Billionaire Watch

Price of Tesla Stock Drops 9 Percent as Elon Musk Faces $13 Billion Tax Bill

Elon Musk, Chief Executive Officer (CEO) of Tesla, is presently owing more than $13 billion in both state and federal taxes according to numerous reports from the United States.

The billionaire had asked his over 62 million Twitter followers over the weekend whether he should sell 10 percent of his Tesla holdings. “Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” Musk tweeted.

As reported by Investors King, the results were 58 percent in support of selling while 42 percent voted against the billionaire’s decision. However, a new report has noted that regardless of the outcome of the poll, Musk would still have to sell given the size of his debt.

In 2012, the billionaire was awarded options as part of a compensation plan because he doesn’t collect salary or cash bonus, therefore his wealth comes from stocks award and the gains in Tesla’s share price. Musk was awarded 22.8 million shares at $6.24 per share in 2012. Tesla stock was hovering around $1,050 a unit at the time of writing, meaning Musk’s gain on the shares is about N23.797 Billion.

But because the billionaire has to pay income tax on the gain since the options are taxed as an employee benefit or compensation. They will be taxed at top ordinary-income levels, or 37 percent plus the 3.8 percent net investment tax. Also, he will have to pay the 13.3 percent top tax rate in California since the options were granted while he was a resident in California.

But because the billionaire has to pay income tax on the gain since the options are taxed as an employee benefit or compensation. They will be taxed at top ordinary-income levels, or 37 percent plus the 3.8 percent net investment tax. Also, he will have to pay the 13.3 percent top tax rate in California since the options were granted while he was a resident in California.

In total, the billionaire would be paying 54.1 percent in state and federal tax. Meaning, the total tax bill on Musk’s options at the present price would be around $12.874 billion.

While Musk didn’t confirm the size of his tax bill in his tweets, he suggested he can only pay his taxes by selling some of his holdings. “Note, I do not take a cash salary or bonus from anywhere. I only have stock, thus the only way for me to pay taxes personally is to sell stock.”

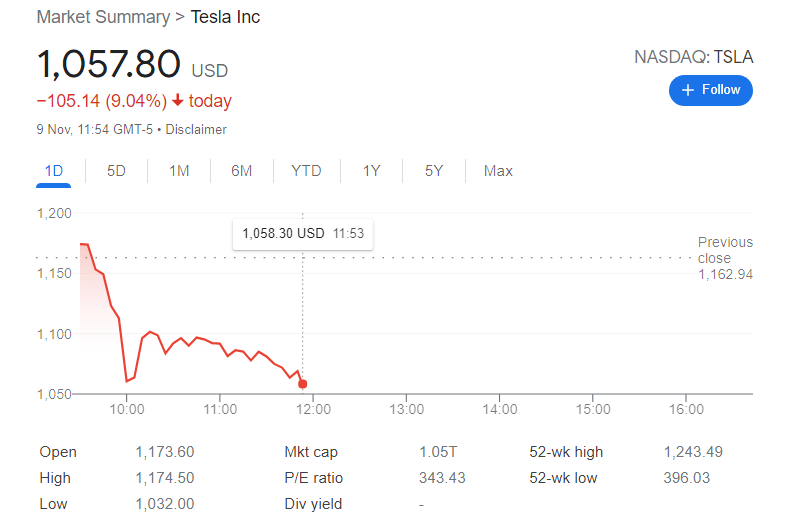

Tesla stock closed at $1222 on Friday but started plunging on Monday after Musk’s tweet as some investors and analysts were interpreting the billionaire’s decision to sell as cashout.

Wall Street Journal on Tuesday said “Did Elon Musk outsource the decision of whether to sell his Tesla stock to his Twitter followers because he’s a wacky billionaire who is angry about Democratic tax plans? Or is it because he knows more about Tesla’s true value than anyone else, and thinks now’s the time to get out?

“Either way, it’s a good time to sell as the three trends that helped Tesla shares soar are fickle and might reverse at any time.”

Michael Burry, a big short investor who has criticised Elon Musk and described Tesla stock as overpriced, said regardless of what the billionaire claimed was the reason for selling the 10 percent, he has to pay back personal loans he used 88.9 million of his shares as security for on June 30, 2021.

“Regarding what @elonmusk NEEDS to sell because of the proposed unrealized gains tax, or to #solveworldhunger, or … well, there is the matter of the tax-free cash he took out in the form of personal loans backed by 88.3 million of his shares at June 30th,” the investor tweeted.

Burry then went on to share a link to Securities and Exchange Commission filing in August that said Musk had pledged about 88 million shares, or 36 percent of his total stake, as collateral for personal loans as of June 30.

The uncertainty surrounding the real reason for the sale is forcing several retail investors to start taking profit as they await more clarity. Still, the billionaire Tesla holdings outside his options or compensation worth over $200 billion.