Economy

FGN Budget – an Expansionary Stance in 2022

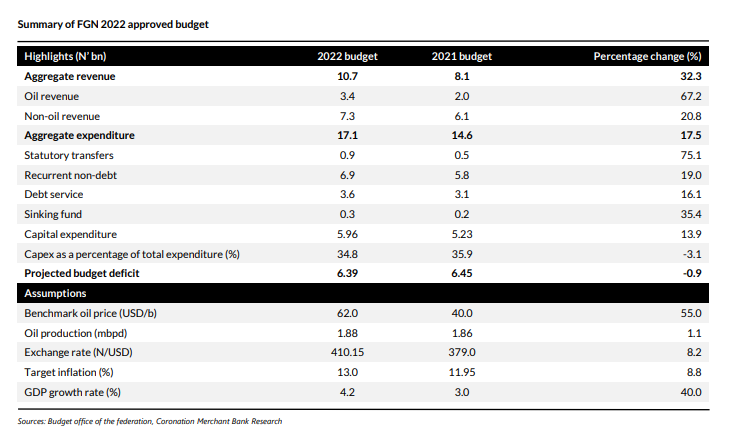

The 2022 FGN budget titled Economic Growth and Sustainability was signed by President Buhari on 31 December ’21. The aggregate expenditure is estimated at N17.1trn, which is 18% higher than the 2021 FGN aggregate expenditure of N14.6trn.

The aggregate amount allocated for capital expenditure in the 2022 budget is N5.96trn. This represents 35% of total expenditure (above the 30% target set by the current administration) and is 14% higher than the 2021 provision of N5.23trn. The budget has an estimated deficit of N6.39trn, approximately 4.1% of total GDP (in 2020) and is slightly above the 3% ceiling set by the fiscal responsibility Act 2007 (FRA).

The fiscal expenditure also comprises of statutory transfer of N869.7bn, debt service of N3.6trn, sinking fund of N270.7bn, recurrent (non-debt) expenditure of N6.9trn, and special interventions (recurrent) of N350.0bn.

The assumptions for the 2022 national budget include an oil price benchmark of USD62/b, 1.9mbpd in oil production, an exchange rate of N410.15/USD, GDP growth rate of 4.2% y/y and an inflation rate of 13%.

Furthermore, the budget deficit is expected to be financed by foreign borrowings of N2.6trn and domestic borrowings of N2.6trn, privatisation proceeds of N90.7bn, and multilateral/bi-lateral loan drawdowns of N1.2trn.

Regarding debt sustainability, Nigeria’s debt-to-GDP ratio stood at 30% at end-September’21. It is relatively low when compared with other African economies such as Kenya (65%), South Africa (80%) and Egypt (90%). However, the country’s debt service-to-revenue ratio stood at 76% as at November ’21, one of the highest among African economies.

The aggregate revenue available to fund the 2022 national budget is projected at N10.7trn. The projected revenue is 32.3% higher than the previous year and comprises of an estimated oil revenue of N3.4trn (31.3% of total revenue) and non-oil revenue of N7.3trn (68.7% of total revenue).

Turning to revenue mobilisation, the FGN plans to grow the revenue-to-GDP ratio from about 8% to 15% by 2025. In line with the 2022 budget’s priorities, some critical policies in the Finance Act 2021 that could assist with achieving this include the imposition of excise duty on non-alcoholic, carbonated and sweetened beverages as well as the technology reforms by the Federal Inland Revenue Service (FIRS) to enhance tax administration and increase revenue.

Based on our estimates, between January to November ‘21, the FGN’s expenditure is 5.9% lower than the prorated budget of N13.4trn while the revenue is 25.9% less than the prorated budget of N7.4trn. Additionally, we note that debt servicing is 38% higher than the prorated budget of N3.0trn.

The FGN aims to further strengthen frameworks for concessions and public-private partnerships (PPP) as well as explore opportunities in green finance, such as implementing the sovereign green bond programme and debt-for-climate swap mechanisms. The national budget is expected to target the financing of critical development projects and programmes which should improve the economic and business environment.

Proper fiscal housekeeping is required to keep the economy afloat in the near-term and drive it towards double digit growth in the medium-to-long term. Capital expenditure should be maximised to raise the potential of revenue generation and growth in the non-oil economy. Although there are existing PPP initiatives by the FGN, increased private sector participation is still required.