Startups

Lydia Includes Crypto and Stock Trading in Payment App

Lydia, a loan fintech startup based in Lagos, Nigeria, will be pushing into an entirely new classification in a move to expand its offerings. The company will be integrating financial assets like cryptocurrencies and stocks trading on its platform.

For the addition of this new trading feature, Lydia will partner up with Bitpanda. Bitpanda is another startup company that deals with cryptocurrency. Lydia users will now be able to purchase, keep and later sell shares belonging to both American and European companies, cryptocurrencies, highly valued metals and ETFs (Exchange-traded funds).

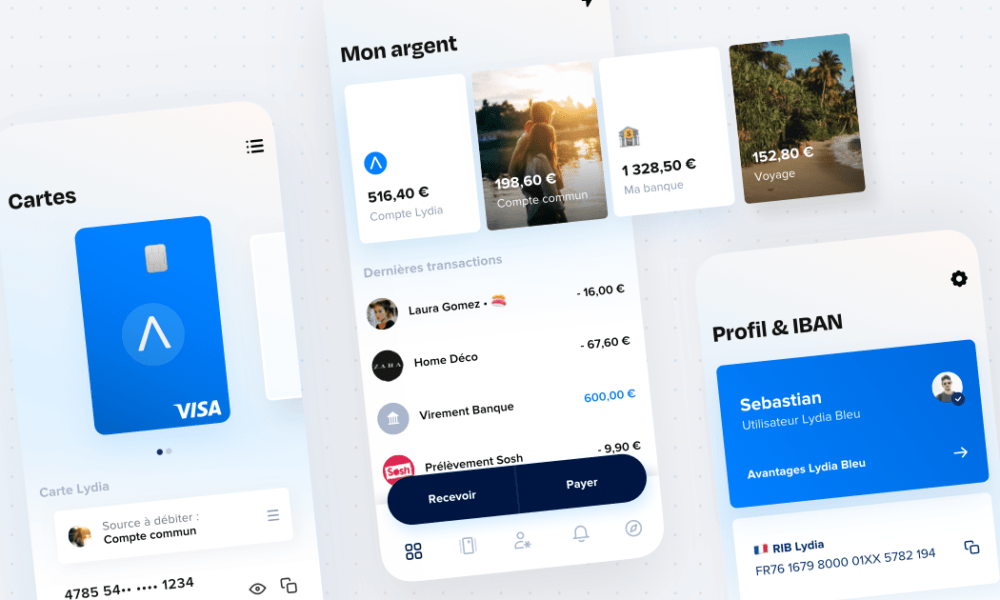

At its inception, Lydia was a peer-to-peer payment app that allowed users to send and receive money without delay from a mobile application. Over time, Lydia added more features like debit cards, cashback donations, personal loans, International Bank Account Numbers (IBANs), etc.

The company is similar to popular the United States of American companies Venmo and Cash App, in that it initially attracts users with peer-to-peer payments before introducing them to new features and products which they can have access to directly from the app. This plan has worked well for Lydia so far, as the company now has about 5.5 million users. Only a few months ago, Lydia introduced savings accounts which were done in partnership with Cashbee.

With the trading feature, users can buy or sell cryptocurrencies, or buy fractional shares in American and some European companies.

The partnership between Lydia and Bitpanda means that users will be able to use the Lydia platform to gain access to any asset which is normally accessible through an existing Bitpanda account. There are no fees for transactions involving fractional shares, but there are fees for both cryptocurrencies and metals.

Lydia co-founder and current CEO Cyril Chiche told TechCrunch that before agreeing on the partnership with Bitpanda, Lydia had met with a lot of potential partners. However, Lydia realized that they had more in common with Bitpanda than other potential partners.