Binance, once a dominant force in global Bitcoin trading, is now facing significant headwinds as regulatory challenges and intensified competition reshape the industry.

Over the past year, Binance has share of the market had declined outside the United States.

According to data from research firm Kaiko, Binance’s market share in non-US Bitcoin trading has plummeted from 81.3% to 55.3%.

The trend is mirrored in the trading of smaller cryptocurrencies, known as altcoins, where Binance’s share has dropped from 58% to 50.5%.

The decline in Binance’s market share can be attributed to several factors. One significant factor is the cessation of a promotion that previously waived trading fees, which drew in substantial trading volumes.

With the end of this promotion, offshore markets have become less concentrated, allowing smaller exchanges to gain momentum and capture a larger share of the trading activity.

Platforms such as Bybit and OKX have emerged as formidable competitors to Binance, expanding their presence in regions like Asia.

Bybit, in particular, has seen its share of non-US Bitcoin trading surge from 2% to 9.3%, while OKX’s share has risen from 3% to 7.3%. These exchanges have capitalized on Binance’s vulnerabilities, seizing market share and establishing themselves as viable alternatives for cryptocurrency traders.

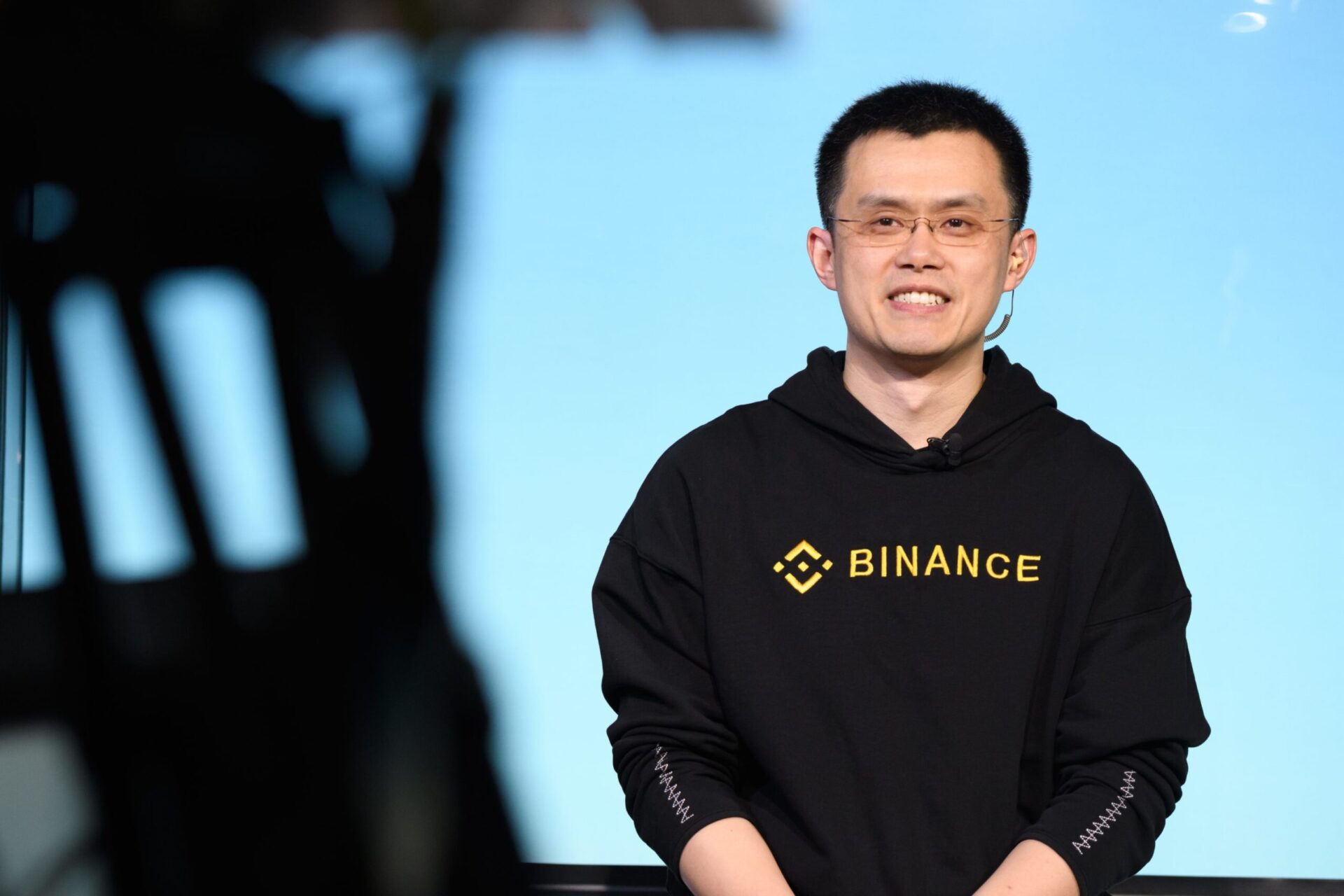

Binance’s challenges are further compounded by ongoing regulatory scrutiny and legal issues. In November of last year, Binance and its co-founder Changpeng Zhao pleaded guilty to US anti-money laundering and sanctions violations.

The company has since been working to rebuild its reputation and navigate a complex regulatory environment, particularly in the United States.

Under the leadership of its new CEO, Richard Teng, a former regulator in Singapore, Binance has implemented stricter token listing rules and appointed a board of directors to enhance oversight and compliance measures.

Despite these efforts, the exchange continues to face regulatory challenges and uncertainty, which have undoubtedly impacted its market position and reputation.

The broader cryptocurrency industry has experienced significant growth, fueled by a fourfold increase in the price of Bitcoin since the beginning of last year.

However, Binance’s diminishing market share underscores the rapidly changing dynamics of the industry, where regulatory compliance and competitive pressures are reshaping the landscape of global cryptocurrency trading.

As Binance navigates these challenges, the future of the exchange and its position in the cryptocurrency market remain uncertain.

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago