Cryptocurrency

Lack of New Money Stales Bitcoin, Cryptocurrencies

Lack of Fresh Inflow of Outside Money Weighs on Bitcoin, Other Cryptocurrencies.

Bitcoin, cryptocurrency’s most dominant coin, remained in range this week as lack of new capital inflow by institutional and retail investors staled price action.

On Monday, the digital currency plunged below $9,000 a coin for the first since May 27 to $8,888 before rebounding almost immediately following the announcement of an additional stimulus package by the Federal Reserve.

While Bitcoin is not regarded as a traditional asset, it has started exhibiting similar characteristics in recent months and has been described by JPMorgan as a resilient asset for surviving March global crash with little to zero damage.

However, lack of fresh capital inflow continues to stale Bitcoin potential, especially after the third bitcoin halving of May 12 failed to bolster the attractiveness of the coin among institutional investors to sustain price above the $10,000 resistance level projected to kick start the bullish run.

This is in spite of several reports of Whales buying huge quantities of the coin in anticipation of its usual bullish run after every halving. While global pandemic distorted global financial markets, it also impeded outside capital inflow into the crypto market as institutional investors that now moves market remained apprehensive amid rising global risk and uncertainty.

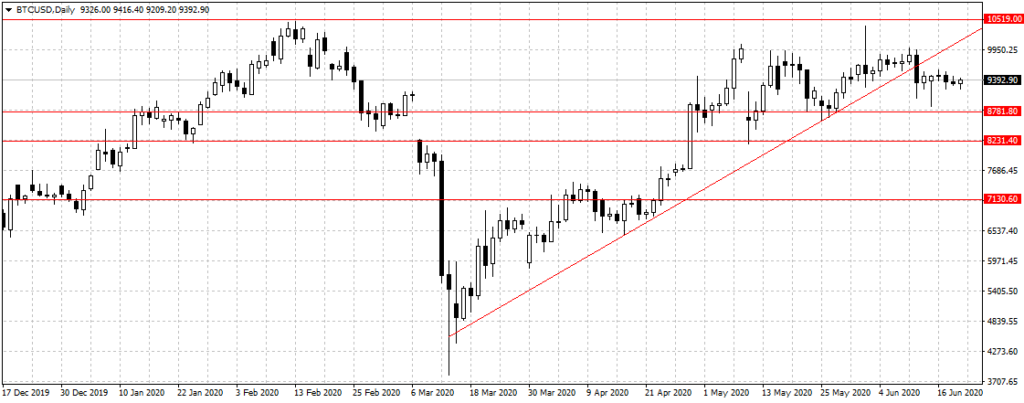

Like Investors King projected in May, until new money or outside money starts flowing into Bitcoin and the rest of crypto coins, Bitcoin will continue to struggle at the current level or even pull back to $8,781 support level.

At Investors King, we will need a sustained break of $10,519 resistance level as shown above to validate bullish continuation. While on the other hand, a sustained break of the $8781 support level will likely upon up $8,231 support level and down to $7130 support.

At Investors King, we will need a sustained break of $10,519 resistance level as shown above to validate bullish continuation. While on the other hand, a sustained break of the $8781 support level will likely upon up $8,231 support level and down to $7130 support.