- Chinese Stocks Plunge to Record-Low Amid Coronavirus

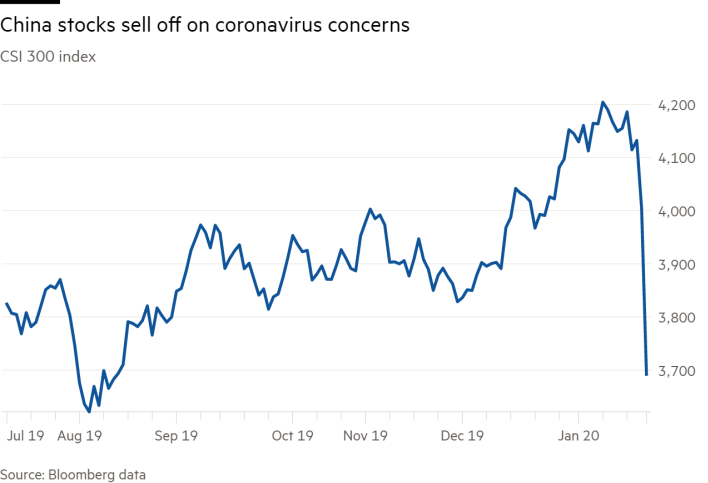

Chinese stocks plunged 9.1 percent on Monday to make the worst opening in almost 13 years as investors fear the uncertainty surrounding coronavirus outbreak would hurt economic activity and weigh on the world’s second largest economy.

The CSI 300 index of Shanghai and Shenzhen-listed equities fell as much as 9.1 percent to erase $358 billion from the total market capital, according to a Bloomberg data.

Experts are worried that the virus will hurt the Chinese economy that is already growing at its slowest rate in three decades. Li-Gang Liu, a chief China economist at Citi, predicted that the world’s second largest economy would grow at aboout 4.8 percent in the first quarter of 2020, slower than the 6.1 percent recorded in 2019 and the lowest in decades.

Experts are worried that the virus will hurt the Chinese economy that is already growing at its slowest rate in three decades. Li-Gang Liu, a chief China economist at Citi, predicted that the world’s second largest economy would grow at aboout 4.8 percent in the first quarter of 2020, slower than the 6.1 percent recorded in 2019 and the lowest in decades.

Accordingly, global oil demand is expected to be affected as airlines have started canceling flights to China while Chinese government discourages flight to and out of Wuhan City, the outbreak city of 11 million people.

“Fears of weaker demand have weighed on refinery margins, and continued weakness could see some refineries cut run-rates in China. If we were to see this, it would likely be the independent refiners who are first to cut, given their focus on the domestic market,” ING strategists said on Friday.