Banking Sector

FirstBank Shows Resilience, Delivers Strong Growth Across the Board

Published

3 years agoon

Just like the words of Anne Frank, the weak die out and the strong will survive. The First Bank of Nigeria Limited survived damning COVID-19, rising inflation rate, low-interest rate and the drop in economic productivity amid rising unemployment rate to deliver a 77.9% increase in profit before tax in the 2021 financial year.

Analysts and business experts who perused the impressive results attributed the overwhelming performance to a broad-based rejig of the bank’s leadership structure, reinvention of core strategies and financial technology integration at all facets of the bank.

Key Metrics

According to the financial analysts, FirstBank was able to grow its key metrics by carefully mitigating the effect of low-interest rates on investment securities and revenue generation, and then intensified deposit mobilization and funding strategy to support enhanced loan growth at optimized rates that resulted in a 5.7% increase in interest expense from ₦133.2 billion recorded in 2020 to ₦140.8 billion.

In spite of the increase in interest expense, non-interest revenue rose by 96.1% to ₦364.6 billion from ₦185.9 billion achieved in 2020. Largely due to the improved treasury activities, operating income and surge in fees and commission. During the period, operating income expanded by 35.5% from ₦437.6 billion filed in the corresponding year of 2020 to ₦592.8 billion, resulting in an improvement in cost to income ratio to 56.4% as against 66.8% in December 2020.

Digitisation

Similarly, FirstBank’s sound investment in agent banking, digitalisation and deployment of digital platforms, improved customer penetration and deepened solid retail franchise bolstered customers’ deposits by 19.5% to ₦5.9 trillion from ₦4.9 trillion in 2020 to reaffirm FirstBank’s strong market access and robust funding base.

Also, this validated the bank’s position as Nigeria’s largest financial inclusion services institution by total assets and gross earnings. With over 120,000 banking agents called Firstmonie Agents that are presently operating in 772 of the 774 local government areas in Nigeria, FirstBank has been able to facilitate and promote financial inclusion in most local governments in Nigeria.

Again, in line with its strides in over 128 years of operations, FirstBank has developed internet and mobile banking systems that have made banking easier for Nigerians at home and abroad.

Named FirstOnline, the leading Internet Banking platform in Nigeria provides unrestricted and secure access to customers at any time and anywhere through any internet-enabled device. This platform comes with classy features, impeccable user experience, convenience and is easy to use. As of June 2021, FirstOnline boasts of an impressive 597,466 customers, a 17% growth on the previous year and 578,292 transactions per month averaging a value of 388 billion per month.

This broad network ensures access to stable funding and subsequently, a reduction in the cost of fund ratio to 2.1% in the 2021 financial year.

Profitability

Having successfully restructured its businesses, FirstBank delivers ₦130.9 billion in profit before tax, a 77.9% increase from ₦73.6 billion recorded in 2020. In the same period, the bank paid ₦13.1 billion in taxes to report a 73.9% increase in profit after tax from ₦67.8 billion attained in 2020 to ₦117.8 billion. The strong profit reflects the lender’s success in leveraging Fintech and E-business for organic growth.

Presently thriving on strong fundamentals, demonstrated by impressive performance. The 128 years old bank is less risky given its robust assets, the lender grew total assets by 15.9% to ₦8.5 trillion in the year under review on the back of the increase in customers’ loans and advances to ₦2.8 trillion, a 27.7% increase from ₦2.2 trillion attained in 2020.

Non-Performing Loans

Because of FirstBank’s quality fundamentals that stem from a cleaner balance sheet, non-performing loans (NPL) declined from 7.7% in 2020 to an acceptable level of 6.1% while Capital Adequacy Ratio (CAR) marginally increased to 17.4% from 17.0% in 2020.

New Investment

First Bank of Nigeria Limited, entered into a definitive agreement with Access Bank Plc for the planned acquisition of the entire share capital of Access Pension Fund Custodian Limited held by Access Bank Plc. This will further boost the bank’s market share in the industry, aid revenue diversification and support annuity income.

FirstBank 2021 Key Financial Highlights

- Gross earnings of ₦716.8 billion, up 30.3% y-o-y (Dec 2020: ₦550.3 billion)

- Net interest income of ₦225.7 billion, down 7.7% y-o-y (Dec 2020: ₦244.6 billion)

- Non-interest income of ₦342.2 billion, up 106.4% y-o-y (Dec 2020: ₦165.8 billion)

- Operating expenses of ₦313.9 billion, up 14.3% y-o-y (Dec 2020: ₦274.6 billion)

- Profit before tax of ₦130.9 billion, up 77.9% y-o-y (Dec 2020: ₦73.6 billion)

- Profit after tax of ₦117.8 billion, up 73.9% y-o-y (Dec 2020: ₦67.8 billion)

- Total assets of ₦8.5 trillion, up 15.9% y-o-y (Dec 2020: ₦7.4 trillion)

- Customers’ loans and advances (net) of ₦2.8 trillion, up 27.7% y-o-y (Dec 2020: ₦2.2 trillion)

- Customers’ deposits of ₦5.6 trillion, up 19.5% y-o-y (Dec 2020: ₦4.7 trillion)

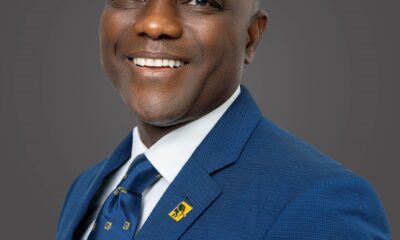

Commenting on the results, Dr. Adesola Adeduntan, Chief Executive Officer of FirstBank Group said: “Following years of strategic restructuring of the Bank’s balance sheet and operations, the Commercial Banking business is beginning to transition into a sustained growth phase delivering performance commensurate to the size of our business and capabilities of our people. Profit before tax is up 77.9%, gross earnings 30.3%, total assets 15.9% and customer deposits up 19.5%.

“This performance was driven by a relentless focus on the needs of customers and improving the competitiveness of our offerings. We have sharpened our ‘Go To Market’ approach to better leverage the opportunities which our large scale provides in addition to becoming more relevant to our clients by improving our value propositions.

“This performance is also in line with the Bank’s Quantum Profitability Leap agenda which seeks to ensure that we fully maximise the revenue generating capacity of our business to boost the bottom line and fulfil the expectations of all stakeholders in the business.

“The demonstrated resilience of our franchise to headwinds and excellent risk management capabilities place us in a good position to weather any macro-economic shocks which may arise due to the volatile nature of current operating environment. Our Non-performing loans ratio at the end of the year was 6.1% which represents significant progress towards those of other Tier 1 banks and the regulatory threshold of 5.0%.”

“We will continue to leverage our investments in digital platforms, IT infrastructure, people, and pan-African operations to ensure this growth trend is sustained”.

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

FirstBank Backs Esports Industry Growth With Education and Fintech Collaboration

-

FirstBank Appeals Court Ruling, Seeks Injunction to Halt Crude Cargo Release

-

FirstBank Reinforces Digital Leadership with Lekki Xperience Centre Launch

-

Asian Banker Awards: FirstBank Maintains Dominance in SME Banking Across Nigeria Africa

-

Allegations of Fraud Unfounded and False

-

FirstBank Breaks Ground on Nigeria’s Tallest Green-Certified HQ in Eko Atlantic