Nigerian Exchange Limited

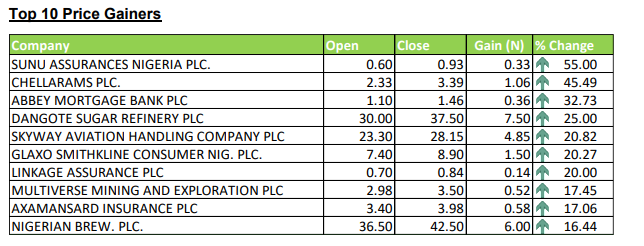

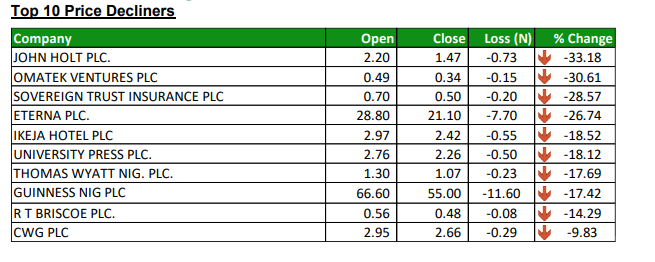

Dangote Sugar, Others Propel Nigerian Stock Market to N77bn Gain Last Week

All-Share Index Rises by 0.22% as Equities Soar in Key Sectors; Financial Services Industry Remains Dominant on the Exchange

Nigerian Exchange Limited

NGX Group Unveils Plans for Online Public Offer Platform and African Expansion

Nigerian Exchange Limited

Nigerian Stock Market Rebounds, Led by Banking Giants

Nigerian Exchange Limited

Nigerian Exchange Sees 0.05% Uptick After Bearish Streak: Investors Gain N26bn

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Billionaire Watch4 weeks ago

Billionaire Watch4 weeks agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira4 weeks ago

Naira4 weeks agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 17th, 2024

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 18th, 2024

-

Economy4 weeks ago

Economy4 weeks agoSiemens $2.3bn Power Project Sees Advancement with Arrival of Transformers, Substations, Announces Minister

-

Naira3 weeks ago

Naira3 weeks agoNaira Appreciates to N1,136/$ Officially, N1,050/$ Parallel Market