Economy

Fuel Subsidy, Debt Servicing Pushing Nigeria into Bankruptcy — Sanusi

Published

6 years agoon

- Fuel Subsidy, Debt Servicing Pushing Nigeria into Bankruptcy — Sanusi

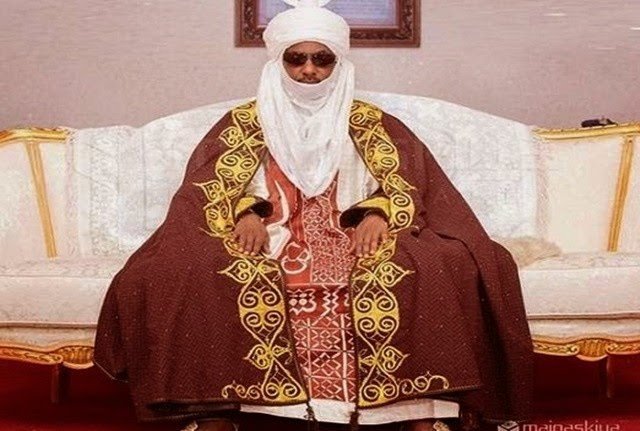

The Emir of Kano, Mallam Muhammad Sanusi II, has warned that Nigeria is on the verge of bankruptcy as fuel and electricity subsidies, as well as debt servicing, continue to eat into government revenue.

Sanusi, who is a former governor of the Central Bank of Nigeria, said this while delivering his address at the ongoing third National Treasury Workshop, organised by the office of the Accountant-General of the Federation in Kano.

He advised President Muhammadu Buhari’s administration to scrap fuel and electricity tariff subsidies in order to stabilise the economy.

He said, “In 2011, when I was CBN governor, Nigeria made $16bn from petroleum sales, and we spent $8bn importing petroleum and spent another $8.2bn subsidising the product…and I asked, ‘Is this sustainable?

“The country is bankrupt and we are heading to bankruptcy. What happens is that the Federal Government do pay petroleum subsidy, pays electricity tariff subsidy, and if there is a rise in interest rates, the Federal Government pays. What is more life-threatening than the subsidy that we have to sacrifice education, health sector and infrastructure for us to have cheap petroleum?”

Sansui said, “If truly President Buhari is fighting poverty, he should remove the risk on the national financial sector and stop the subsidy regime, which is fraudulent.”

He said the President must tell Nigerians the facts about the economic situation and act promptly to address it.

Sanusi told the participants at the workshop, “We need to ask these questions: why are there high mortality rates, malnutrition, high rate of out-of-school children, among others, while the national treasury goes to petroleum sector?

“In 2016, we were told that we are consuming 28 million litres of petrol per day and just a few weeks ago, we were told that it has jerked up to 60 million litres daily; what went wrong? Since I have decided to come here, you have to accept what I have said here. And please, if you do not want to hear the truth, never invite me.”

The Emir expressed worry about the state of public finance in the country, saying there were a number of very difficult decisions that must be made.

He said, “We should face reality. His Excellency, the President, said in his inaugural speech that his government would like to lift 100 million people out of poverty. It was a speech that was well received, not only in this country but worldwide.

“The number of people living in abject poverty in Nigeria is frightening. By 2050, 85 per cent of those living in extreme poverty in the world will be from the African continent, and Nigeria and the Democratic Republic of Congo will top the list.

“Two days ago, I read that the percentage of government revenue going to debt servicing had risen to 70 per cent. These numbers are not lying. They are public numbers. I read them in the newspapers. When you are spending 70 per cent of your revenue on debt services, then you are managing 30 per cent.

“And then, you continue subsidising petroleum products and spending N1.5tn per annum on petroleum subsidy! And then we are subsidising electricity tariff. And maybe, you have to borrow from the capital market or the Central Bank of Nigeria to service the shortfall in the electricity tariff. Where is the money to pay salaries? Where is the money for education and other government projects?”

In his address at the workshop, the Chairman, Economic and Financial Crimes Commission, Mr Ibrahim Magu, stressed the need to tackle corruption in the country and warned public and private office holders to desist from corrupt practices.

Economic and financial experts, who spoke with our correspondents in separate interviews, expressed divergent views on the Emir’s statement that the country was heading towards bankruptcy.

The President, Lagos Chamber of Commerce and Industry, Mr Babatunde Ruwase, said the chamber had always stood against petrol subsidy, adding that it was not economically healthy to keep subsidising consumption.

He said instead of subsidising consumption, the money should be channelled into capacity building in the educational sector, health and other ventures.

“Productive ventures like farming should benefit from subsidy and not consumption. If we continue the way we are going, it is only a miracle like a sudden and astronomical rise in the global price of crude oil that will save us; otherwise, the nation will definitely go bankrupt,” he added.

According to Ruwase, the current subsidy regime is not sustainable and is open to abuse and fraud.

On electricity tariff, he said, “If the government wants investors to come into the electricity sector, it has to relax its control and allow the economic cost to determine the tariff. The current tariff we have was set three years back and it is lower than the cost of investing in the sector.”

The Registrar, Chartered Institute of Finance and Control of Nigeria, Mr Godwin Eohoi, described the nation’s debt service cost as high but said it could not make the country go bankrupt.

According to him, there are many areas that the country can explore to generate much-needed revenue.

He, however, said the over-reliance on oil had made it difficult to focus on the revenue-earning potential of the non-oil sector.

He said, “The debt profile of Nigeria is very high and there is no doubt about it. But we have revenue that can sustain it and there is the capacity to do more. I don’t see Nigeria going into bankruptcy. There is no doubt that we have high debt profile but the revenue we are generating is gradually increasing and there is an aggressive drive by all the agencies of government to boost revenue generation.

“While I agree with the Emir that the amount spent on debt service is high, I disagree with him that it will lead us to bankruptcy. The government has given an indication that revenue would be increased; so, if that is achieved, then we can avoid bankruptcy.”

When asked if he was in support of the removal of subsidy, he said, “Subsidy is an issue that has lingered for long and it will take the political will for it to be removed. There is no political will to remove it now.”

A former President, Association of National Accountants of Nigeria, Dr Sam Nzekwe, described the Emir’s statement as a wake-up call to the government to make things work better in the economy.

He said, “It is subjective that Nigeria is heading to bankruptcy, but I think what he is trying to say is that because of our dependency on oil when there is internal and external volatility or attack on oil pipes, we will not be able to produce as much.

“If there is volatility in prices, then there will be a problem. We have not been able to get the economy working as we are supposed to. A country whose economy is not producing and the population is growing faster than the economy is a problem. The government is still the driver of the economy, but we need to get the private sector to drive the economy. We need to create an enabling environment for things to work, provide critical infrastructure for the private sector to join.”

Is the CEO and Founder of Investors King Limited. He is a seasoned foreign exchange research analyst and a published author on Yahoo Finance, Business Insider, Nasdaq, Entrepreneur.com, Investorplace, and other prominent platforms. With over two decades of experience in global financial markets, Olukoya is well-recognized in the industry.

You may like

-

Nigeria Joins BRICS as Partner Country, Strengthening Global South Cooperation

-

70 Million Poorest of The Poor Nigerians To Get N75,000 From FG

-

Nigeria Surpasses OPEC Quota with 1.51 Million bpd, Targets 2.06 Million in 2025

-

Global Investors Commit $7.6 Billion to Nigeria’s Development at AIF 2024

-

Nigeria-China Trade Strengthened as Grimaldi Introduces Direct Shipping Line

-

Nigeria’s GDP Records 3.46% Growth in Q3 Spurred by Non-Oil Sector