In furtherance of its resolve to help Nigerian businesses build sustainable export capabilities, leading Nigerian lender, Fidelity Bank Plc, is set to host the 11th and 12th editions of its highly acclaimed Export Management Programme (EMP).

Launched in 2016, the EMP is targeted at preparing participants for real-time experiences in the international non-oil export markets and the broader export market at large. The session typically covers a wide range of topics including Export documentation, Selection and Implementation of Supply Chain Management for Exports, Application of Export Development Business Processes amongst others.

Speaking on the programme, the Managing Director, Fidelity Bank Plc, Mrs. Nneka Onyeali-Ikpe noted that, “As a leading supporter of small businesses, we introduced the EMP five years ago to bridge the knowledge gap in the export business locally and to help participants to compete effectively in the global export market. Given the success, we have recorded in the course of the programme and following the yearnings of potential participants, we decided to host an edition of the training in Kano for those who are unable to attend the session in Lagos.”

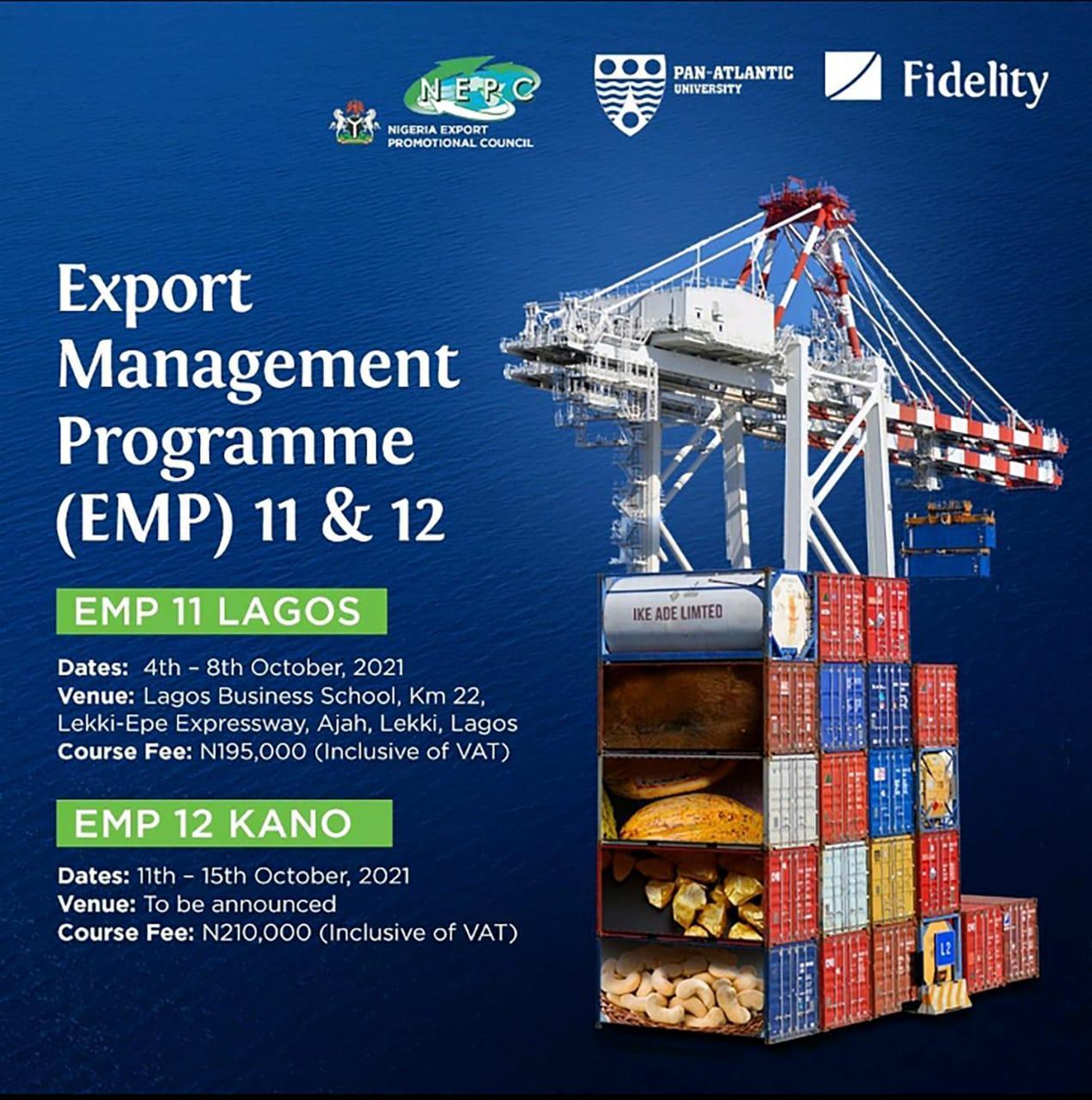

While EMP 11 is scheduled to hold at the Lagos Business School (LBS), Lekki, Lagos between 4 and 8 October 2021; EMP 12 would hold at a soon-to-be-announced venue in Kano State from 11 to 15 October 2021. The sessions would be facilitated by leading faculty from LBS, Nigerian Export Promotion Council (NEPC) staff as well as experts in financial management and exports.

Fidelity Bank has over the years demonstrated its resolve to grow the non-oil export side of the economy through strategic initiatives and partnerships. For instance, the bank provided over N32.7 billion in credits to businesses operating in strategic sectors including rice, dairy, poultry, oil palm and cocoa in 2019. The bank has also successfully leveraged strategic partnerships with the Central Bank of Nigeria (CBN) and Development Finance Institutions (DFIs) under various industry targeted intervention funding programmes to enhance access to credit for eligible players in the agribusiness and non-oil exports space with the aim of addressing food security gaps and enhancing foreign exchange earnings.

“The benefits of supporting the non-oil sector of the economy cannot be overemphasized given the immense benefits that it provides to the economy and the nation in terms of providing much needed foreign exchange investments, increasing our Gross Domestic Product (GDP) and employment generation. This informs our decision to host the EMP regularly and we enjoin interested entrepreneurs to take advantage of this initiative to take their business to the next level,” Onyeali-Ikpe explained.

To register for the event, kindly visit www.fidelitybank.ng

About Fidelity Bank Plc

Fidelity Bank is a full-fledged commercial bank operating in Nigeria, with about 6million customers who are serviced across its 250 business offices and various other digital banking channels. The bank has in recent times won accolades as the Best SME Friendly Bank, Best in Mobile Banking and the Most Improved Corporate/Investment Bank among several industry awards and recognitions. The bank was also ranked the 4th Best Bank in the Retail Banking Segment in the 2017 Banking Industry Satisfaction Survey conducted by KPMG.

Focused on select niche corporate banking sectors as well as Micro Small and Medium Enterprises (MSMEs), Fidelity Bank is rapidly implementing a digital-based retail banking strategy which has resulted in an exponential growth in savings deposits over the last 3 years and a corresponding surge in customer enrollment on the bank’s flagship mobile/internet banking products.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago