Between 2020 and now, financial markets experts have attributed the characteristics of gold to Bitcoin and gone on to describe the digital asset as the new safe haven, or digital gold.

In fact, JPMorgan Global Market Strategist Nikolaos Panigirtzoglou, in a note to clients on Oct.6, 2021, said “Bitcoin’s allure as an inflation hedge” was the reason for growing investor interest in the unregulated digital asset.

An inflation hedge is an investment that will hold its value even when prices go up or the currency’s worth goes down. It means investors were drawn to Bitcoin because of its attractiveness as a store of value, just like the world’s most reliable safe-haven asset, gold.

But the Russia-Ukraine war has shown Bitcoin, the world’s most dominant cryptocurrency, to be a risk asset. A risk asset, as the name implies, is any asset that has a significant degree of volatility or risk.

Just like other risk assets like equities, real estate or currencies, Bitcoin plunged with the Russian invasion of Ukraine and has remained largely subdued even when gold rose to an 18-month high last week.

The Reason for This Bitcoin Misconception

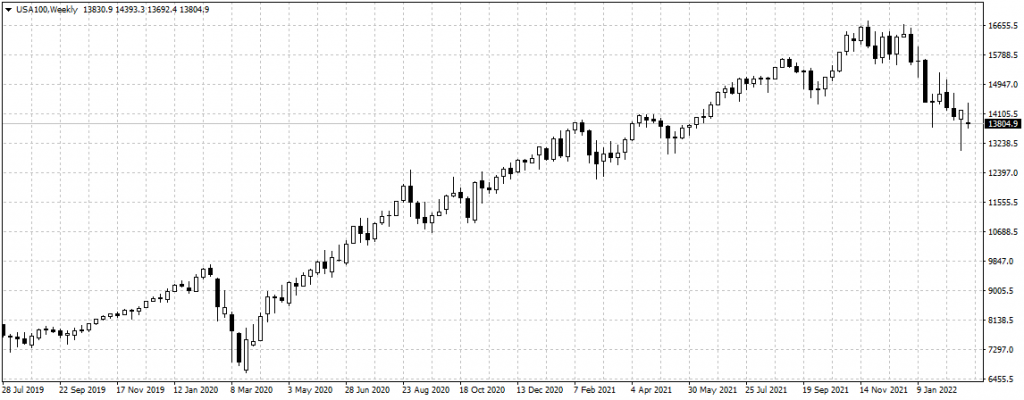

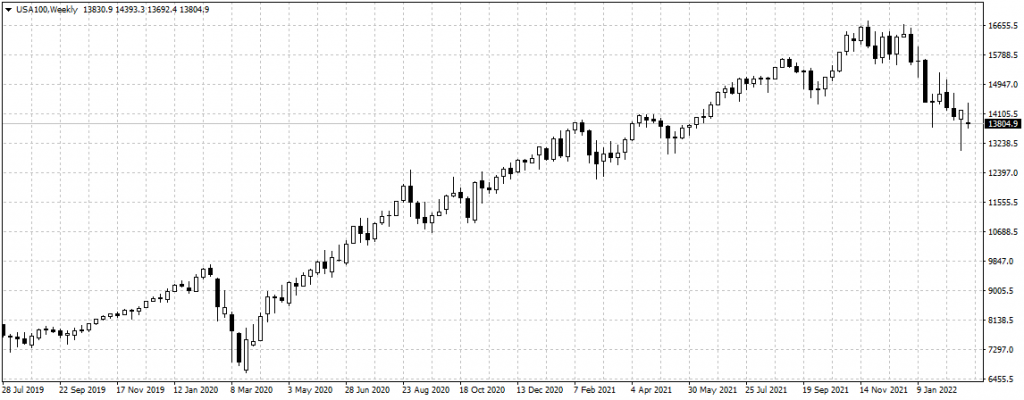

It was the same in January 2020, when nations started announcing Covid-19 restrictions to halt the spread of the pandemic, the value of Bitcoin declined with other risk assets as shown in the chart below, whereas the value of gold surged as shown in the second chart.

Here is where it gets interesting. Bitcoin at the time was trading well under $10,000 per coin but started gaining momentum once investors, largely retail investors, started factoring in Bitcoin halving. Bitcoin halving is a process in which the reward of Bitcoin miners is halved after building additional 210,000 blocks. Therefore, since miners’ reward is the only means by which Bitcoin is available for purchase, the value of Bitcoin rises thanks to the decline in supply.

It was Bitcoin Halving that occurred in May 2020 during the peak of Covid-19 that bolstered the value of Bitcoin above $22,000 a coin and subsequently attracted institutional investors already struggling to find the right investment at a period when all economies were closed. The size of their investments coupled with the scarcity created by Bitcoin Halving was what led to the Gap, circled in the first chart (institutional investors entry).

However, because this happened at a period of high global uncertainty and risk, and coincidentally during COVID-19, experts with little or zero knowledge of Bitcoin technology started pushing safe haven narratives.

Here is Why Bitcoin is Not a Safe Haven Asset or Digital Gold

A safe haven asset is that asset that can at least retain its value or appreciate during financial markets downturns. Please note that while it does not guarantee positive returns, it maintains its value in a crisis.

In fact, from the second chart, Gold took off immediately COVID-19 broke out in Wuhan, China in November 2019 and rose above $2067 per ounce by June 2020 while Bitcoin continued to struggle until after halving as seen in the first chart.

As clearly shown in the two charts, the value of Gold started declining in June 2020 when tech stocks started thriving on growing remote workspace and gradual adaption to the new normal. Bitcoin, NASDAQ, Standard and Poor 500, and other risk assets were rising simultaneously as shown in Chart 1, 3, and 4. Again, a critical look at the last few weeks of the three charts revealed that Bitcoin, NASDAQ and Standard and Poor 500 have been on the decline in response to the Federal Reserve projected rates hike and the Russia-Ukraine war. Indicating that despite Bitcoin’s huge returns when compared to traditional assets, it mirrored the characteristics of risk assets than it has been established.

Also, since Russia invaded Ukraine, Bitcoin has failed to replicate the 2020/21 run even with people projecting that Russia will turn to cryptocurrency to avoid the impact of sanctions. The reason is not far-fetched, this is not a halving year. The next Bitcoin Halving is in 2024. Suggesting that Bitcoin might be at the beginning of a bearish period despite global happenings.

It was based on these modalities that I established how Bitcoin could hit $50,000 a coin as early as 2020. Here is an excerpt of the article titled, Bitcoin Halving: Nigeria, Others Get Ready For Uncertain Bitcoin Future, written on May 11, 2020, “Unlike the Central Banks, Bitcoin is not manually regulated rather its algorithm has been engineered to gradually reduce the number of Bitcoins that can be created over time.

“Therefore, while the supply of Bitcoin will continue to reduce, its demand will remain constant. A process that if eventually worked could see the digital currency hitting $50,000 a coin or even $1 million as more money would be chasing fewer coins.”

Bitcoin thrives on this methodology and not the assumption that it is a store of value or inflation hedge.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Technology4 weeks ago

Technology4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Economy4 weeks ago

Economy4 weeks ago