Nigerian Exchange Limited

Nigerian Stock Exchange Halts Bearish Trend, Gained N436 Billion Last Week

The Nigerian Stock Exchange rebounded last week after weeks of bearish trends to close with a N436 billion profit.

Market value of all listed equities grew from N20.082 trillion in the previous week to N20.518 trillion last week, representing an increase of N436 billion.

The Nigerian Stock Exchange All-Share Index gained 2.17 percent or 833.81 index points from 38,382.39 index points in the previous week to close at 39,216.20 index points last week.

The Exchange year to date decline moderated to -2.62 percent.

During the week, investors traded a total of 1.530 billion shares worth N21.311 billion in 20,016 deals, against a total of 2.342 billion shares valued at N19.272 billion that exchanged hands in 20,173 deals in the previous week.

The Financial Services Industry led the activity chart with 1.096 billion shares valued at N12.294 billion traded in 11,106 deals; thus contributing 71.67 percent and 57.69 percent to the total equity turnover volume and value respectively.

The Consumer Goods Industry followed with 177.673 million shares worth N3.577 billion in 3,139 deals.

In the third place was Conglomerates Industry, with a turnover of 99.609 million shares worth N216.997 million in 856 deals.

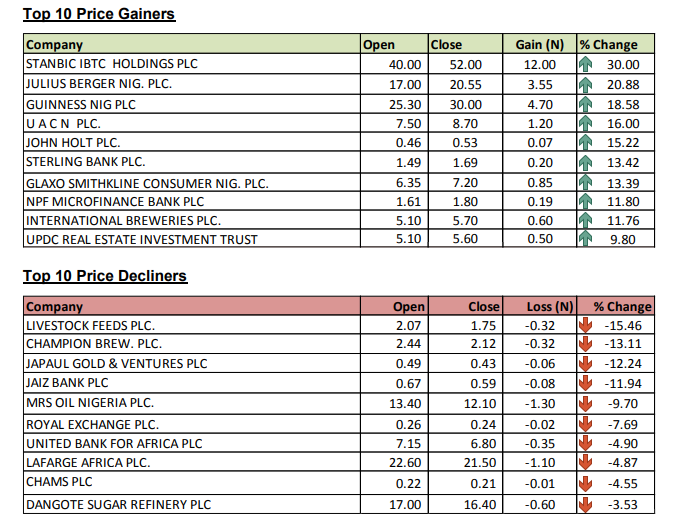

The top three most traded stocks in terms of volume were Union Bank Nig. Plc, Guaranty Trust Bank Plc and Dangote Sugar Refinery Plc, together the three accounted for 687.616 million shares worth N9.496 billion in 3,022 deals. Therefore, they contributed 44.95 percent and 44.56 percent to the total equity turnover volume and value, respectively. See the list of top gainers.