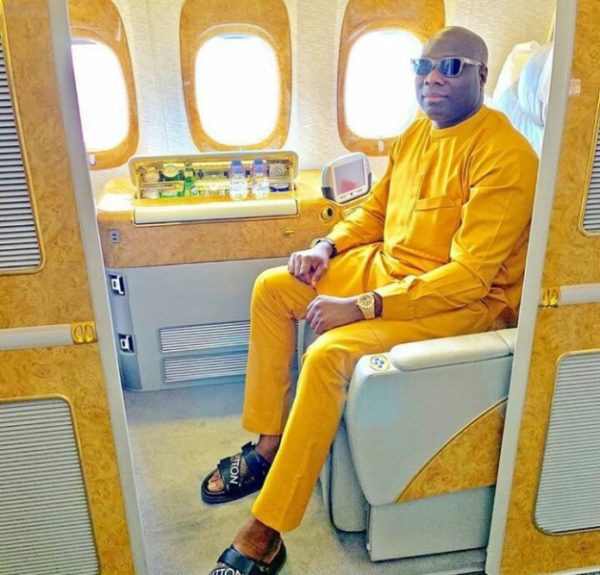

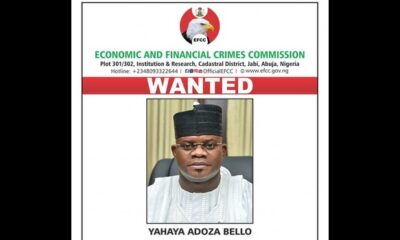

Popular social media celebrity, Ismaila Mustapha, popularly known as Mompha is currently in the custody of the Economic and Financial Crimes Commission, EFCC, pending the hearing of his bail application in the N6 billion fraud charge filed against him.

The agency re-arraigned Mompha and his firm, Ismalob Global Investment Limited before Justice Mojisola Dada of an Ikeja Special Offences Court on eight counts bordering on the alleged offences.

The EFCC made this disclosure at Lagos Special Offences Court in Ikeja, on Wednesday.

The defendants were accused of conspiracy to launder funds obtained through unlawful activity, retention of such funds, transfer of funds for a suspect Olayinka Jimoh a.k.a Nappy Boy, and unlawful transfer of funds for a record label, among others.

The sums named in the charge are N5.9 billion, N32m, N120m and N15.9 totalling over 6 billion. The agency alleged that Mompha hid his wealth in wristwatches and other movable assets valued at over N70m.

However, the Instagram celebrity pleaded ‘Not guilty’ to the eight counts while Islamob Limited (represented also by Mompha) pleaded ‘not guilty’ to the first six counts.

Earlier on Monday, the anti-graft agency had arrested the internet celebrity and his firm, Ismalob Global Investment Limited for alleged money laundering. The agency, in a statement, had revealed that a fraudulent transfer slip of $92, 412, 75 was found in his iPhone 8 device.

“It will be recalled that Mompha had earlier been arrested on October 18, 2019 at Nnamdi Azikiwe International Airport while boarding an Emirates Airline Flight to Dubai by the staff of the Nigeria Immigration Service, following a watch list by the EFCC.

“Mompha is alleged to have used his registered companies to receive illicit funds on behalf of “yahoo yahoo” boys from across the world in return for commission.

“The account of one of his companies, Ismalob Global Investment Limited Bank, a Bureau de Change Company, domiciled in Zenith Bank Plc, was allegedly used to launder funds derived from unlawful activities”, the statement had read.

Meanwhile, this is not the first time the anti-graft agency would arraign Mompha.

Recall that sometime in 2019, Investors king had reported that Mompha was arraigned on 14 counts bordering on fraud, money laundering and running a foreign exchange business without the authorisation of the Central Bank of Nigeria.

The EFCC, in the charges against Mompha, said the suspect used his company’s bank account with the name Ismalob Global Investment to facilitate a combined N33 billion transfer between 2015 and 2018.

There are however reports that this fresh arrest is unconnected to the existing charges in court.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira4 weeks ago