Nigerian Exchange Limited

Activity on Stock Market Declined Last Week Amid Weak Economic Fundamental

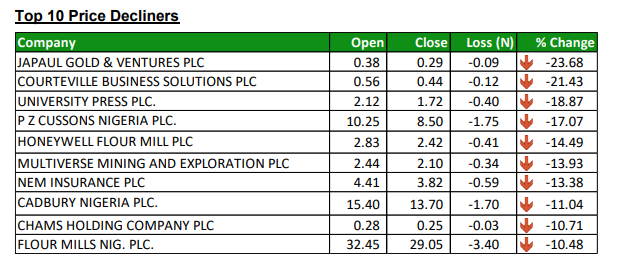

Nigeria’s stock market extended its decline last week as more economic data points to growing uncertainty amid slowing productivity.

Nigerian Exchange Limited

Nigeria’s Market Falls 1.09% Amid Decline in Key Sectors

Nigerian Exchange Limited

VFD Group Plc’s Rights Issue Listed on NGX’s Daily Official List

Nigerian Exchange Limited

Nigerian Exchange Sees Historic N18.203tn Gain in Q1, 2024

-

Forex2 weeks ago

Forex2 weeks agoZiG to the Rescue: Zimbabwe Shifts Gear with New Currency Backed by Gold

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 9th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Exchange Rate at Black Market Today, March 21st, 2024

-

Company News4 weeks ago

Company News4 weeks agoNNPC Gears Up for Public Listing, Embraces Full Commercialization

-

Billionaire Watch1 week ago

Billionaire Watch1 week agoNigerian Billionaire Tony Elumelu Contemplates Acquiring NPFL Club

-

Naira2 weeks ago

Naira2 weeks agoDollar to Naira Black Market Today, April 8th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, March 26th, 2024

-

Naira1 week ago

Naira1 week agoNaira Hits Eight-Month High at 1,120/$ Amidst Central Bank Reforms