E-commerce

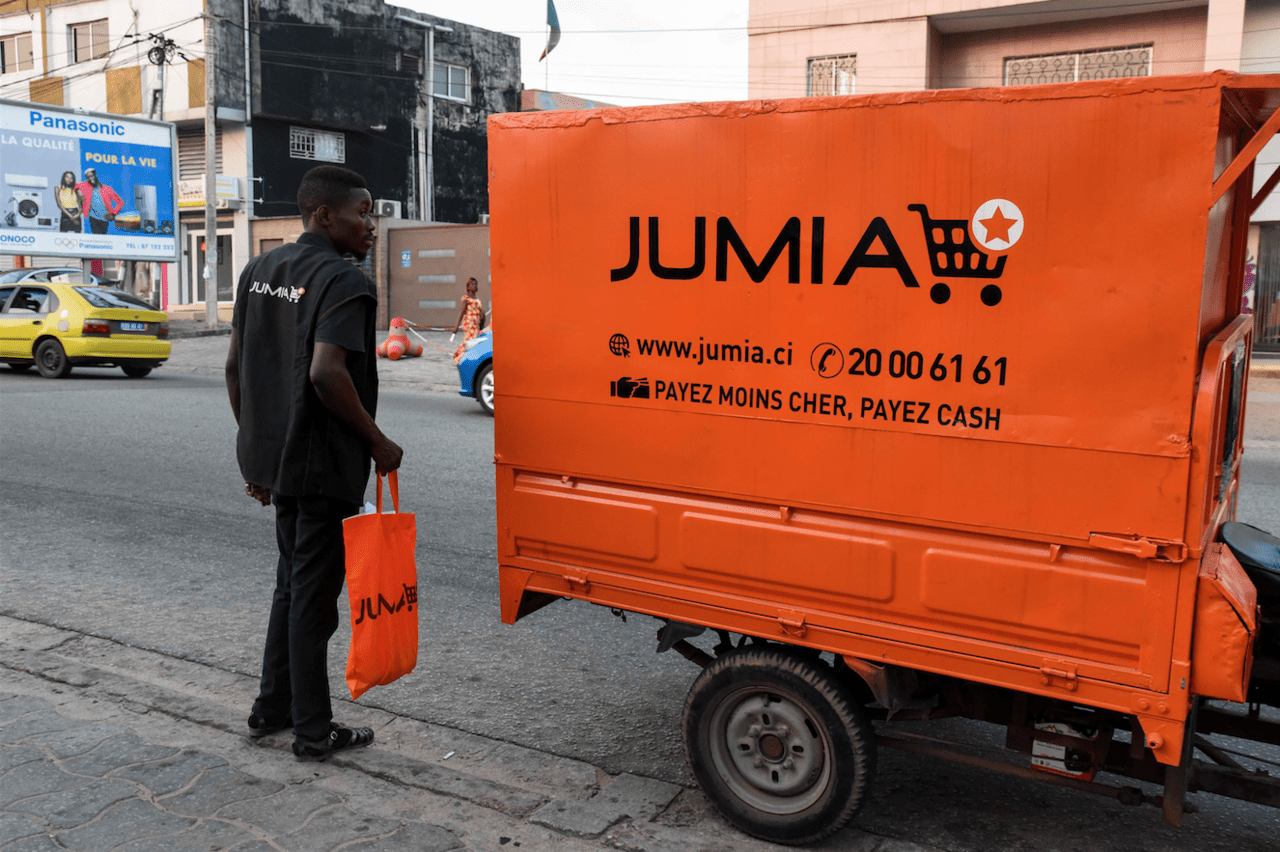

COMESA Holds Jumia Accountable for Third-party Goods Sold on its Platform

E-commerce

Jumia Plans Warehouse Consolidation in Lagos Amid Nigeria Focus

E-commerce

Alibaba Eyes Gulf Expansion, Seeks Partnerships in Saudi and UAE Markets

E-commerce

Shoprite Shuts Down Kano Branch Due to Financial Challenges and Unfavorable Business Climate

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 24th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 22nd, 2024

-

Travel3 weeks ago

Travel3 weeks agoSaudi Arabia Breaks 70-Year Alcohol Ban, Opening Shop for Diplomats

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 25th, 2024

-

Jobs4 weeks ago

Jobs4 weeks agoJob Cuts Hit Tesla: More Than 6,000 Positions Axed Across Texas and California

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Investment4 weeks ago

Investment4 weeks agoMinister Accuses Past NCDMB Leadership of Squandering $500m on Unproductive Projects

-

Travel4 weeks ago

Travel4 weeks agoDelta Air Lines Flight Diverts to Togo After Passenger Dies Midair