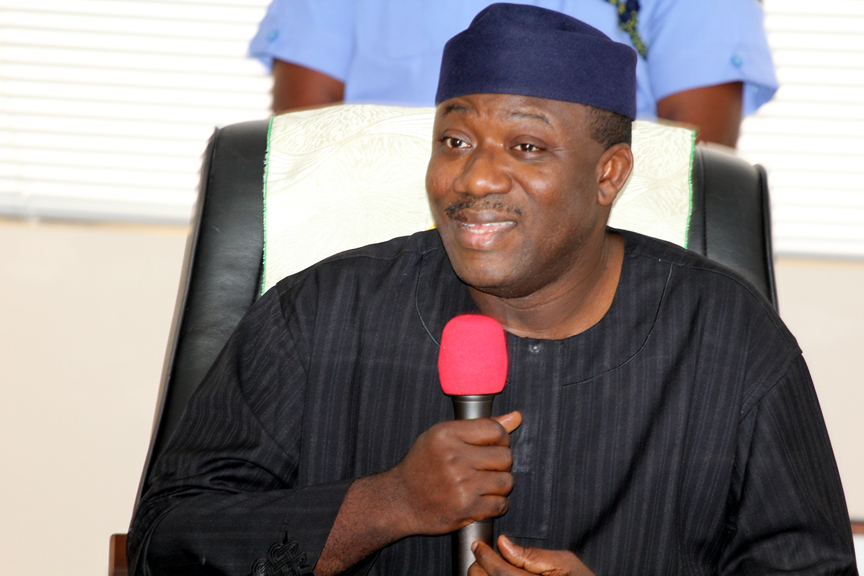

Governor of Nigeria’s Ekiti State, Dr. Kayode Fayemi, has disclosed that his administration had attracted over $100 million investment to the southwest state in the last three years to buoy its Internally Generated Revenue (IGR).

Fayemi said he was able to accomplish the feat through offering of waivers to investors on payment of some statutory fees and partnership with private investment to boost the economy.

The governor, who said this in Ado Ekiti, on Tuesday, during a workshop organised by the Ekiti State Development and Investment Promotion Agency for State officials on Nigerian Investment certification programme for states (NICPS) was represented by the Commissioner for Trade and Industry, Chief Muyiwa Olumilua.

While noting that his government had created veritable platform to ease means of doing businesses to drive economic development, Fayemi said, “In the last three years, we introduced some reforms to make establishment of business easier, which included granting of business premises waiver, Automation of PAYE registration, introduction of online payments for construction and setting of High Court minimum thresholds at six judgments per quarter.

“All these were put in place to attract new businesses to Ekiti. In totality, we have attracted over $100m to Ekiti since 2018. Ikun Dairy Farm alone gulped $5m, which we achieved through partnership with Promasidor Nigeria Limited and we are making similar progress in other agro based companies”.

The Ekiti governor said the NIPC certification programme was introduced to support investors for business promotion, job creation and economic diversification.

According to him, the government has been partnering intending investors via provision of accurate information on business opportunities, allocation of buildings and sites that were investment-friendly and maintaining marketing standard that could boost their investments.

Special Adviser to the Governor and Director General, Ekiti State Development and Investment Promotion Agency, Mr. Ayoola Owolabi, also said the training was conceptualised to enhance promotion of private investments in the state.

Owolabi stressed that improving business environment was critical to the Fayemi government policy thrust and that accounted for the establishment of the EKDIPA with the mandate to work with Ministries, Departments and Agencies (MDAs) for effective delivery of government’s focus in investment.

“This training deals majorly with knowledge that will enhance contracts and registering of businesses. Through serious investment drive, we have worked for the resuscitation of Ikun Dairy Farm in partnership with Promasidor Nigeria Limited while Ikogosi Warm Spring and Resort, Ire Burnt Brick, Ekiti House in Abuja and Lagos are at advanced stages of Public Private Partnership,” he said.

The Southwest Zonal Head, Nigeria Investment Promotion Commission (NIPC), Mr. Hassan Lawal, said the training showed the eagerness of the Fayemi government to develop investment for economic growth and development in the state.

“Working with stakeholders is very necessary, because you can’t develop business alone. Our focus is to improve the IGR of the states. We don’t want them to rely alone on monthly federal allocation and this can only be achieved with investment promotion, where our youth can be more engaged and productive”.

Also at the commissioning of a multi-million naira integrated snail farm in Okemesi-Ekiti, Fayemi affirmed that the Egbeja Snail Farm which will produce 2,600 metric tons of snails per annum, is a private initiative of Farmkonnect Agribusiness Nigeria Limited.

The governor said many investors prefer to invest in the state because of the ease of doing business policy of his administration and sundry supports the government offers prospective investors, including land and tax holidays.

“You will recall that the state governments efforts on agriculture and agribusiness over the last two years had already attracted almost a hundred million dollars investment in the agricultural sector to Ekiti State via the Ikun Dairy Farm by Promasidor Nigeria; FMS Agro, JK Rice, Stallion Rice, Dangote rice, Promise Points and many more that are located in our special agricultural processing zones where all the facilities are being provided such as good roads, irrigation facilities, schools etc.

“Our ease of doing business personnel would continue to work with all investors while intending investors will enjoy necessary support including ease of doing business registration, land allocation, issuance of C of O and tax holidays for certain category of business,” he added.

Commissioning the Egbeja Farm, Fayemi promised to continue to provide the enabling environment and strengthen the ease of doing business policy to attract more investors into Ekiti.

The governor said the new snail farm would produce a minimum of 2,600 metric tons of snail per annum and provide opportunity for the extraction of slime for use by beauty care and pharmaceutical companies across the world.

He said the project would not only place Ekiti in the world market for the exportation of snails and slime but would also complement the vision of his administration in providing job opportunities for the youth population as the project has the capacity to engage over 2,000 personnel across various sectors of the initiative.

Fayemi, who undertook a guided tour of facilities on the farm, explained that the Egbeja snail village project was a demonstration and commitment of his administration’s quest for a complete agribusiness value chain“ from farm to fork where there will be value addition that would go beyond primary production to include processing, marketing and delivery to our various dining table.”

He added: “Only last week, we flagged off the first phase of a 1000 kilometre rural access and Agricultural Marketing Project initiative, which is a state-wide rural road project. This is an addition to the ongoing road projects that cut across the three senatorial districts of Ekiti State.

“Our rural road project is strategically structured to link our farmstead and hinterland to the major roads in order to enhance movement of farm produce to the market and by the time we complete all the ongoing road projects, particularly the ring road and the cargo airport, agribusiness in Ekiti State will experience unprecedented growth.”

Azeez Oluwole, the initiator of the project and founder of Farmkonnect Agribusiness, said the project was proposed to occupy a 100,000 square metre of land to make it the largest place of snail farms in Africa and the second in the world.

He said the construction of the structures of the farm would continue for the next two years and is going to be technologically driven. According to him, the setting up of the snail project in Ekiti was informed by the friendly-investment environment made possible by the ease of doing business policy of the Fayemi-led administration

Forex2 weeks ago

Forex2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira6 days ago

Naira6 days ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago