Oil Prices Rise to $64.32 Amid Expected Output Extension

Oil prices extended gains during the early hours of Thursday trading session amid the possibility that OPEC+ producers might not increase output at a key meeting scheduled for later in the day and the drop in U.S refining.

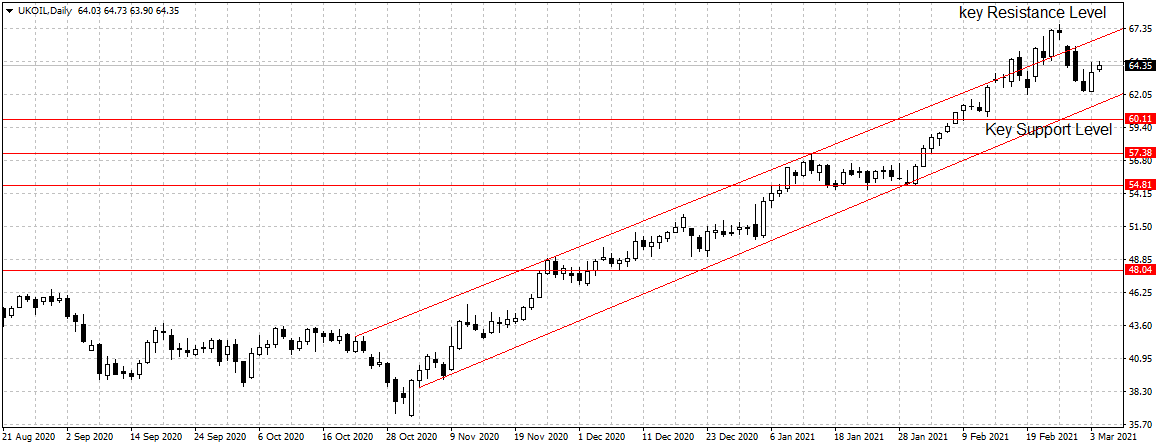

Brent crude oil, against which Nigeria oil is priced, gained 0.4 percent or 27 cents to $64.32 per barrel as at 7:32 am Nigerian time on Thursday. While the U.S West Texas Intermediate gained 19 cents or 0.3 percent to $61.47 a barrel.

“Prices hinge on Russia’s and Saudi Arabia’s preference to add more crude oil production,” said Stephen Innes, global market strategist at Axi. “Perhaps more interesting is the lack of U.S. shale response to the higher crude oil prices, which is favourable for higher prices.”

“Prices hinge on Russia’s and Saudi Arabia’s preference to add more crude oil production,” said Stephen Innes, global market strategist at Axi. “Perhaps more interesting is the lack of U.S. shale response to the higher crude oil prices, which is favourable for higher prices.”

The Organization of the Petroleum Exporting Countries (OPEC) and allies, together known as OPEC+, are looking to extend production cuts into April against expected output increase due to the fragile state of the global oil market.

Oil traders and businesses had been expecting the oil cartel to ease production by around 500,000 barrels per day since January 2021 but because of the coronavirus risk and rising global uncertainties, OPEC+ was forced to role-over production cuts until March. Experts now expect that this could be extended to April given the global situation.

“OPEC+ is currently meeting to discuss its current supply agreement. This raised the spectre of a rollover in supply cuts, which also buoyed the market,” ANZ said in a report.

Meanwhile, U.S crude oil inventories rose by more than a record 21 million barrels last week as refining plunged to a record-low amid Texas weather that knocked out power from homes.