- Facebook’s Libra Suffers as Paypal Pulls Out

Paypal Inc has officially pulled out of Facebook’s cryptocurrency project, Libra, amid rising regulatory scrutiny and opposition.

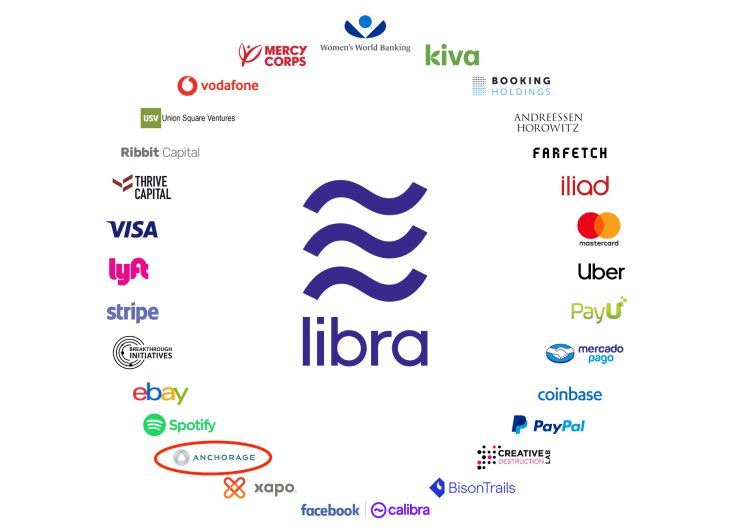

Paypal was one of the companies that invested at least $10 million in the project when it was unveiled earlier this year, however, none of them anticipated the level of opposition and scrutiny that trailed the announcement.

Regulators across the world are worried about trusting Facebook with financial details of their citizens following its failure to protect users’ data in the past and its reluctant to even report the stolen data.

The 29 companies that initially signed up for the project are now sceptical, and with Paypal out, others may start pulling out to limit regulatory scrutiny and negative impact on their overall branding.

A move that could hurt the entire project as Facebook would lose more bargaining power and its ability to convince regulators that the project is a collective effort and not a move to monopolise global financial service.

In a statement released by Paypal, the company decided to focus on advancing its existing mission and business priorities.

“PayPal has made the decision to forgo further participation in the Libra Association at this time and to continue to focus on advancing our existing mission and business priorities as we strive to democratize access to financial services for underserved populations,” PayPal said in an emailed statement to TechCrunch. “We remain supportive of Libra’s aspirations and look forward to continued dialogue on ways to work together in the future. Facebook has been a longstanding and valued strategic partner to PayPal, and we will continue to partner with and support Facebook in various capacities.”

Earlier this week, WSJ reported that Mastercard, Visa and other companies may also pull out ahead of the scheduled meeting to elect the first board of directors for the project this month in Geneva.

Facebook, however, responded to the Paypal announcement: “It requires a certain boldness and fortitude to take on an endeavor as ambitious as Libra – a generational opportunity to get things right and improve financial inclusion,” said a spokesperson. “The journey will be long and challenging. The type of change that will reconfigure the financial system to be tilted towards people, not the institutions serving them, will be hard. Commitment to that mission is more important to us than anything else. We’re better off knowing about this lack of commitment now, rather than later.”

The only CEO who has spoken regarding the project, Al Kelly, Visa, said: “It’s important to understand the facts here and not any of us get out ahead of ourselves,” Kelly said in the company’s most recent earnings call. “So we have signed a nonbinding letter of intent to join Libra. We’re one of – I think it’s 27 companies that have expressed that interest. So no one has yet officially joined. We’re in discussions and our ultimate decision to join will be determined by a number of factors, including obviously the ability of the association to satisfy all the requisite regulatory requirements… It’s really, really early days and there’s just a tremendous amount to be finalized. But obviously, given that we’ve expressed interest, we actually believe we could be additive and helpful in the association.”

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira3 weeks ago

Naira3 weeks ago