- Trade War Strengthens Yen Across Board

The Japanese Yen gained across the board on Friday following president Trump’s decision to finally impose tariffs on $50 billion of Chinese imports and China’s resolve to reciprocate similar action.

The Chinese Minister of Commerce announced tariffs on $3 billion U.S imports while at the same time calling for dialogue to ease global tension but warned that China will react to further provocation.

In an effort to curb risk exposure amid rising uncertainties, investors sold off their shares during the Asian session but Yen gained across the board as demand for the haven currency surged.

The Yen rose to a 15-month high against the U.S. dollar, breaking descending trendline at 105.06 to validate our second target, 104.16, first mentioned earlier this month.

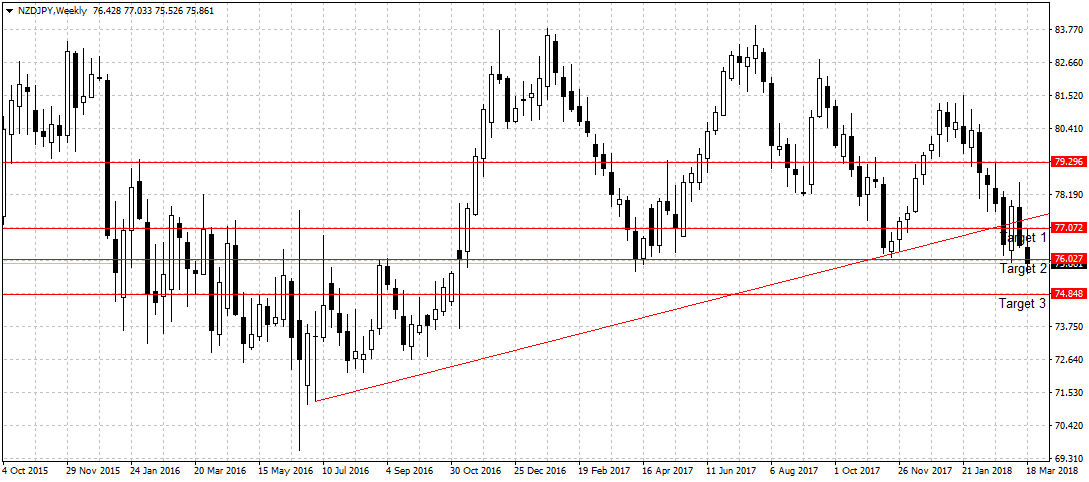

While, against emerging currencies the Yen sustained its gains, rising to 75.52 against the New Zealand dollar as shown below. A close below our second target, 76.02 support level should open up 74.84 as previously analyzed.

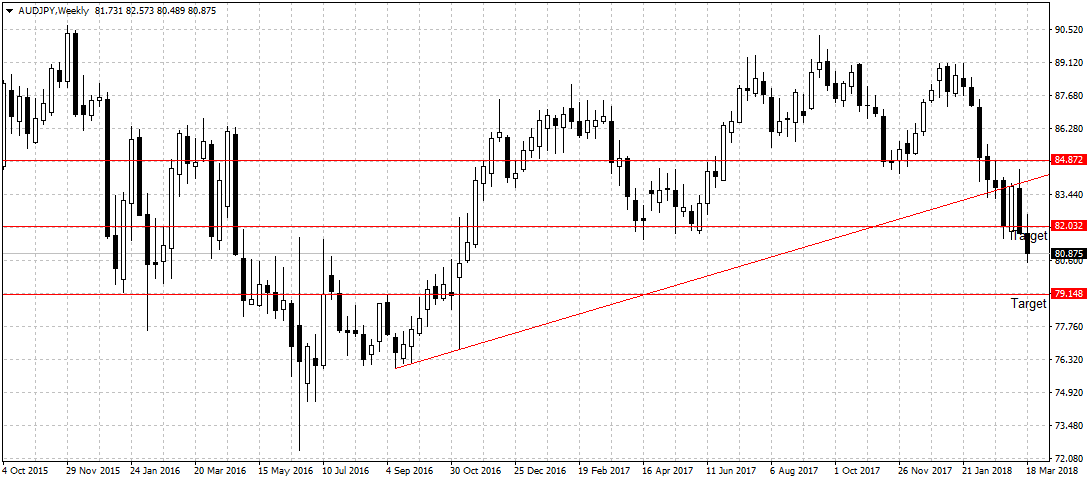

As previously stated, the uncertainty surrounding Australian economy due to weak wage growth, falling retail sales and the weak inflation rate is expected to hurt Australian economic outlook in 2018. Again, Australian unemployment rate inched slightly higher in February, jumping to 5.6 percent from 5.5 percent, according to the Australian Bureau of Statistics.

Also, change in China’s steel importation and leverage policy is expected to hurt Australian economy this year. Therefore, after closing below our first target, we remained bearish on AUDJPY and expect the current global uncertainty to further strengthen the Yen outlook against the much weaker Australian dollar towards our second target at 79.14 support level.