- Buhari Gets China’s Support for 3,050MW Mambila Hydropower Project

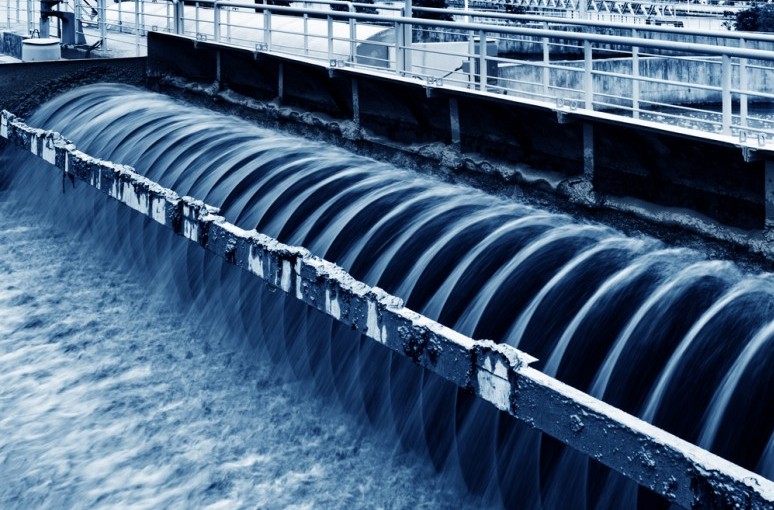

President Muhammadu Buhari on Wednesday secured the support of the Chinese President, Xi Jinping, for the building of the 3,050 megawatts Mambila hydroelectric power project.

The Senior Special Assistant to the President on Media and Publicity, Garba Shehu, said this in a statement from Beijing, China, where Buhari met with Jinping on Wednesday on the sidelines of the China-Africa Cooperation summit.

The summit was attended by other African leaders and entrepreneurs.

Shehu stated that during the meeting between Buhari and Jinping, the Nigerian leader also sought additional Chinese funding for four airport terminals as well as the Abuja light rail project.

Buhari was said to have noted that the Mambilla project remained a key priority to Nigeria.

The President, while celebrating the brotherly relationship between China and Nigeria since his visit to the Asian country in 2016, sought the support of the Chinese government for the Mambilla power project.

He said, “In the past 24 months, the Chinese government has provided humanitarian aid to our conflict-affected areas, scholarship to Nigerian youths, military training and security support to our personnel and agricultural modernisation training.

“Mr President, as we celebrate these successes, I would like to once again solicit your support for the Mambilla hydropower project, which remains a key priority for my government. Our hope is to fund the project with concessionary loans from China as any alternative funding arrangement will adversely impact the project’s viability.

“We have been informed that our submission on this project is undergoing assessment by the relevant Chinese agencies. We hope that with your kind intervention, this assessment will be expedited. Your Excellency, Mambilla is Nigeria’s equivalent of the Three Gorges Dam. My wish is that you join me for the ground-breaking ceremony of this project in the not too distant future.”

Buhari also thanked China for accepting to support the international efforts to recharge the Lake Chand Basin.

“The inclusion of this project in the FOCAC Action Plan 2019 to 2021 will go a long way in supporting our efforts to rehabilitate and resettle the conflict-impacted North-East region,” he said.

Similarly, the President advocated easy movement of citizens of both countries, which he said would complement the currency swap agreements recently signed by the central banks of both nations.

He stated, “Since our last meeting two years ago, Nigeria has relaxed its visa requirements for Chinese citizens. Today, I am pleased to inform your Excellency that Chinese citizens receive Nigerian visas in less than 48 hours.

“Another measure that will improve our trade volumes will be to introduce import duty waivers on Nigeria’s commodity exports to China. Today, our commodities such as sesame seeds, hibiscus and cassava, among others, attract import duty in China.”

The Nigerian leader also lauded China’s support for two permanent seats for Africa at the United Nations, noting that the reform of the security council would ensure equitable representation for the continent.

In his remarks, President Jinping, who commended Nigeria’s fight against terrorism and the progress that had been made so far, promised China’s support in capacity building and intelligence sharing.

He also pledged 50 million yuan support to Nigeria’s military, noting, “Buhari is as decisive in dealing with terrorism as China.”

Jinping said China would import more agricultural products from Nigeria and expressed gratitude to Buhari for Nigeria’s interest to participate in the forthcoming Chinese Import Fair.

On the Mambilla hydropower project, the Chinese leader told Buhari, “We understand how critical the project is to your country and we will take a serious look at it and ensure that it succeeds, because of its social and economic benefits.”

Shehu stated that Nigeria and China also signed a $328m agreement for the Information and Communication Technology Infrastructure Backbone Phase II project.

He said the concessional loan agreement between Galaxy Backbone Limited and Huawei Technologies Limited was signed by Nigeria’s Minister of Finance, Kemi Adesoun, and the Director General, International Development Agency, Wang Xiaotoa.

Buhari and Jinping were said to be present during the signing.

The presidential media aide said Nigeria and China also signed a Memorandum of Understanding on the One Belt One Road Initiative.

Education4 weeks ago

Education4 weeks ago

News3 weeks ago

News3 weeks ago

Business3 weeks ago

Business3 weeks ago

Technology3 weeks ago

Technology3 weeks ago

Investment4 weeks ago

Investment4 weeks ago

Investment3 weeks ago

Investment3 weeks ago

Telecommunications4 weeks ago

Telecommunications4 weeks ago

Banking Sector3 weeks ago

Banking Sector3 weeks ago