Behind every great success story lies an often-overlooked tale of struggle, missteps, and lessons learned.

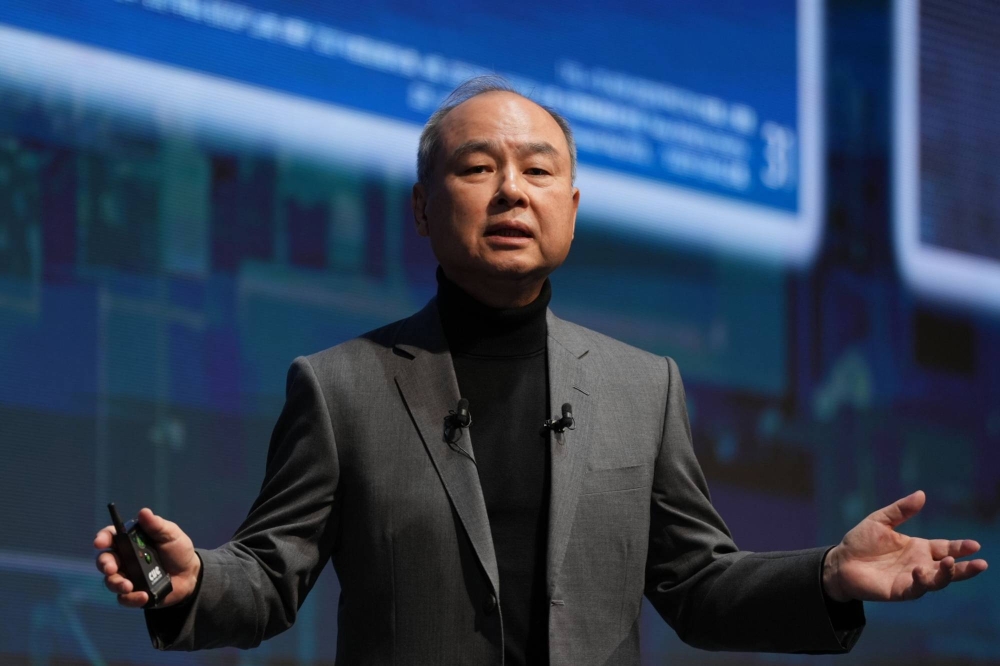

Africa’s richest man, Aliko Dangote, recently shared his untold journey of failure and financial loss during a keynote speech at the 2024 Manufacturers Association of Nigeria (MAN) summit in Abuja.

According to Independent.ng, Dangote opened up about a chapter in his career that saw billions of naira lost in Nigeria’s once-thriving textile industry—a venture that, despite his best efforts, ended in closure and significant setbacks.

Dangote, the Chairman of Dangote Group and a global business icon, revealed that his foray into the textile industry in the 1960s did not go as planned.

Reflecting on the experience, he explained how his company, Dangote General Textile Mills, invested billions in two textile mills—one in Kano and the other being Nigeria Textile Mill, an enterprise originally set up for the Western Region by political leader Chief Obafemi Awolowo.

At a time when the Nigerian textile industry was booming, Dangote had high hopes for the success of these mills.

“We massively invested billions at that time,” Dangote said, recalling the scale of the operations. His company had bought out the foreign shareholders of the Nigeria Textile Mill, aiming to capitalize on the growth of the industry.

However, the boom didn’t last, and the lack of supportive government policies spelled doom for Dangote’s textile ventures.

Dangote explained that the government’s failure to protect the sector through consistent and effective policy decisions ultimately led to the collapse of both textile plants.

“We had to shut both the two factories,” he said, attributing the downfall to a combination of unfavorable conditions and a government that was unable to shield the industry from economic pressures.

The situation worsened when it came to paying the pensions and gratuities of employees who had been with the textile mills for decades.

Dangote noted that many of the workers had been employed for 25 to 30 years, creating a massive financial burden for the company.

Facing these enormous costs, he was forced to sell Liberty Merchant Bank, another one of his business ventures, to cover the debt. “Luckily for us, somebody came and said he wanted to buy our bank, Liberty Merchant Bank,” Dangote explained.

The sale of Liberty Merchant Bank brought in N1.2 billion, but this financial relief was short-lived. “After cashing out N1.2 billion, the industry consumed N985 million to pay pensions and gratuities just to get out of the business,” Dangote revealed.

The losses from the textile industry were devastating, leaving him to admit that his company had “burnt its fingers” in the process.

Despite encouragement from former President Olusegun Obasanjo to re-enter the textile industry years later, Dangote declined, citing the trauma of his previous experiences.

“I told him, ‘No, I will not go back there,’” Dangote said.

The billionaire’s candid recounting of these struggles serves as a reminder that even the most successful entrepreneurs face setbacks on their journey to success.

His willingness to share these hardships offers valuable insights for other aspiring business leaders, especially in emerging markets like Nigeria, where industries can be unpredictable, and policy shifts often complicate growth efforts.

Though the textile industry didn’t yield the results Dangote had hoped for, his resilience and ability to learn from failure allowed him to shift focus to other sectors.

Today, the Dangote Group is a leading conglomerate with investments spanning cement, sugar, salt, and petroleum, among others.

Dangote has solidified his place as one of Africa’s wealthiest men, a testament to his determination to succeed in adversity.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Technology4 weeks ago

Technology4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Economy4 weeks ago

Economy4 weeks ago