Telecommunications

MTN Nigeria Records Solid Growth In Profit After Tax Despite Fall In Mobile Subscribers

Telecommunications

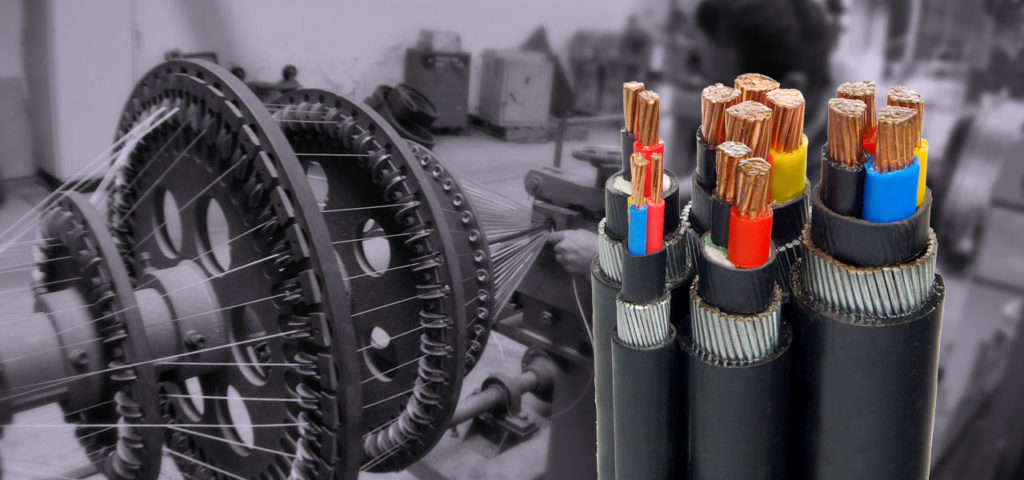

Nigeria to Expand Internet Access with 90,000km of Fibre Optic Cable

Telecommunications

Naira Devaluation Spurs Airtel Africa’s $549 Million Forex Loss

Telecommunications

Telecom Tax, Other Levies Back on the Table for $750m Loan

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 24th, 2024

-

Naira4 weeks ago

Naira4 weeks agoDollar to Naira Black Market Today, April 22nd, 2024

-

Travel3 weeks ago

Travel3 weeks agoSaudi Arabia Breaks 70-Year Alcohol Ban, Opening Shop for Diplomats

-

Jobs4 weeks ago

Jobs4 weeks agoJob Cuts Hit Tesla: More Than 6,000 Positions Axed Across Texas and California

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 25th, 2024

-

Naira3 weeks ago

Naira3 weeks agoDollar to Naira Black Market Today, April 30th, 2024

-

Investment4 weeks ago

Investment4 weeks agoMinister Accuses Past NCDMB Leadership of Squandering $500m on Unproductive Projects

-

Travel4 weeks ago

Travel4 weeks agoDelta Air Lines Flight Diverts to Togo After Passenger Dies Midair