The Government of Canada and the African Development Bank have signed an agreement formalizing the Canada–African Development Bank Climate Fund (CACF), a transformative special fund aimed at providing concessional loans to climate change-related projects with a strong gender-responsive component.

The fund will be capitalized through a combination of a CAD 122.9 million ($104.8 million) repayable contribution, aimed at providing concessional loans for both sovereign and non-sovereign operations plus a CAD 10 million grant contribution for complementary technical assistance. The African Development Bank will administer the fund.

Speaking at a virtual signing ceremony to conclude the agreement, held 17 March on the sidelines of the Canada-Africa Clean Growth Symposium, Canada’s Minister of International Development, the Hon. Karina Gould, said the investment, with its strong gender footprint, recognized “the critical role that women need to play in climate action, and supports their efforts to mitigate and adapt to the effects of climate change.”

“Climate change is one of the most important challenges of our time…And, although we are all affected by it, we in Canada know that not everyone is affected equally…that means that vulnerable and marginalized people are bearing the brunt of this crisis.”

As a concessional facility, CACF resources will be deployed in innovative low-carbon technologies, renewable energy, climate-smart agriculture, sustainable forestry, water management, and climate-resilience projects. The fund will finance climate change related projects in the African Development Bank’s regional member countries, including those that demonstrate a strong gender equality focus. The empowerment of women and girls will be an objective across all concessional financing of the CACF, aiming at direct, measurable gender equality outcomes.

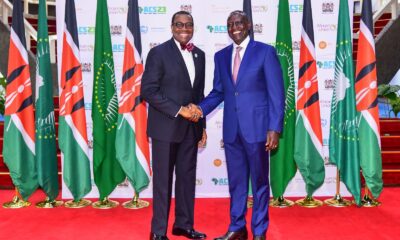

“In building back Africa, climate resilience is very important… This is why I’m delighted and thrilled with the Canada-African Development Bank Climate Fund that we are launching today,” African Development Bank President Dr. Akinwumi A. Adesina said in remarks after the announcement.

He thanked Canada for its “tremendous” support to the Bank in terms of general capital increases, temporary callable capital, and the support that Canada has given to Africa through the Bank.

“These resources that you are making available, it’s very unique, in helping us with adaptation. First, it is long-term financing. It will provide long-term capital to the private sector and to the public sector. It also provides it at affordable levels for countries…What I like most about it is that it looks at multi-sectoral use of this financing…all these things are very important to support Africa in climate adaptation and mitigation,” Adesina said. “Canada has always been there for Africa…Canada is a great friend of Africa.”

The African Development Bank’s financing for climate has increased fourfold from 9% of its total portfolio in 2016, to 36% by 2019, and is on track to achieve its target of 40% of total portfolio by the end of 2021. The Bank has committed to providing $25 billion in climate financing by 2025.

The Canada-Africa Clean Growth Symposium, co-hosted by Canada, Ethiopia and Senegal, brings together economic and business leaders from the public and private sectors from Canada and sub-Saharan Africa to explore innovative ways to grow their economies, while reducing emissions and building resilience to climate change.

The sessions focused on a blueprint for a green economy, incorporating socioeconomic development, while ensuring sustainable management of natural resources, minimizing waste and pollution, and following climate-resilient and low-carbon development pathways.

The symposium also included a trade policy discussion on environmental considerations in international trade and the promotion of rules-based trade.

Canada, one of the African Development Bank Group’s key non-regional members, has participated in all the Group’s capital increases. This includes its 7th General Capital Increase, the replenishments of the African Development Fund, including the 15th replenishment of the Fund (ADF-15), with a 7.5% increase in African Development Bank Units of Account (UA) terms. It has also contributed to numerous trust funds and initiatives managed by the Bank Group.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago