The Federal Executive Council (FEC) has approved the sum of N10.168 billion for the execution of various projects under the ministries of Water Resources, Aviation, as well as two agencies under the Presidency.

The virtual FEC, which was presided over by the Vice President, Professor Yemi Osinbajo (SAN), held in the First Lady’s Conference Room of the Presidential Villa on Wednesday.

Speaking to State House Correspondents after the virtual meeting, Ministers of Water Resources, Engr. Suleiman Adamu; Aviation, Senator Hadi Sirika; and Information and Culture, Alhaji Lai Mohammed, gave details of the various projects approved by the Council.

In the Ministry of Water Resources, the Minister said Council approved augmentation for two contracts, which had been affected by time and inflation.

“The contracts, Bagwai Irrigation Project in Kano State and the Biu Water Supply Project in Borno State, according to Adamu, got an aggregate of N8.825 billion.

“The first one was for expansion and completion of Bagwai Irrigation Project on Watari Dan in Bagwai local government area of Kano State. We have sought an augmentation of N3.76 billion, which was approved.

“Therefore, Council was gracious to approve this augmentation with the sum of N3.762 billion, bringing the new contract sum from N5.4 billion to N9.2 billion, inclusive of 7.5 percent VAT, with an additional completion period of 24 months plus another 12 months liability period.

“The second memo was for requesting for augmentation for Biu Water Supply Project. Again, this is a project that was started in 2001 but is still yet to be completed. It ran into a lot of problems, mainly associated with the funding and the Boko Haram insurgency. So, we sought an augmentation.

“So, the total augmentation, like I said, is N5.063 billion, bringing the contracts sum now to N9.36 billion from N4.29 billion, inclusive 7.5 percent VAT, with a new completion period of 24 months. We hope that these projects will be implemented in earnest and hopefully, we’ll be able to get them completed by 2023 for the overall benefit of the people,” he said.

For the Ministry of Aviation, Council approved a contract for the procurement of a towable mobile office for the Accident Investigation Bureau (AIB) of the Civil Aviation Authority.

“The contract is for the procurement, equipment and installation of accident investigation towable mobile offices in favour of Messrs. Crases Integrity Services Limited. The total contract sum is N201,150,437.21.

“The purpose of this equipment, once purchased, if there is, God forbid, an accident anywhere, these mobile offices will be driven to the location and an office will be established for the purposes of taking data, collecting samples and gathering information regarding the incident and then analysing them on-site and tagging them and doing all sorts of things there and you know, this can take any time, sometimes a few hours, sometimes even weeks,” he said.

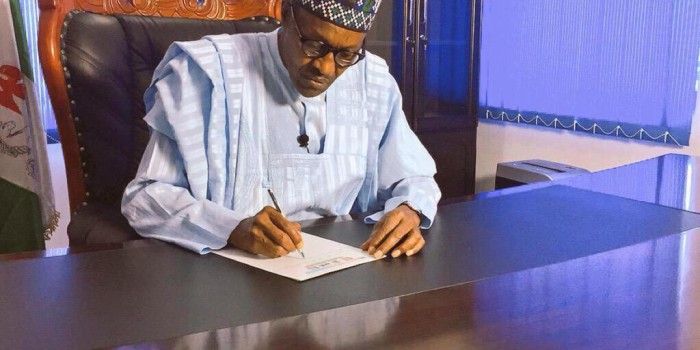

Also reporting two memoranda approved by Council in President Muhammadu Buhari’s name, the Minister of Information and Culture, Alhaji Mohammed said “I have two memos presented in the name of Mr. President. The first was a memo seeking approval of the Council for the enhancement of security at the newly completed premises of the Economic and Financial Crimes Commission headquarters located at Jabi. You will recall that from 2011 upwards, there’ve been various attacks on federal government institutions and even multilateral institutions like the United Nations building.

“Consequent upon those attacks in 2011, 2014, 2018, the federal government set up what is called the Vulnerability Assessment Committee to see how we can better protect ministries, departments and agencies and it’s in line with this that the EFCC, today presented to Council a memo seeking approval for the procurement of four sets of automatic and static anti-crush boulder system, with automatic vehicle scanners and other accessors, linear meters perimeter fencing, intrusion detection system and human screening equipment, four walk-through metal detectors, two handheld metal scanners, one luggage scanner and three handheld explosive trace detectors, all at the value of N805,738,541.95, inclusive of the 7.5 percent VAT, with the completion period of 12 weeks. The memo was approved by Council.

“The second memo, which Mr. President presented today is a memo seeking Council’s approval for the procurement of 16 vehicles for the use of Federal Civil Service Commission. You know we have 16 members of the FCC; the Chairman and 15 commissioners representing the states and they normally embark on extensive advocacy visits and team oversight functions to ministries, departments and agencies across the country.

“So, they asked for replacement of the old unserviceable vehicles and the Council duly approved the purchase of one Toyota Landcruiser V8 and 15 Toyota Rush, all at a total of N336,216,198,” he said.

News3 weeks ago

News3 weeks ago

Business3 weeks ago

Business3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Investment3 weeks ago

Investment3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Appointments3 weeks ago

Appointments3 weeks ago

Investment3 weeks ago

Investment3 weeks ago