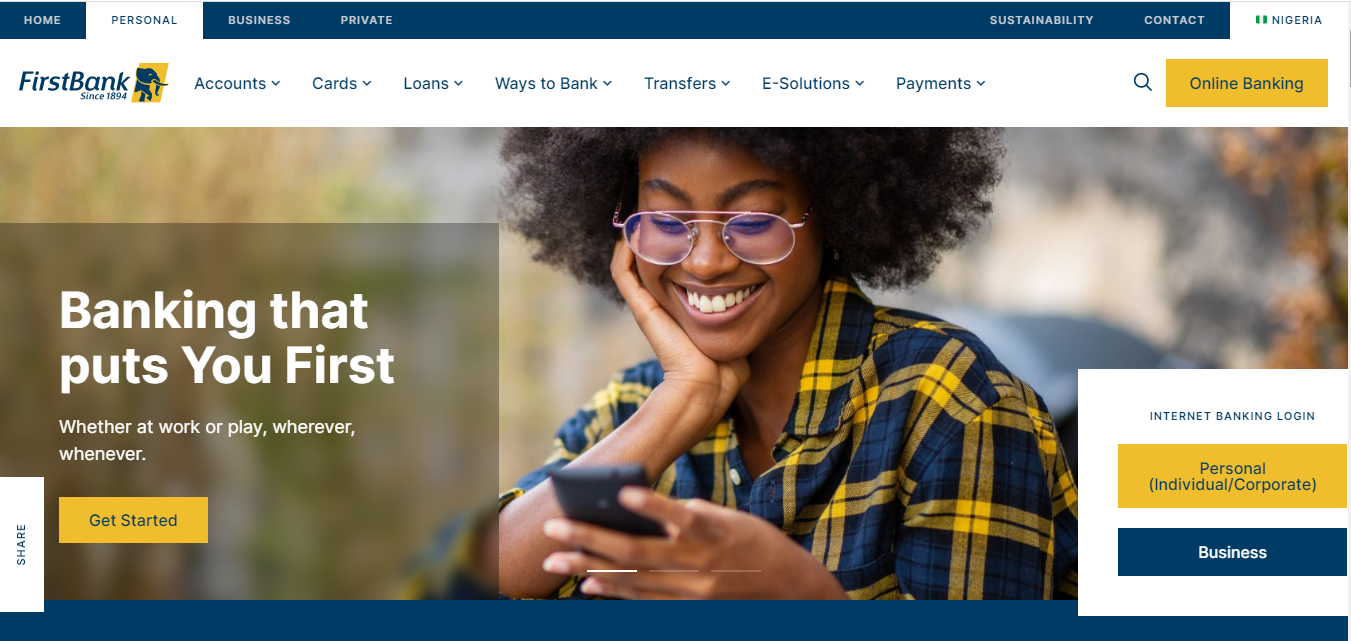

FirstBank, Nigeria’s leading financial institution, has unveiled its new improved corporate website designed to enhance service delivery, increase access and promote financial inclusion across the country.

The easy to use website was developed with improved functionality that covers all FirstBank units from Account Opening to Cards (Prepaid, Debit and Credit Cards); Loans; Foreign Transfers; E-Solutions (FirstPay, FirstBillsPay, POS Terminal etc) and Payments of Taxes & Duties; Bills & Utilities; School Solutions; Collections and Trade.

On ease of banking, the website was redesigned with better user-friendly navigation, speed and security to ensure transactions are done just-in-time and in a secure technological environment.

Customers can now open a functioning bank account within 5 minutes on their mobile devices and experience top-notch convenience. The website has been upgraded with a smoother experience on funds transfer, bill payments and airtime transactions as customers can add and delete beneficiaries without having to repeatedly enter the recipients’ details over and over again. Users can also take a photo or select from the Avatar (available icons) to personalize their dashboard and beneficiaries for Transfers, Bills Payment & Airtime Transactions by uploading a picture to associate with their beneficiary, especially the more frequent ones.

The dashboard has been designed to reflect the lifestyle and social pattern of the user as it can be customized by adding any profile picture of choice. The dashboard also enables users to monitor their spending patterns over a period. It shows the inflow and outflow of funds on their account.

The new website also includes Agent Banking, an initiative by FirstBank that brings financial services to the unbanked and underbanked segment of the society by empowering existing businesses within the communities to deliver these bank services.

With over 100,000 Agents across the nation, it is no surprise why the leading financial institution is spending billions to deepen financial inclusion and ensure more Nigerians can access financial services at a near-zero fee. In 2020, Firstmonie Agents processed over 295 million transactions with a total value of N6.65 trillion and opened more than 196,000 accounts in 774 local governments.

Therefore, in order to make sure more people in the unbanked population join the growing financial system and take advantage of FirstBank numerous financial opportunities, security, affordable loans, top-notch customer service, etc, the lender has redesigned its website with an onboarding form for potential Firstmonie Agents to apply from the comfort of their home without queuing in the bank.

It is almost impossible to effectively take advantage of numerous financial opportunities, make the right investment calls and manage money without the right education, this FirstBank knows better, therefore, a section of the new website has been dedicated to teaching customers, both existing and new customers, how to better manage money, invest and grow their investments.

Speaking on the launch of the new corporate website, Dr. Adesola Adeduntan, CEO of FirstBank Group, said that “as one of the key contact points to existing and potential customers, the Bank’s website remains a gateway to our business, supporting our unique value propositions and financial services solutions. As such, we are committed to continuously improve the overall user experience through intriguing content quality, exciting features and ease of navigation”.

He further stated that “the Bank’s new website will be updated on a regular basis with exciting features that will continue to reinforce the Bank’s resolve to promote digital customer interactions and transactions across our virtual touchpoints and platforms’’.

He further stated that “the Bank’s new website will be updated on a regular basis with exciting features that will continue to reinforce the Bank’s resolve to promote digital customer interactions and transactions across our virtual touchpoints and platforms’’.

Concluding, he remarked that “the website will also serve as a financial services library that will keep customers and the public abreast of various financial services solutions and offerings, thereby helping them to improve their economic and social wellbeing.”

Adeduntan encouraged everyone to explore the new improved website and follow the Bank’s social media pages for updates.

Education4 weeks ago

Education4 weeks ago

News3 weeks ago

News3 weeks ago

Business3 weeks ago

Business3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Investment3 weeks ago

Investment3 weeks ago

Telecommunications4 weeks ago

Telecommunications4 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago