Dollar

U.S Dollar Pares Losses Against Safe Haven Yen on Wednesday

The United States Dollar rebounded slightly from a three-day low recorded against major peers since the Federal Reserve announced tapering without plans to raise interest rates in spite of the inflation rate hitting 5.4 percent in the month of September.

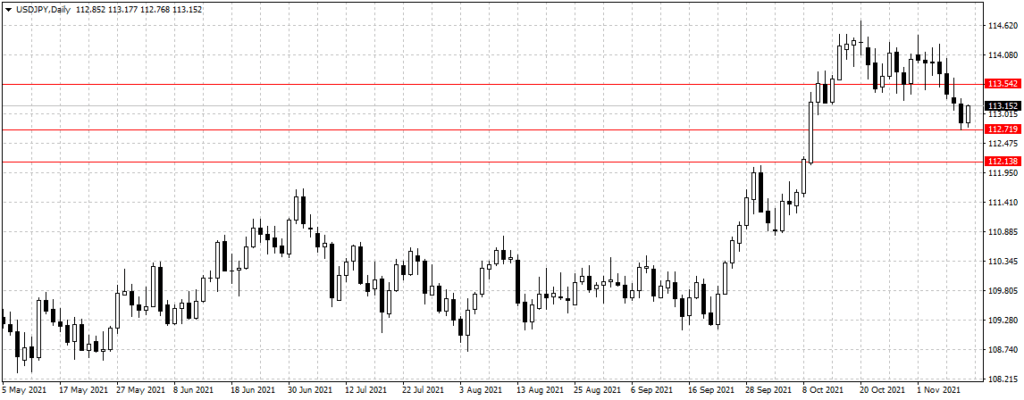

The U.S dollar after trading near one month low against the Japanese Yen in the early hours of Wednesday rebounded from 112.76 to 113.15 at the time of writing. Widely regarded as safe haven, investors normally jump on Yen during a period of high uncertainty to curb risk exposure.

The dollar index, which measures the greenback against six major currencies, was largely unchanged at 93.997 after declining gradually from more than a one-year high of 94.634 it reached on Friday.

The Euro common currency was little changed at $1.1565, sustaining its three-day gain against the greenback.

Experts are predicting that a further increase in Consumer Price Index, which measures inflation, in October could force the Fed to raise interest rates than previously anticipated. Economists polled by Reuters are predicting 0.4 percent for CPI in October, up from 0.2 percent in September.

Still, We’ll need to see a print of 0.8% month-on-month to see the dollar index break out of the top of the range of 94.50,” Chris Weston, head of research at brokerage Pepperstone in Melbourne, wrote in a client note.

Although the dollar has been trending lower against the yen, “if U.S. CPI comes in hot then this poses a risk to USDJPY shorts,” he wrote.