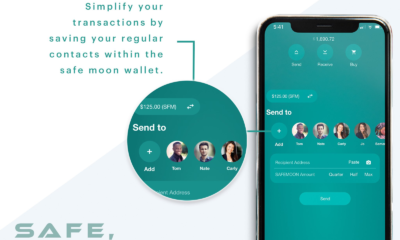

SafeMoon announced it had partnered with Simplex to begin offering streamlined and integrated SafeMoon wallets for crypto investors.

Simplex is an EU-licensed financial institution that provides fiat infrastructure for the crypto industry, securely processing credit card payments and making cryptocurrency accessible to all. Created in 2021, SafeMoon is the world’s fastest growing DeFi Crypto Currency made on the Binance Smart Chain (BSC), with 2.1 million holders and counting. The partnership with Simplex will enable crypto investors to invest in SafeMoon much more directly.

“Doing things differently is both our starting point and part of our end goal,” said John Karony, SafeMoon CEO. “This new SafeMoon wallet is a vital tool for our investors, and that’s why we’re happy to be partnering with Simplex – another company that understands the importance of operating on the principal of opening financial markets and strategies to everyone.

“One of our founding principles is transparency, so we’re extremely public with a great deal of our activity. It’s one of the reasons why we routinely hold ‘Ask Me Anything’ (AMAs) on Twitch. We want our investors to see and interact with us, to learn more about what we’re doing, and to become as deeply involved with their investment as they choose to be. That’s just an entirely different approach to crypto and investing in general. And it’s an approach we know works. Our growing army of investors is highly dedicated to our mission because they know we’re just as dedicated to providing service and value to them.”

SafeMoon: Crypto Done Differently

Specifically encoded to benefit long term holders (called “hodlers”), SafeMoon is a new but extremely popular crypto currency that incentivizes long-term investment by offering a core liquidity guarantee. In a bold attempt to discourage price volatility, often incited by massive day traders (crypto “whales”), the SafeMoon protocol charges sellers a fee of 10% of the amount sold while rewarding hodlers with 5 percent of the seller’s fee in SafeMoon tokens, and storing the other 5% in a public liquidity pool. In addition, SafeMoon opts for manual burns versus continuous burns, allowing SafeMoon more control over the coin’s overall supply.

With some of the most avid fans in the cryptosphere, SafeMoon skyrocketed to fame when it was featured in a sensational Times Square billboard ad wholly solicited by Reddit user “ighproperties” and funded by the SafeMoon community. SafeMoon has also recently been featured in national publications like Fortune and the Wall Street Journal. Currently working on multiple evolutions and company branches for the future, SafeMoon is planning the launch of a NFT exchange that would extend the SafeMoon concept to other cryptocurrencies, a SafeMoon app, and a deal with a major African country that would integrate SafeMoon as part of their public currency.

About SafeMoon

The SafeMoon Protocol is a community-driven, fair launched DeFi crypto token with three simple functions that occur during each trade: Reflection, LP Acquisition, and Burn. Bringing a truly innovative approach to tokenomics, holders get rewarded by simply holding SafeMoon coins with auto-generated liquidity and static farming. The longer a wallet is held, the more tokens are awarded by redistributing 5 percent of the 10 percent fee levied on all SafeMoon sales.

Naira4 weeks ago

Naira4 weeks ago

News3 weeks ago

News3 weeks ago

Education4 weeks ago

Education4 weeks ago

Social Media4 weeks ago

Social Media4 weeks ago

Economy4 weeks ago

Economy4 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Dividends4 weeks ago

Dividends4 weeks ago

Business3 weeks ago

Business3 weeks ago