Nigerian Exchange Limited

UPL, FBNH, Others Boost Nigerian Exchange Limited to Gain N340 Billion Last Week

Strong gains recorded in the stocks of University Press, FBN Holdings, Ecobank and other stocks last week boosted Nigerian Exchange Limited (NGX) by N340 billion.

During the week, investors exchanged 2.179 billion shares worth N21.963 billion in 22,438 deals on the floor of the Exchange, against a total of 2.187 billion shares valued at N16.183 billion that were traded in 14,377 deals in the previous week.

In terms of the volume traded, the financial services industry led the activity chart with 1.770 billion shares valued at N18.058 billion and exchanged in 12,942 deals. Therefore, the sector contributed 81.20 percent and 82.22 percent to the total equity turnover volume and value, respectively.

The Conglomerates followed with 93.178 million shares worth N169.819 million in 736 deals. In third place was ICT Industry, with a turnover of 72.338 million shares worth N1.043 billion that exchanged hands in 861 transactions.

FBN Holdings Plc, Universal Insurance Plc and Fidelity Bank Plc were the three most traded stocks and together accounted for 1.161 billion shares worth N12.338 billion that were traded in 3,460 transactions. The three contributed 53.28 percent and 56.18 percent to the total equity turnover volume and value, respectively.

The market value of all listed equities rose by N340 billion or 1.62 percent from N20.956 trillion it closed in the previous week to N21.296 trillion last week.

Similarly, the NGX All-Share Index gained 1.61 percent or 647.19 index points from 40,221.17 index points recorded in the previous week to 40,868.36 index points last week.

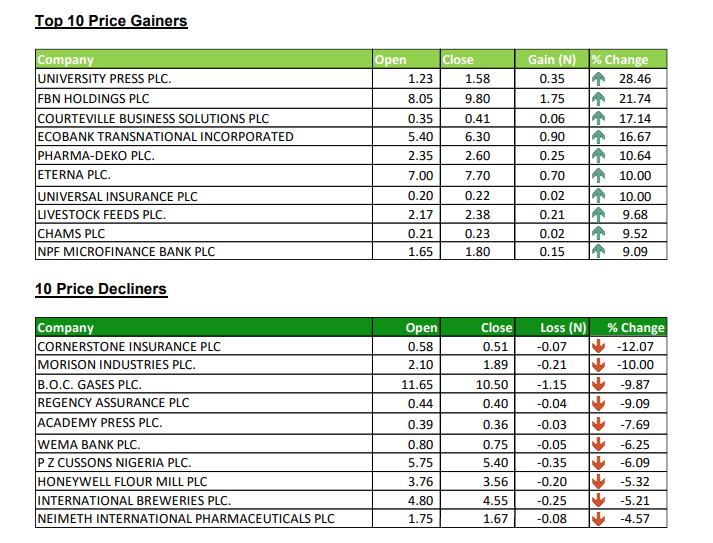

University Press Plc led gainers with 28.46 percent or N0.35 during the week to close at N1.58 percent per share. This was followed by the 21.74 percent or 1.75 percent recorded in FBN Holdings Plc in the same week. See the details below.

Accordingly, all indices closed higher with the exception of NGX Insurance and NGX Consumer Goods Indices that shed 1.51 percent and 0.51 percent, respectively. While the NGX ASeM, NGX Growth and NGX Sovereign Bond Indices closed flat.

The bourse closed positive for the first time in eight months last week. Gaining 1.48 percent year-to-date.