- Facebook Plans a Dating Feature, Sending Match, IAC Plunging

Facebook Inc. announced it’s rolling out a new dating feature, sending shares in matchmaking app company Match Group Inc. and its owner IAC/InterActiveCorp. plunging.

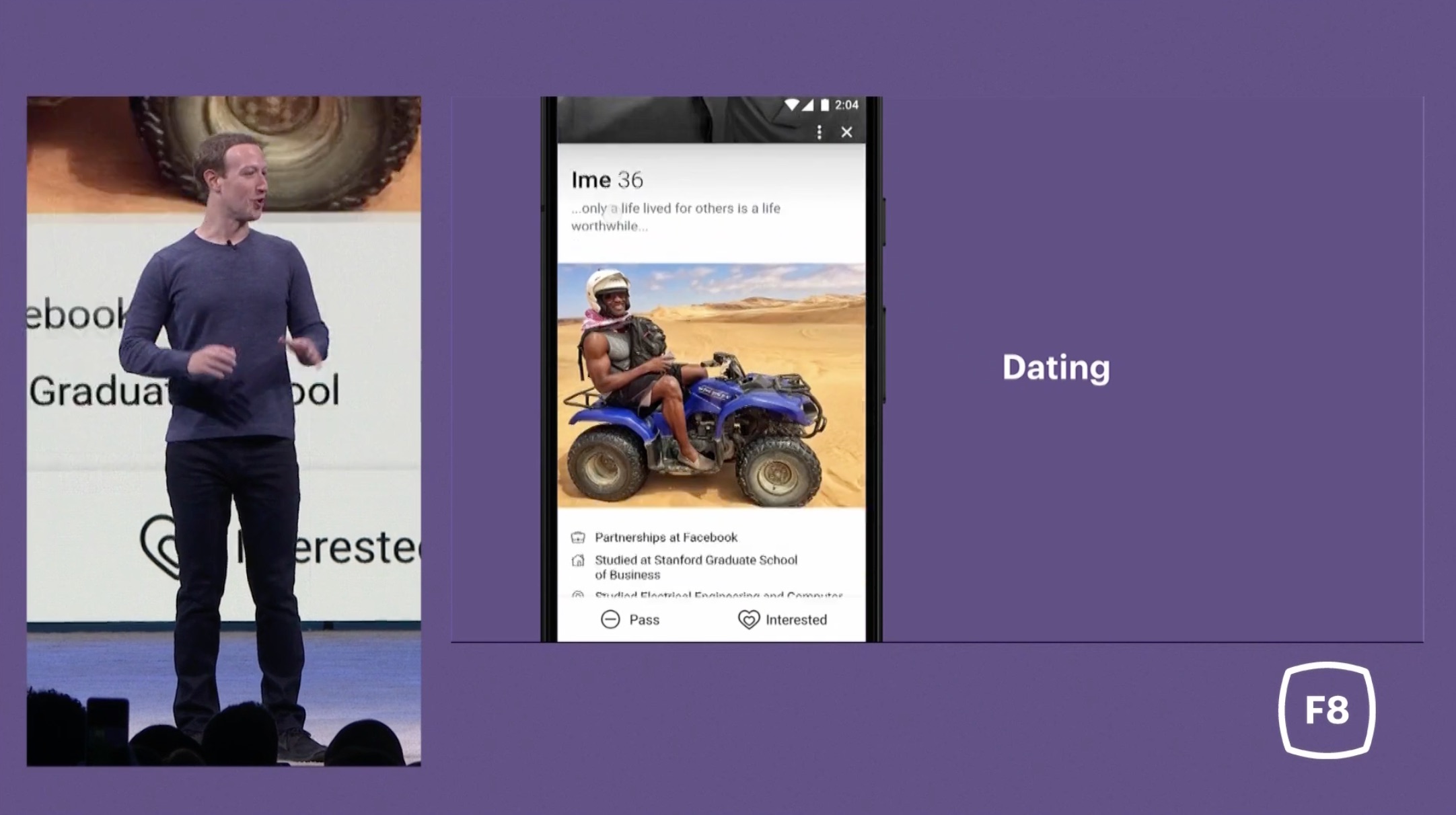

The feature would help connect people who aren’t Facebook friends and be for “building real, long-term relationships — not just for hookups,” Chief Executive Officer Mark Zuckerberg said during a presentation at the company’s F8 developer conference. Match, which owns apps like Tinder and OkCupid, fell 22 percent, the worst single-day drop in its history, while IAC fell 19 percent, the most since 2001.

“If we’re focused on helping people build meaningful relationships this is perhaps the most meaningful of all,” Zuckerberg said.

The announcement shows how Facebook is pushing forward with new products and initiatives for engagement, even as it tries to win back public trust after an outcry over how much data it collects from people online and what it does with it. Zuckerberg acknowledged that Facebook needs “to do more to keep people safe but we will also keep building.”

The dating feature would be opt-in only and users would be able to build their profile out of the view of their Facebook friends.

The news was one of several new initiatives announced, including a feature that lets people post to Instagram from other, non-Facebook apps like Spotify, and the ability to “clear history,” to remove data sent to the social network via outside websites and apps.

With a new dating app, Facebook could potentially leverage its extensive web of connections among people and data on relationships — users are able to publicize their relationship status on their profile pages — as well as its massive financial resources, to compete with the incumbents.

And such a service could give Facebook a whole new avenue for growing its advertising business, said Ali Mogharabi, an analyst with Morningstar Investment Service. If Facebook steps into dating in a big way it could have an impact on Match’s ability to acquire new users, Mogharabi said.

Most dating apps make money by charging users for premium services, something Facebook might not have to do if it uses data from the apps to improve its advertising business.

Match, which has acquired its way to becoming the clear leader in the dating field, uses Facebook to authenticate users on some of its apps, making the social media network a key part of its business. Facebook had already been changing what information it makes available to other companies like Match as part of its efforts to improve its privacy reputation.

“We’re flattered that Facebook is coming into our space – and sees the global opportunity that we do,” Match CEO Mandy Ginsberg said in an e-mailed statement. “We’re surprised at the timing given the amount of personal and sensitive data that comes with this territory.”

Match was partially spun out from IAC in 2015, but many analysts say a majority of IAC’s value still derives from the unit. Tinder, one of Match’s most valuable properties, has been rapidly adding new features to get users to pay for its services.

The fortune of IAC Chairman Barry Diller fell about $250 million to around $3 billion, according to the Bloomberg Billionaires Index.

IAC CEO Joey Levin used the chance to take a swipe at Facebook for how Russian-linked actors used the platform to try and sow division during the 2016 U.S. presidential election.

“Come on in. The water’s warm,” Levin said. “Their product could be great for U.S./Russia relationships.”

Forex3 weeks ago

Forex3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Billionaire Watch3 weeks ago

Billionaire Watch3 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira4 weeks ago

Naira4 weeks ago

Naira1 week ago

Naira1 week ago