Trove and Bamboo, the two of the numerous fintech companies, facilitating investments in foreign assets for Nigerians in Nigeria have released statements to assured Nigerians that have invested through their platforms that their investments are safe.

The assurance came few hours after the Nigerian Securities and Exchange Commission (SEC) released a circular to warn the public against unregistered online investment and trading platforms facilitating access to foreign markets.

The SEC, in a circular titled, ‘Proliferation of Unregistered Online Investment and Trading Platforms Facilitating Access to Trading in Securities Listed in Foreign Markets’ stated that its attention has been “drawn to the existence of several providers of online investment and trading platforms which purportedly facilitate direct access of the investing public in the Federal Republic of Nigeria to securities of foreign Companies listed on Securities Exchanges registered in other jurisdictions. These platforms also claim to be operating in partnership with Capital Market operators (CMOs) registered with the Commission.”

“The Commission categorically states that by the provisions of Sections 67-70 of the Investments and Securities Act (ISA), 2007 and Rules 414 & 415 of the SEC Rules and Regulations, only foreign securities listed on any Exchange registered in Nigeria may be issued, sold or offered for sale or subscription to the Nigerian public. Accordingly, CMOs who work in concert with the referenced online platforms are hereby notified of the Commission’s position and advised to desist henceforth.

“The Commission enjoins the investing public to seek clarification as may be required via its established channels of communication on investment products advertised through conventional or online mediums.”

However, Trove immediately released a statement, saying “Our attention has been drawn to the SEC circular that was recently issued.

“Please be aware that we are and will remain committed to being in compliance with all local laws and regulations. We have always maintained good standing with all existing compliance requirements and regulatory frameworks.

“Be rest assured that your funds and equities are safe and secure with Trove.

“Since the memorandum, we have been liaising with the SEC to get more clarity on the circular. We are also engaging with top level executives at our local partner brokers. Additionally, we have involved legal professionals to manage the on-going mediation.

“From all indications, we anticipate everything would be resolved.

“Kindly note that your US funds and equities are held in custody by Drivewealth LLC, a regulated broker dealer in the US and protected by the SIPC, for up to $500,000.

“You can continue your trading activities as normal as we are still fully capable of carrying out our responsibilities as usual.

“Be rest assured that we are on top of all the happenings and would actively communicate with you all as things progress. Thanks for all your support and confidence”

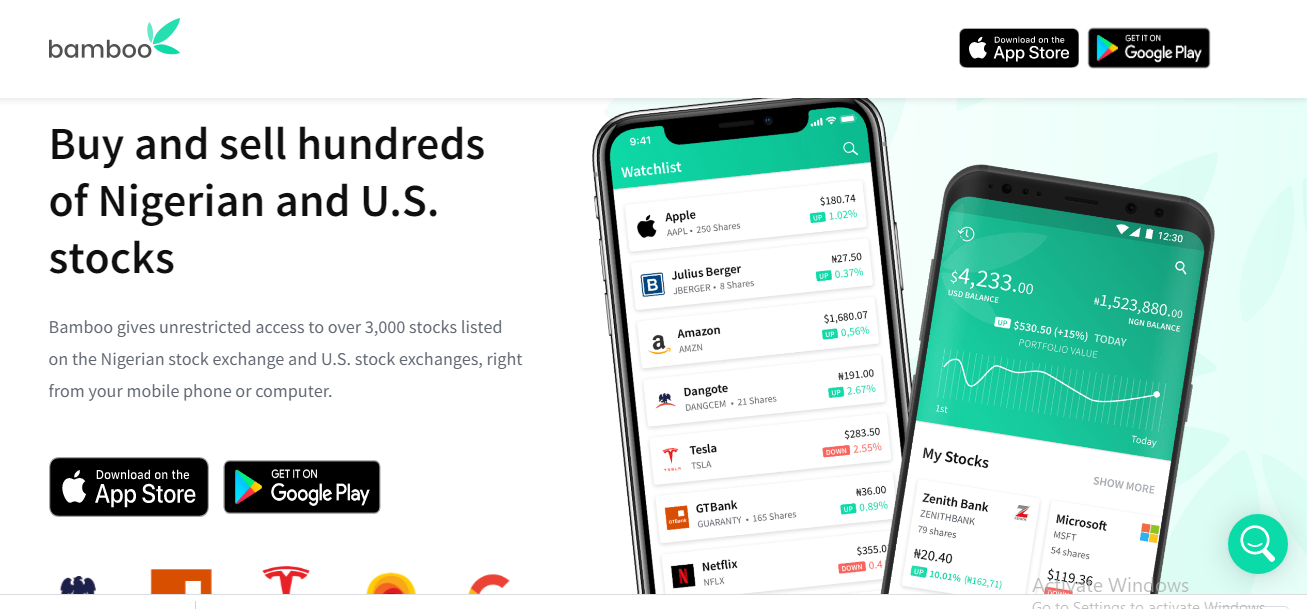

Bamboo also responded in a similar version to calm thousands of investors on its platform.

Richmond Bassey, CEO, Bamboo, in a statement sent to all registered investors said “We are aware of the recently released SEC circular about trading in foreign markets.

“First off, we want to assure you that your assets on Bamboo remain safe and easily accessible to you.

“We are already in discussions with the SEC and our broker partner and are fully committed to working with them to ensure your interests as our users are fully protected.

“We want to reassure you that there’s nothing to be concerned about. We are still able to carry out all our operations and will continue to do so. Should the situation change, we will inform and advise you on the best course of action.

“Thank you for your continued faith and trust in us. We will continue to put in all the hard work to serve you. Thank you.”

News3 weeks ago

News3 weeks ago

Business3 weeks ago

Business3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Investment3 weeks ago

Investment3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago

Appointments3 weeks ago

Appointments3 weeks ago

Investment3 weeks ago

Investment3 weeks ago