.

She also expressed gratitude to the board for their vision and insight, the staff for their unwavering dedication, and the bank’s customers for choosing Zenith as their preferred bank. World Finance is a leading international magazine providing comprehensive coverage and analysis of the financial industry, international business, and the global economy.

In its audited results for the year ended December 31, 2023, Zenith Bank achieved a remarkable triple-digit growth of 125 per cent in gross earnings, from N945.6 billion reported in 2022 to N2.132 trillion in 2023.

The impressive growth in gross earnings resulted in a year-on-year increase of 180 per cent in profit before tax (PBT), from N284.7 billion in 2022 to N796 billion in 2023, while profit after tax (PAT) also recorded triple-digit growth of 202 per cent, from N223.9 billion to N676.9 billion for the period ended December 31, 2023.

The increase in gross earnings was primarily due to growth in interest and non-interest income. Specifically, its interest income increased by 112 per cent, from N540 billion in 2022 to N1.1 trillion in 2023, while non-interest income grew by 141 per cent, from N381 billion to N918.9 billion in the same period.

The rise in interest income was attributed to the growth in the size of risk assets and their effective repricing, alongside the increase in yield of other interest-bearing instruments over the year. Growth in non-interest income was driven by significant trading gains and an increase in gains from the revaluation of foreign currencies.

Zenith Bank’s cost of funds also grew from 1.9 per cent in 2022 to three per cent in 2023 due to the high interest rate environment, while interest expense increased by 135 per cent, from N173.5 billion in 2022 to N408.5 billion in 2023.

Notwithstanding the 32 per cent growth in operating expenses in 2023, the Group’s cost-to-income ratio improved significantly from 54.4 per cent in 2022 to 36.1 per cent in 2023 due to improved top-line performance.

Return on Average Equity (ROAE) increased by 118 per cent, from 16.8 per cent in 2022 to 36.6 per cent in 2023, underpinned by improved gross earnings, as the Group sought to deliver better shareholder returns. Return on Average Assets (ROAA) also grew by 95 per cent, from 2.1 per cent to 4.1 per cent in the same period.

Zenith Bank was established in May 1990 and commenced operations in July of the same year as a commercial bank.

The bank became a public limited company on June 17, 2004, and was listed on the Nigerian Stock Exchange (NSE) on October 21, 2004, following a highly successful Initial Public Offering (IPO). In 2013, the bank listed $850 million worth of its shares at $6.80 each on the London Stock Exchange (LSE).

Headquartered in Lagos, Nigeria, Zenith Bank Plc has more than 400 branches and business offices in prime commercial centres across all states of the federation and the Federal Capital Territory (FCT).

Zenith Bank Plc, founded by Jim Ovia, CFR, in 1990, has since grown to become one of the leading financial institutions in Africa. The underlying philosophy is for the bank to remain a customer-centric institution with a clear understanding of its market and environment.

Zenith Bank’s track record of excellent performance has continued to earn the brand numerous awards.

These latest accolades follow several recognitions, including being recognised as the Number One Bank in Nigeria by Tier-1 Capital for the 14th consecutive year in the 2023 Top 1000 World Banks Ranking, published by The Banker Magazine; Bank of the Year (Nigeria) in The Banker’s Bank of the Year Awards for 2020 and 2022; and Most Sustainable Bank, Nigeria, in the International Banker 2024 Banking Awards, among several others.

Zenith Bank Plc has blazed the trail in digital banking in Nigeria, achieving several firsts in the deployment of Information and Communication Technology (ICT) infrastructure to create innovative products that meet the needs of its customers.

The bank is a leader in the deployment of various channels of banking technology, and the Zenith brand has become synonymous with state-of-the-art technologies in banking.

Driven by a culture of excellence and strict adherence to global best practices, the bank has combined vision, skilful banking expertise, and cutting-edge technology to create products and services that anticipate and meet customers’ expectations, enable businesses to thrive, and grow wealth for customers.

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

NCC Approves Disconnection of USSD Codes for Nine Banks Over Unpaid Debts

-

Expanding Footprint-Nigeria’s FirstBank Sets Sights on Ethiopia, Angola, Cameroon

-

Global Banks to Slash 200,000 Jobs as AI Reshapes Workforce

-

Personal and Retail Loans Contribute to 17.6% Drop in Consumer Credit

-

FirstBank’s Decemberissavybe Lights Up Lagos With Davido Concert

-

Access Bank Raises N351bn From Rights Issues in Recapitalisation Move