Nigerian agritech start-up, Releaf, has just announced a $2.7 million seed funding led by Samurai Incubate Africa, Future Africa and Consonance Investment Managers with participation from Stephen Pagliuca, Chairman of Bain Capital and Justin Kan (Twitch).

In addition to the seed round, Releaf also secured $1.5 million in grants from The Challenge Fund for Youth Employment (CFYE) and USAID.

The seed funding will enable the development of industrial food processing technology in Nigeria’s smallholder-driven Oil Palm sector, while the grant will enable Releaf to provide working capital and other value-added services for smallholders and small-scale processors. Grant funding will support the training, recruitment and retention of more women and youth in Nigeria’s Oil Palm sector by creating both digital and technical jobs.

Nigeria’s oil palm industry is dominated by smallholder farmers, with 80 percent of the local market share. However, production rates are low because many still rely on inefficient processes for de-shelling, including the use of rocks and inappropriate hardware. These ineffective processes also lead to low-quality palm kernels, largely unfit as input for high-quality vegetable oil manufacturing. As a result, food factories are unable to purchase these raw materials and operate significantly under capacity. On average, food factories have 3X more installed capacity than utilisation, which impacts the cost of food and further investment into processing capacity.

Releaf acts as a bridge between smallholder farmers and food manufacturing companies with its proprietary patent-pending machinery, Kraken. Kraken can process any quality of palm nut into premium quality (95 percent purity) inputs for food factories. Releaf’s software connects the start-up to more than 2,000 smallholder farmers, ensuring consistent, large-scale supply. While palm kernel oil production is not foreign to Nigeria, Releaf’s technology and scale mean it can process 500 tonnes of palm nuts per week. The software offerings also allow the start-up to receive inbound supply requests from farmers via USSD, provide working capital financing, and collect proprietary data on supply availability.

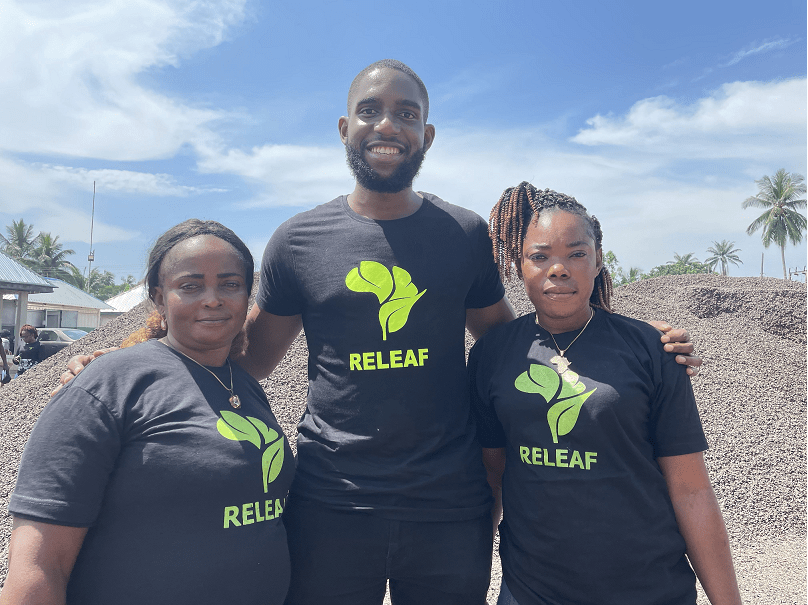

Speaking about the new funding, Ikenna Nzewi, CEO and co-founder of Releaf, said, “our mandate is to industrialise Africa’s food processing industry. This round of funding enables us to develop and prove our technology with smallholder farmers in the oil palm sector. Given Nigerians spend ~60 percent of their income on food and Africa’s population is set to increase by 100,000 people per day over the next three decades, we’re presented with an incredible opportunity to feed more people, reduce consumer costs, and supply the fastest-growing food market in the world. Releaf is committed to harnessing technology to accelerate the economic wealth of rural, agrarian societies throughout the Continent. We firmly believe that a robust real economy is the foundation for long-lasting and shared prosperity for Africans and are excited to deepen partnerships with like-minded organisations, governments, and firms.”

Rena Yoneyama, Managing Partner at Samurai Incubate Africa who led the round, commented, “Releaf’s novel approach to operating within the value chain with proprietary technology set it aside from many agritech startups we have spoken about to. We believe the firm’s thesis on decentralizing food processing would strongly match Africa’s economic development landscape for the next few decades. Ikenna and Uzo are the perfect founders to disrupt this market in Nigeria and beyond. We are thrilled to back them as they innovate in providing both agro-processing and financial services to rural communities and farmers.”

Iyin Aboyeji, General Partner at Future Africa noted, “more than 50% of the goods in supermarkets globally contain glycerine – an extract made from palm oil – a cash crop that is passed down from generation to generation. The team at Releaf is building the agro-allied industry of the future from the ground up, starting with palm oil which they have developed a novel technology to aggregate, deshell and process into critical ingredients like vegetable oil and glycerine. Future Africa is delighted to back Releaf to build the future of modern agriculture.”

Dr. Nneka Enwonwu, Country Relationship Manager, from The Challenge Fund for Youth Employment (CFYE), said, “We are thrilled to partner with Releaf on their mission to improve efficiency and profitability for farmers and food factories in Africa. The founders’ vision and the team’s enthusiasm gave us confidence that Releaf will deliver real value for rural communities and create digital/technical jobs for women and youth. We are looking forward to their results and success over the coming years and continuing to support their work.”

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Naira1 week ago

Naira1 week ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira7 days ago

Naira7 days ago