The year began amidst a raging bull market. Global equities have made up all the post-pandemic losses and are up 85% (as at 7 May 2021) since their March 2020 lows. Yet, our data shows many investors have missed the bull run altogether or are significantly underinvested, waiting for the ‘right’ opportunity to re-enter. Those who did stay invested through the volatility or re-entered the market in 2020 have a slightly different problem (‘Should I sell?’).

It is safe to say that most of us belong to one of these categories. History shows there are time-tested methods to deal with these challenges and earn a respectable return over the long term.

To tackle the last problem first (‘Should I sell?’), we believe it would be imprudent for investors who have ridden the bull market thus far to cash out. We do not expect a major bear market to develop, at least in the next year, given accelerating global growth and corporate earnings expectations and extremely loose policy settings. We expect economies and businesses to gradually return to normalcy by the end of the year as the pace of vaccinations picks up worldwide.

Stay well-diversified

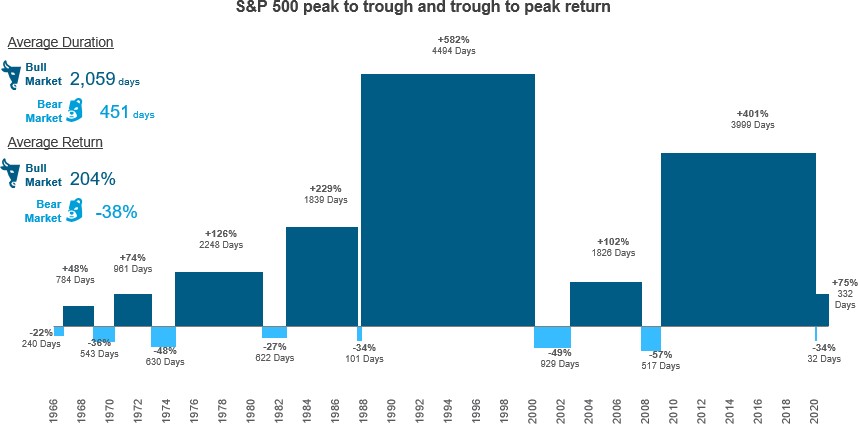

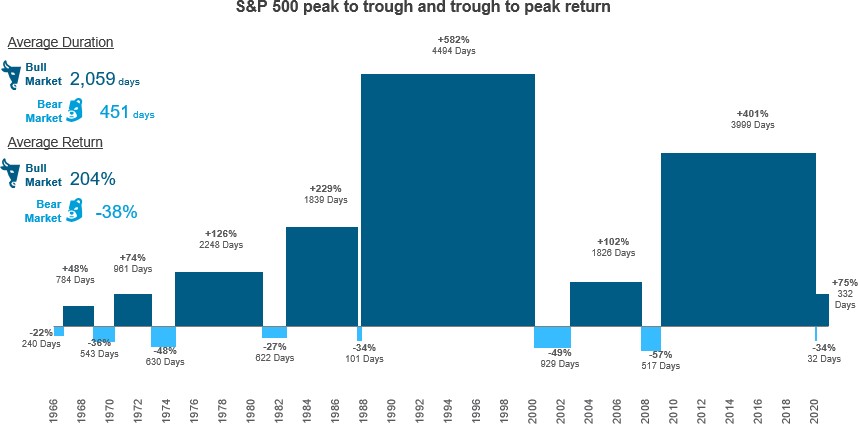

Based on decades of market history, it is hard to make a case for an equity bear market without an accompanying economic recession. Therefore, the risk of trying to time when to exit the market before any short-term correction and re-enter at the bottom are greater than staying invested (since the investor could lose some of the best days in the market by staying out). For this group, the best course would be to ensure that they stay well-diversified across asset classes and sectors and rebalance their portfolios if they have strayed significantly away from their risk tolerance.

Cost of inaction

For those who have stayed out of the market before or after the pandemic, the challenge of when to get back in is seemingly much harder, given that equities are now at record highs and there are increased concerns about a short-term correction. Often, their hesitation stems from a desire to perfectly time their re-entry. In our experience as wealth managers, this is the single most common investment mistake.

For this group, the salient point to consider is the cost of inaction. A simple diversified portfolio (50% global stocks and 50% global bonds) for buy-and-hold investors has returned close to 6% per year over the past 10 years, even after taking into account six 10%+ equity market pullbacks, including the 34% correction at the height of the pandemic in March 2020. At that rate of return, USD10,000 invested a decade ago would have built a roughly USD18,000 nest egg. An equivalent savings deposit paying, let’s say, 1% interest would have grown to only about USD11,000, not even keeping pace with inflation.

The rules of investing

This example brings us to the seven key rules of saving and investing wisely:

- Prepare an investment plan based on your financial goals, risk tolerance and time horizon;

- Set aside funds for short-term exigencies in cash;

- Invest most of the remaining funds (say 80%) in a core portfolio broadly diversified across asset classes, geographical regions and industry sectors. This will help limit the downside from unexpected events (because they will happen over our lifetime!);

- Stay invested through market cycles, since time and the miracle of compounding returns is your friend;

- Rebalance the portfolio at regular intervals (say twice a year) to bring it back to your risk tolerance;

- Use the remaining funds (at most 20%) – let’s call it ‘funny money’ – for short-term trading (for those who want the thrill). Make sure this is based on sound research and not the latest fad, and done with a cool head – not be too greedy at the top and panicky at the bottom (using stop-losses would help remove personal biases and limit downside risks for this part of the portfolio); and

- Finally – and this is the crucial part – follow the investment plan! Procrastination, as we saw above, is the greatest enemy of the investor.

For some investors, putting all funds to work immediately could be psychologically challenging. For this group, setting up a pre-determined regular investment plan would remove any personal biases. This so- called dollar-cost averaging strategy would help the investor to automatically benefit from any market upside, while allowing the investor buy cheaper if the market pulls back along the away. This strategy could include pre-determined rules to accelerate purchases in the event of larger-than-expected market drawdowns.

In the long run, the market is always a bull. The above strategy should enable the investor to overcome the downturns, mitigate biases and stay in the game. Afterall, we need to get on the bull before we can ride it.

(Marc Van de Walle is Global Head of Wealth Management at Standard Chartered Bank)

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Banking Sector4 weeks ago

Banking Sector4 weeks ago