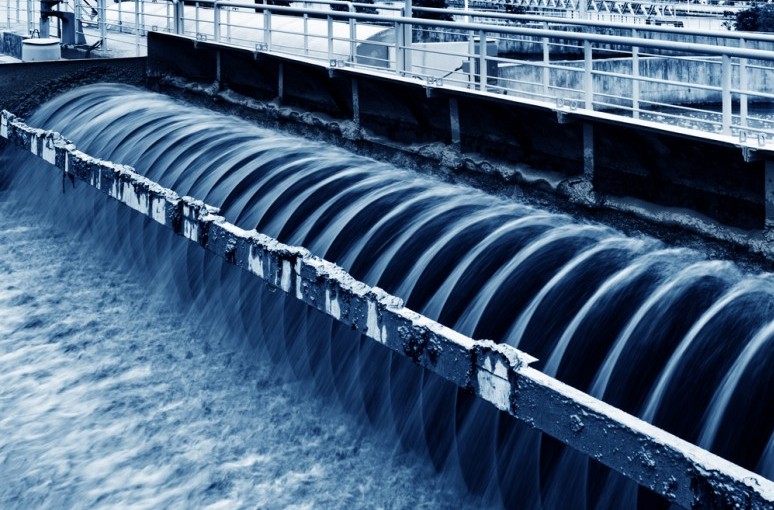

The African Water Facility, a vital unit of the African Development Bank (AfDB), is embarking on a mission to establish a $500 million Urban-Sanitation Fund.

The fund’s creation comes in response to the escalating demand for water and sanitation projects across the African continent. Spearheading this ambitious initiative is Mtchera Chirwa, the facility’s coordinator, who has unveiled a vision of tapping into private investors to achieve long-term sustainability in the region.

Since its inception in 2004, the African Water Facility has solely functioned as a provider of grants. However, as donor funding begins to wane, the facility is adapting its approach by incorporating debt financing in some cases.

Chirwa explains, “We plan to scale up, and the facility’s new sanitation fund will begin to lend for longer-term sustainability.”

Africa faces a substantial challenge, as the World Bank estimates that it requires a staggering $114 billion in global investment annually, with half of this amount allocated to the continent. Shockingly, one-third of Africa’s 1.3 billion people still lack access to water supplies, and one-sixth are without basic hygiene services.

To address this pressing issue, the Urban Sanitation Fund aims to raise the full $500 million over the course of a decade. The fund is expected to draw contributions from the AfDB, generous donors, and forward-thinking private investors.

Chirwa envisions a comprehensive approach, targeting the improvement of sewerage systems in African cities, providing sanitation services to unconnected areas, and financing projects that harness waste for use as fertilizer or in biomass-based energy plants.

While water projects in rural regions will continue to benefit from grant funding, these grants are projected to increase significantly within two years, from the current €21 million to an estimated €50 million ($55 million) to €60 million annually.

Remarkably, for each euro invested by the African Water Facility, up to €29 can be leveraged from other sources, as these grants effectively reduce risk for additional investors.

Since its formal inception in 2006, the African Water Facility has actively participated in 133 projects across 52 of Africa’s 54 countries. The positive impact of its work is evident, with considerable funding already secured, amounting to €205 million.

While Libya and Mauritius have yet to benefit from the facility’s support, Chirwa remains optimistic about the future. He emphasizes that the Urban Sanitation Fund is not only an investment in infrastructure but also a commitment to the well-being of the continent’s growing population.

With the African Water Facility taking the lead in pioneering this urban-sanitation fund, it sets a precedent for other regions to follow.

By combining public and private efforts, Africa moves closer to bridging the gap in water and sanitation services, creating a cleaner, healthier, and more sustainable future for its people.

The opportunity for private investors to join this transformative journey signifies a collaborative approach to meeting the challenges of the present and building a brighter tomorrow.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira2 weeks ago

Naira2 weeks ago