Oil Caps Gain as US Oil Inventories Rises Than Expected Last Week

Oil prices halted its bullish run on Wednesday after data from a group known as the American Petroleum Institute (API) revealed that U.S. crude inventories expanded by 7.5 million barrels last week, higher than the expected 2.1 million barrels.

This surged in oil inventories damped the recent increase in oil prices brought about by the renewed hope in COVID-19 vaccines and the 750 billion Euro ($859 billion) stimulus announced by the European Central Bank (ECB) to prop up economies – within the region – affected by the COVID-19 pandemic.

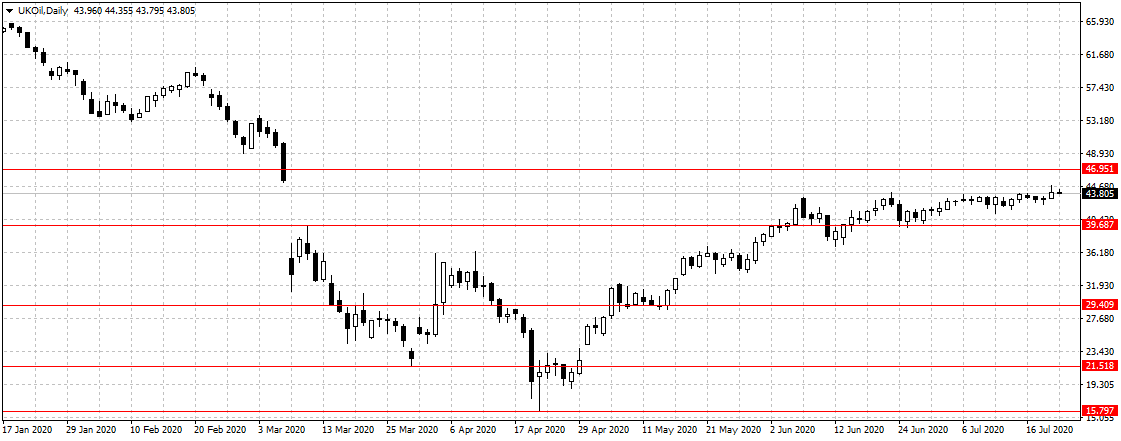

Brent crude oil, against which Nigerian crude oil is priced, rose to $44.86 barrel per day on Tuesday before pulling back to $43.80 on Wednesday during the London trading session.

The US West Texas Intermediate (WTI) crude oil rose as high as $42.48 per barrel on Tuesday before hitting $41.31 a barrel on Wednesday following the release of the data.

“Crude’s rally hit a brick wall after the API report showed a sharp rise in stockpiles and on President Trump’s warning that the coronavirus pandemic in the U.S. is likely to worsen,” said Edward Moya, senior market analyst at OANDA in New York.

“The crude demand outlook just got a double whammy with what could be the biggest rise in stockpiles since late May if confirmed by the EIA report tomorrow and on Trump’s downbeat virus briefing,” Moya said.

The official crude oil inventories data would be released on Wednesday by the US Energy Information Administration (EIA).