- Nigeria and China’s Open market

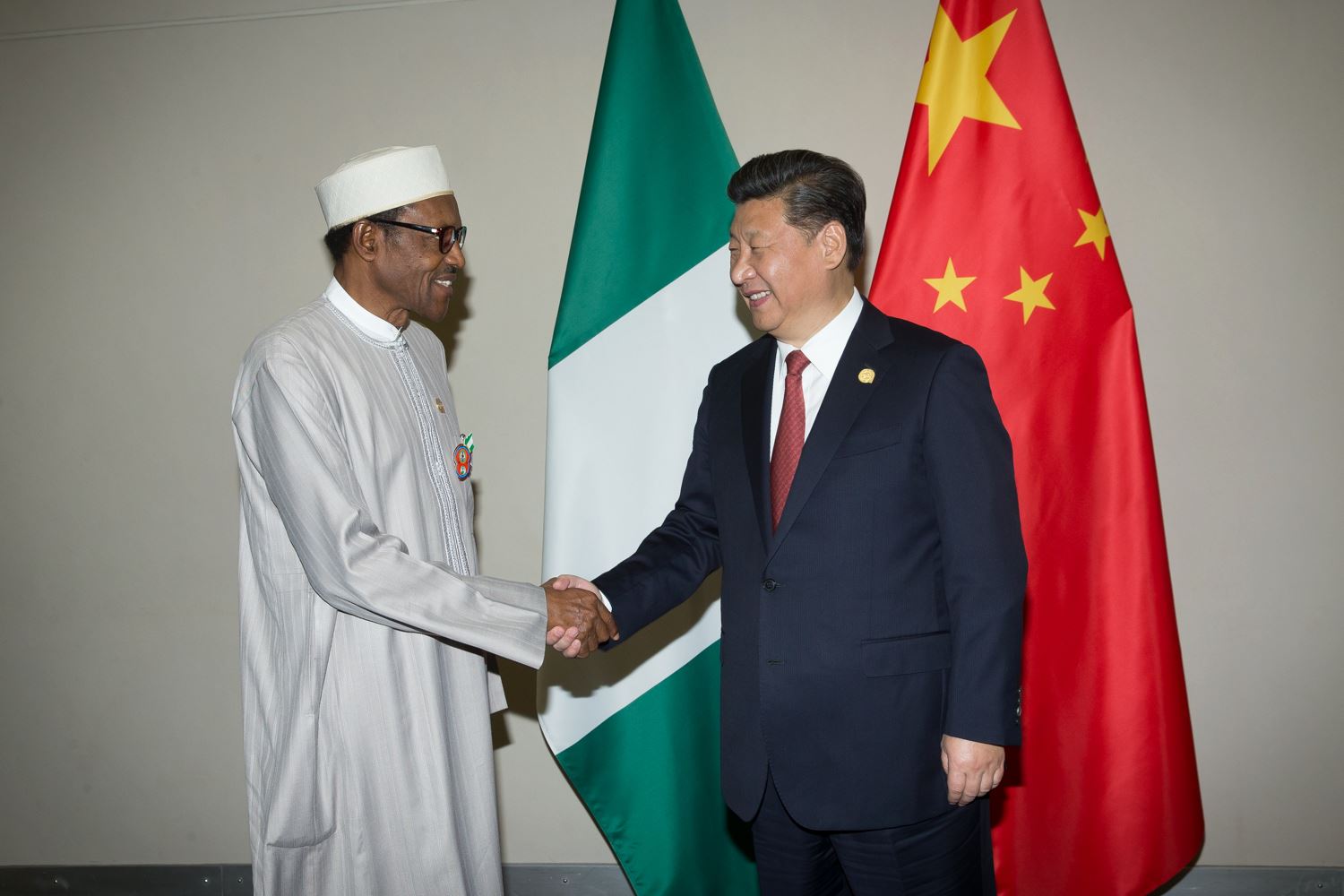

“China has a big market of over 1.3 billion people and it is our sincere commitment to open the Chinese market” – President Xi Jinping.

The prime worry for most commentaries about China and Nigeria bilateral cooperation is what can be done to breach the gap of the trade imbalance, which is in favour of China. Even as Chinese ambassador to Nigeria, Dr. Zhou Pingjian said in his recent interview that “China never deliberately pursues trade surplus…” and correctly argued that “trade pattern is more of a natural outcome of the competitiveness of product and consumer’s choice.” Many would argue that China as major responsible power should take deliberate measures or steps to grant access to her market, the only means to reduce or even eliminate the trade imbalance between her and Nigeria.

However, it is important to note that the clarion calls have been fully heeded by Beijing. The first China’s International Import Expo that opened 5th – 10th November in her mega commercial city of Shanghai offered a concrete response to access to China’s huge market, which President Xi Jinping made a solemn and “sincere commitment to open”. For anyone who thinks that the determination to open Chinese market for Import is sham or rhetoric, the Chinese leader assured that “China initiative to expand imports is not a choice of expediency. It is a future-oriented step taken to embrace the world and promote common development.” And in order to meet the trend of exponential trend in domestic consumption, he assured that China “will take more proactive measures to increase people’s income and spending power, foster new growth areas of medium-high-end consumption, continue to unleash the potential of the domestic market and expand the scope for import.”

Leaving no shred of doubt that China means what it says, President Xi Jinping made clear that “we will take further steps to lower tariffs, facilitate customs clearance, reduce institutional costs in import and step up cross-border e-commerce and other new forms and models of business.”

And to underscore what is at stake, in gaining access to the market of 1.3 billion people, whose purchasing power would be upgraded, the Chinese leader projected that “in the next coming 15 years, China’s import of goods and services are expected to exceed 30 trillion and 10 trillion U.S dollars respectively.”

And the first China International Expo which was attended by 172 countries including Nigeria, more than 3600 companies and more than 400, 000 Chinese and foreign buyers and which will hold annually from henceforth, is a major and significant leap in accessing the Chinese market.

The question of anyone concerned about the trade imbalance between Nigeria and China should ask or would be asking, is how far Nigeria seized the opportunity of the expo to expose Nigerian manufacturers and businesses to the opportunity of China’s huge market? According to the Chinese ambassador to Nigeria, the China first International expo “serves as another new and important platform for various products to access the market,” adding that he “believes Nigerian friends will seize the enormous business opportunities in this.” The Chinese envoy further expressed optimism that just as “made in China,” products enjoy wide popularity in Nigeria, we would be delighted to see more “made-in-Nigeria for China” products becoming popular in China as well.”

To build the necessary capacity to access international market and the particularly Chinese huge market would require a focused and consistent national policy targeted at creating value-added products, sufficiently competitive which arises from cost efficiency in the factors of production.

The high cost of production remains one of the most serious challenges of Nigeria’s access to highly competitive international market and while in the long term, sustained investment in strategic infrastructure like power plants, transport network – high ways, and railways, seaports, etc., are the right way to go, in the short term. Such strategic engagement as China-Nigeria industrial and production capacity, where China’s excess industrial capacity is deployed to priority sectors to shore up the country’s production capacity would fill industrial capacity gap. The nexus of strategic industrial and production capacity cooperation between Nigeria and China combined with a considerably fair access to the huge Chinese market makes China a unique opportunity in Nigeria’s effort at economic recovery, sustainable and inclusive growth.

With China obviously central to realizing key Nigeria’s economic priorities, the question remains of how Nigeria engages China? In a report of an international management consultancy, Mckinsey & Co published in June last year under the title of “Dance of Lions and Dragons: How are Africa and China engaging, and how will the partnership evolve?” it grouped Nigeria among China’s solid partners in Africa that needs to get strategic. The report defined this group of China’s partners in Africa who have done well with China but not necessarily as a result of a purposeful strategic approach,” adding that most in this group have simply benefited from other factors. It singled out Nigeria, noting “that it is actually the big market that is bound to attract a fair share of Chinese investors.” The report defined some countries as robust partners to China, “that have strategically defined relationship with China, with success on both the government-to-government and private sector fronts.”

Even as a choice strategic partner, a rare privilege in bilateral relations which Beijing extended to only two other African countries-South Africa and Egypt along with Nigeria since 2005, the imperative to define clear strategic road map to engage China more robustly has become compelling.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago