Stock Market

Economic Uncertainty Plunges Stock Market, Investors Lose N83 Billion in 7 Days

The Nigerian Exchange Limited (NGX) extended its decline in the week ended March 18, 2022. The Exchange sheds 0.33% amid rising economic uncertainty, harsh business operating environment, among others.

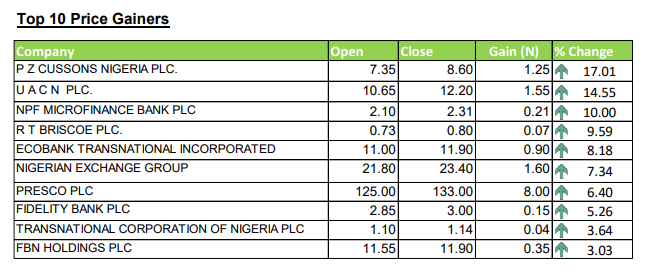

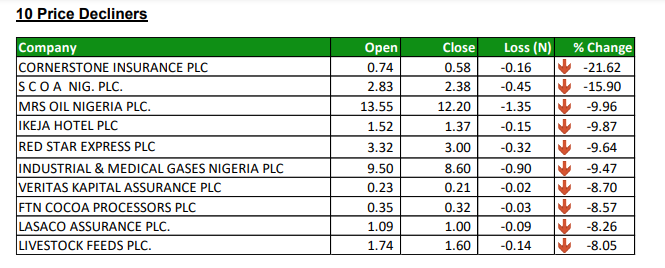

During the week, only 21 equities gained in price while a total of 45 equities lost points. The remaining 90 equities closed flat, indicating a broad-based weak sentiment in the stock market.

As expected, the activity level dropped with investors trading 2.449 billion shares worth N20.653 billion in 20,764 deals, in contrast to a total of 2.798 billion shares valued at N23.859 billion that exchanged hands in 22,970 deals last week.

Sectorial analysis showed the financial services industry led the activity chart with 1.810 billion shares valued at N11.556 billion traded in 11,233 deals. Therefore, contributing 73.91% and 55.96% to the total equity turnover volume and value, respectively.

The ICT Industry followed with 349.937 million shares worth N4.050 billion in 1,292 deals. In third place was The Conglomerates Industry, with a turnover of 101.523 million shares worth N548.693 million in 1,084 deals.

FCMB Group Plc, ETranzact International Plc, and Fidelity Bank Plc were the three most traded equities and accounted for 1.472 billion shares worth N5.064 billion in 1,006 deals. The three contributed a combined 60.12% and 24.52% to the total equity turnover volume and value, respectively.

Market value of listed equities declined by N83 billion from N25.566 trillion it closed last week to N25.483 trillion this week. The NGX All-Share Index shed 0.33% or 154.81 index points to 47,282.67 index points. The year-to-date gain adjusted to 10.69%.

Similarly, all other indices finished lower with the exception of NGX Meri value, NGX lotus II and NGX Industrial Goods indices, which appreciated by 0.76%, 0.12% and 0.14% respectively While NGX Asem, NGX Growth and NGX Sovereign bond indices closed flat.

Rising inflation amid persistent forex scarcity are some of the challenges businesses operating in Nigeria are facing. On Friday, manufacturers had demanded that the federal government reverse tax and levies on importation of petroleum products.

Other issues are fuel scarcity and the total collapse of the power grid. Almost 200 million Nigerians are thrown in darkness yet they can not power their electricity generators due to fuel scarcity. The productivity of these businesses drop and subsequently dragged on their stock values.

Earlier in the week, one of Nigeria’s most respected entrepreneurs and investors, Tony Elumelu attributed the situation to Nigeria’s growing insecurity that prevented her from taking advantage of the recent jump in crude oil price. He claimed 95% of the nation’s crude oil production is lost to theft.