- 45 Deals Value at $32 Billion Secured -AfDB

Out of 61 transactions valued at $40.4bn tabled for discussions in boardroom sessions at the just concluded African Investment Forum in Sandton, South Africa, 45 deals worth over $32bn were secured, the African Development Bank has said.

In a statement made available to our correspondent in Abuja on Sunday, the AfDB said that the final numbers were yet to be announced.

The AfDB on Friday unveiled the conclusions of the boardroom sessions at the heart of the forum, which brought together over 1,000 participants from government, the private sector, development finance institutions, commercial banks, and institutional investors such as sovereign wealth funds and pension funds.

The forum focused on projects and advancing deals spanning several sectors to financial closure. The sectors include – Energy, Infrastructure, Transport and Utilities, Industry, Agriculture, Information and Communications Technology and Telecoms, Water and Sanitation, Funds/Financial Services, Health, Education, Hospitality and Tourism, Housing, and Aviation.

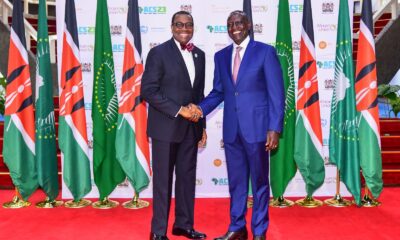

Presiding over the session, ‘Unveiling the Boardroom Deals’, the AfDB President, Dr Akinwumi Adesina, said, “Today is an incredible day. You are here because you have faith. Africa has come of age. We saw partnership in action, and commitments to make deals. We saw resounding confidence in Africa. Africa is bold.”

His comments came on the heels of a panel of project sponsors who shared their views on the forum and boardroom sessions.

They included Frank Nweke from Brass Fertilizer and Petrochemical project; Jack Van Der Merwe from Gauteng Rail Infrastructure; Solomon Assamoah, CEO of Ghana Infrastructure Investment Fund and promoter of Accra Skytrain; Akim Daouda from Ngoulmendjim Hydropower; Basil El Baz, Chairman and CEO Carbon Holdings, promoter of Tahrir Petrochemical Plant and Port; and Tahane Mahaole from IHS Kenya Affordable Housing Fund.

Panellists lauded the unprecedented initiative and the fact that African institutions leveraged capital. In one instance, within 24 hours of boardroom discussions, one of panellists indicated that he had received investors’ interest valued at $500m.

Key moments of the forum included the signing of a Memorandum of Understanding between Ghana and South Africa for a $2.6bn Skytrain project witnessed by President Nana Akufo-Addo of Ghana.

The Accra Ai Skytrain is an elevated light rail project that uses air propulsion technology to drive lightweight, high passenger volume vehicles.

Another important moment of the forum was the signing of a bridge construction project linking Kinshasa and Brazzaville. The project is a priority project that would help advance the infrastructure and transport agendas of the two nations.

The bridge will also help diversify the countries’ economies through increased trade and investment.

About 350 investors from 53 countries across the globe attended the Forum. Thirty Africans and 23 foreign countries were represented including from United Arab Emirates, United Kingdom, France, United States, China, Japan, India, Switzerland, Argentina, Austria, Canada, Germany, South Korea, Portugal, Luxemburg, Saudi Arabia and Malta.

Top 12 African delegations included South Africa, Nigeria, Ghana, Côte d’Ivoire, Kenya, Angola, Egypt, Tunisia, Morocco, Gabon, Mauritius, and Mozambique.

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Naira1 week ago

Naira1 week ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira3 weeks ago

Naira3 weeks ago

Naira1 week ago

Naira1 week ago