- Forex Weekly Outlook March 5-9

The uncertainty in the U.S. continued to weigh on U.S. economic outlook after president Trump announced that the import tariffs on steel and aluminum will be increased to 25 percent and 10 percent respectively. This led to weak U.S dollar as investors abandoned the currency despite strong economic fundamentals.

In the U.K., manufacturing activities grew at an 8-month low in February while construction activities expanded slightly in the month. Signaling a mixed economic data, especially with the uncertainty surrounding Brexit plan following Prime Minister Theresa May’s speech on Friday.

Therefore, a strong services PMI number is needed to better assess U.K. economic position ahead of European Union response to Theresa May’s plan.

In Canada, the economy expanded at a slower pace in the second half of 2017, growing at an annualized rate of 1.7 percent in the fourth quarter. Suggesting that rising household debt has started weighing on consumer spending and likely to worsen economic outlook ahead of NAFTA trade deal with the U.S. Meaning, not just the correlation between the U.S. and Canada’s economy will weigh on Canadian dollar despite strong global commodity outlook but weak trade relation, low inflation, rising debt and overpriced housing market amid new tariffs on imports will hurt the loonie attractiveness, as Canada exports 90 percent of its steel to the U.S., representing 16 percent of the total U.S. steel imports, and also accounts for about 41 percent of America’s aluminum imports.

In Japan, the Governor of the Bank of Japan Haruhiko Kuroda for the first time announced the apex bank may start looking into balance sheet normalization as early as April 2019. This, bolstered Yen’s outlook across the board as investors jumped on it to avert the U.S and Europe’s uncertainties.

This week, USDJPY, CADJPY, NZDJPY, AUDJPY, and GBPJPY top my list.

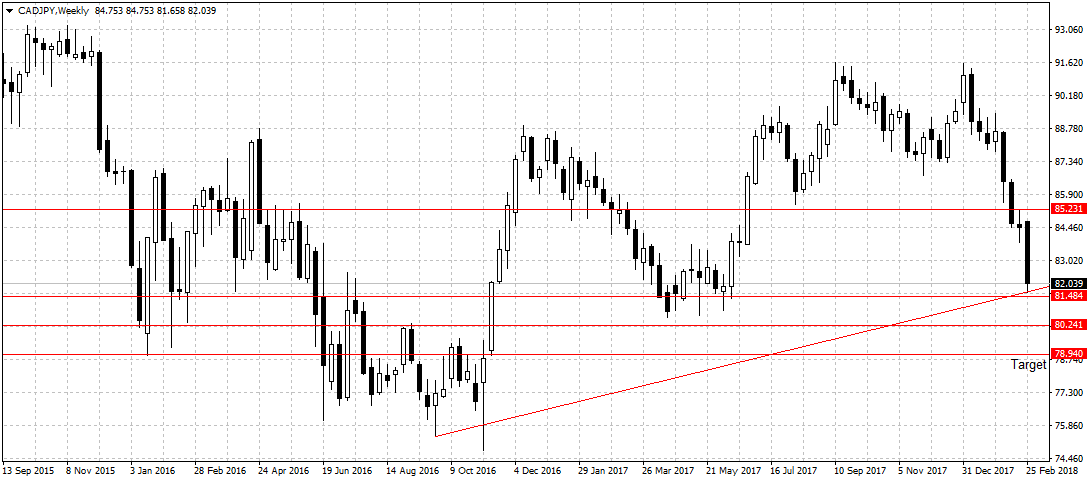

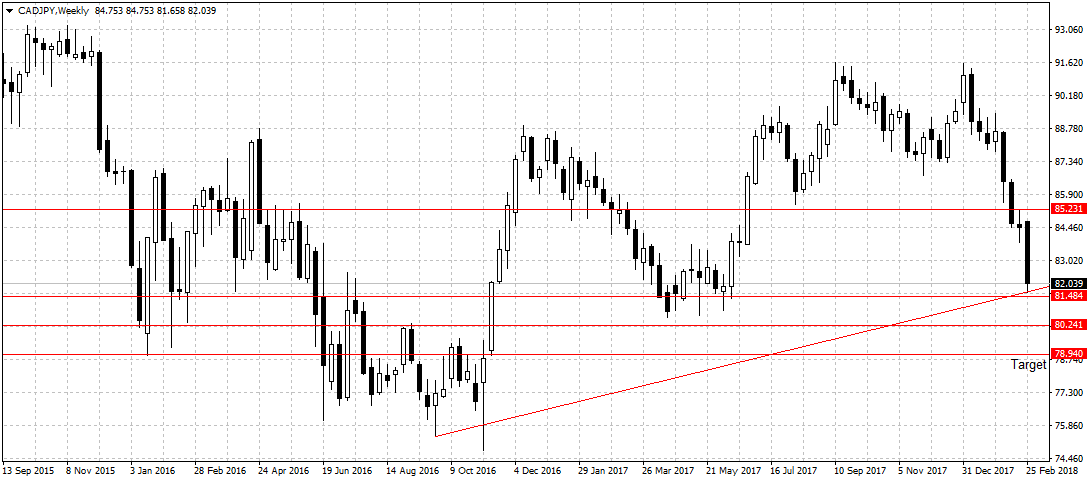

CADJPY

The uncertainty surrounding the Canadian economic outlook ahead of NAFTA trade agreement and possible tariffs increment is likely to hurt the Canadian currency against the more attractive Japanese Yen in the first half of 2018, especially now that investors are likely to be looking for a weaker currency to trade the Yen against.

Therefore, after dropping more than 230 pips against the Yen last week to bring its total lost since December peak reached at 91.56 price level, to 953 pips. I will be looking to sell CADJPY pair below the ascending channel as shown above, and expect a sustained break below the 81.48 support level to further validate bearish continuation and open up 78.90 support level. However, a break of 80.24 support level, below the 2017’s low, is imperative to our target.

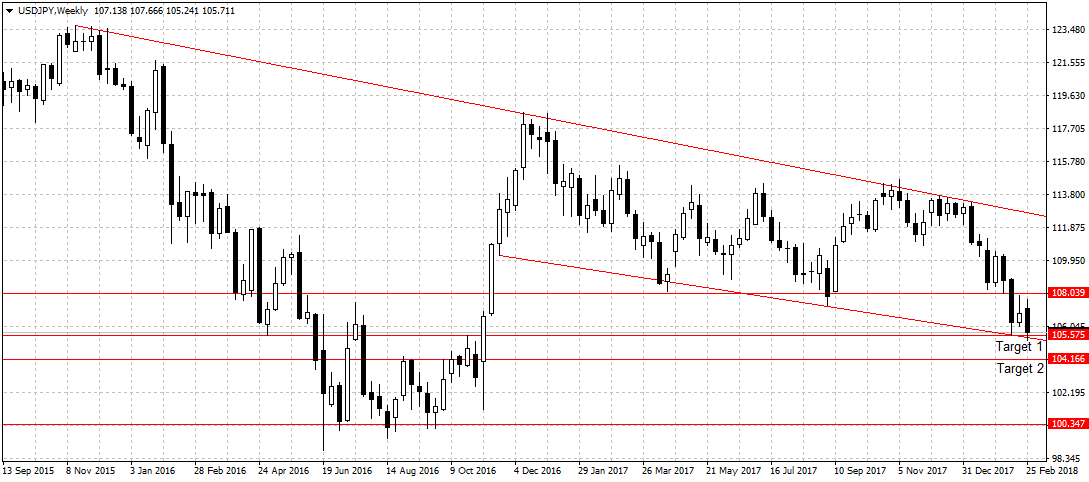

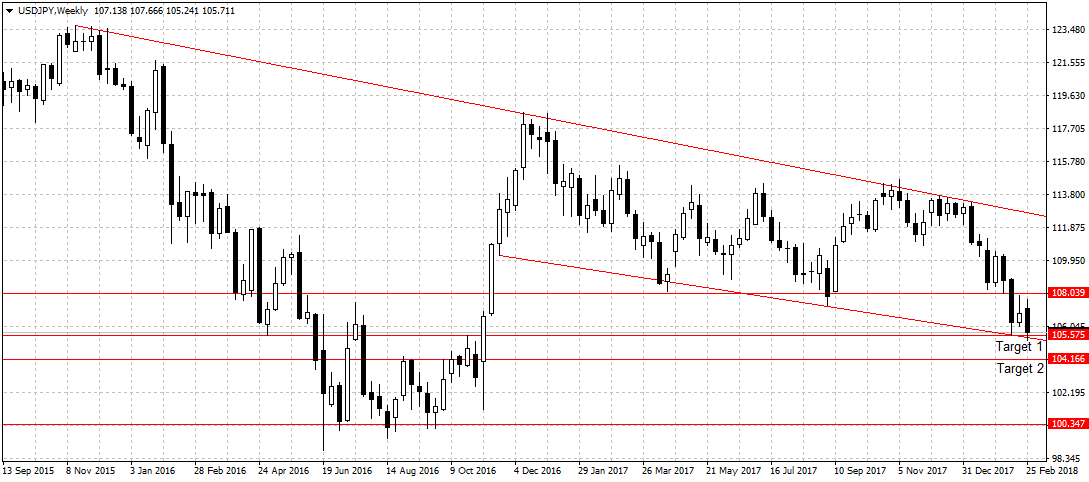

USDJPY

As previously analyzed, the Yen remained the most attractive currency at the moment.

This week, I will expect a sustained break of our last week target at 105.57 support level and break below the descending channel to open up 104.16 as shown above. Again, given strong Japan’s fundamentals and Yen’s haven status, USDJPY is likely to break 100.30 support level by the second or third quarter of this year.

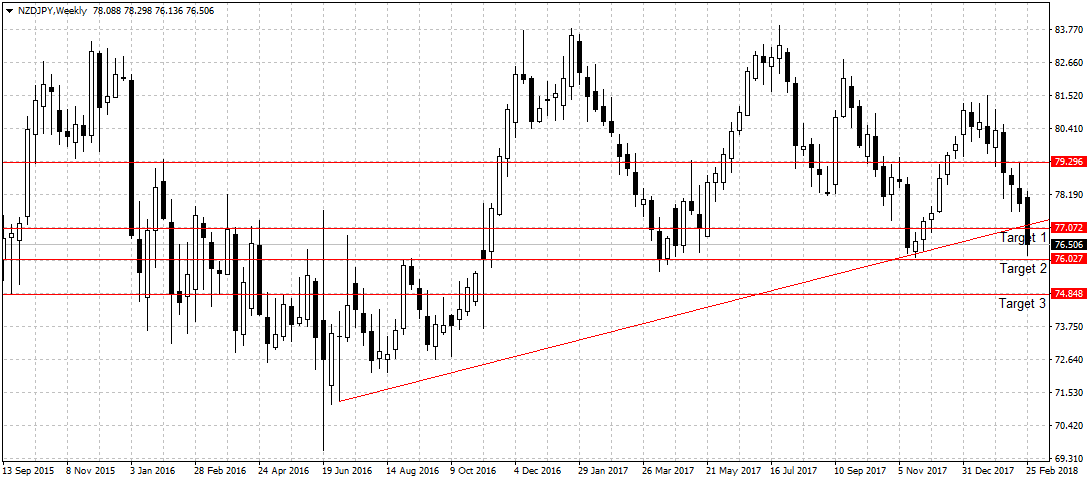

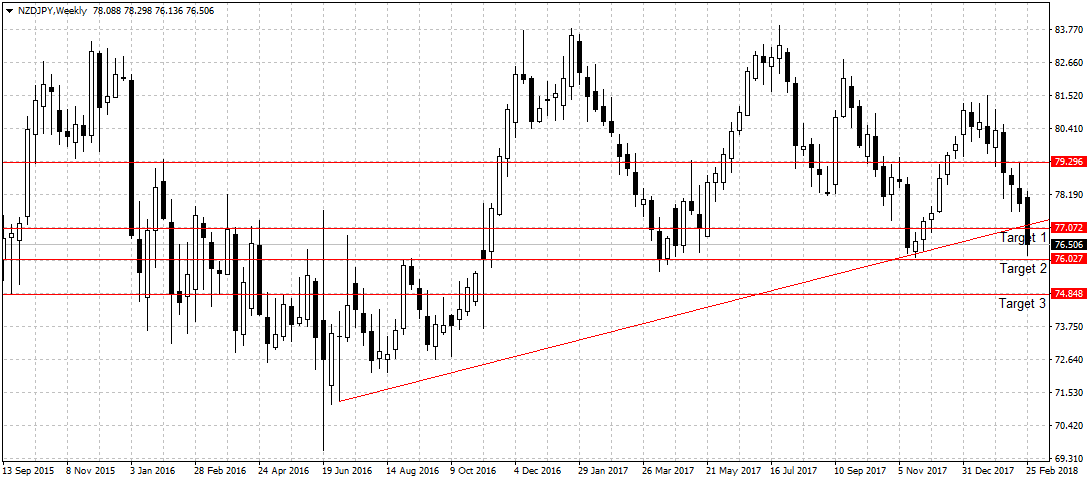

NZDJPY

New Zealand economy is projected to slow down on China’s credit control and steel restriction policies instituted by the government to curb rising debt and extreme pollution. Again, the low wage growth, weak inflation, and rising house debt are hurting consumer spending despite the strong commodity outlook.

Similarly, while the New Zealand dollar rebounded slightly against the Yen last week, it remained below 77.07 key support level. Therefore, as previously stated I expect the Yen to sustain its last week gains against the Kiwi dollar this week, and a break of 76.02 support level that doubled as our second target to open up 74.84 (target 3).

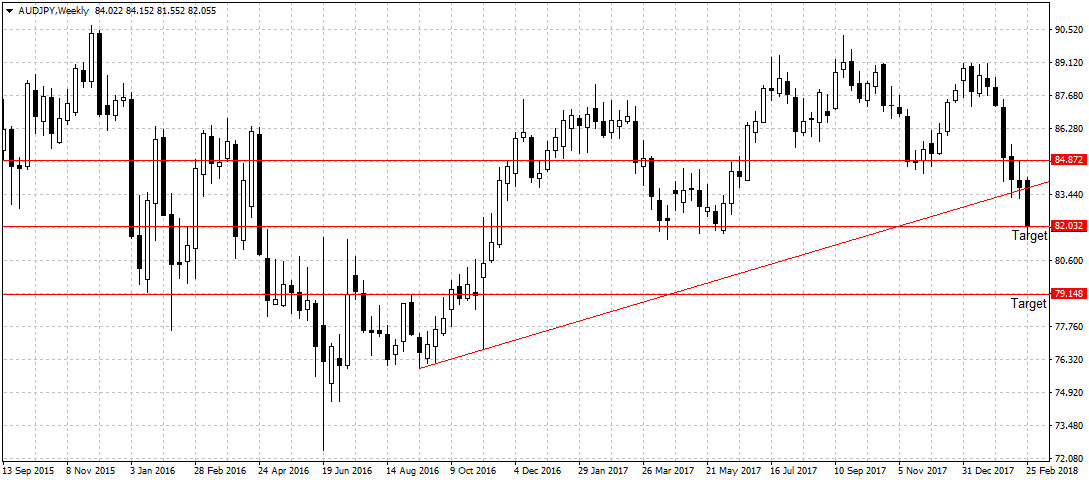

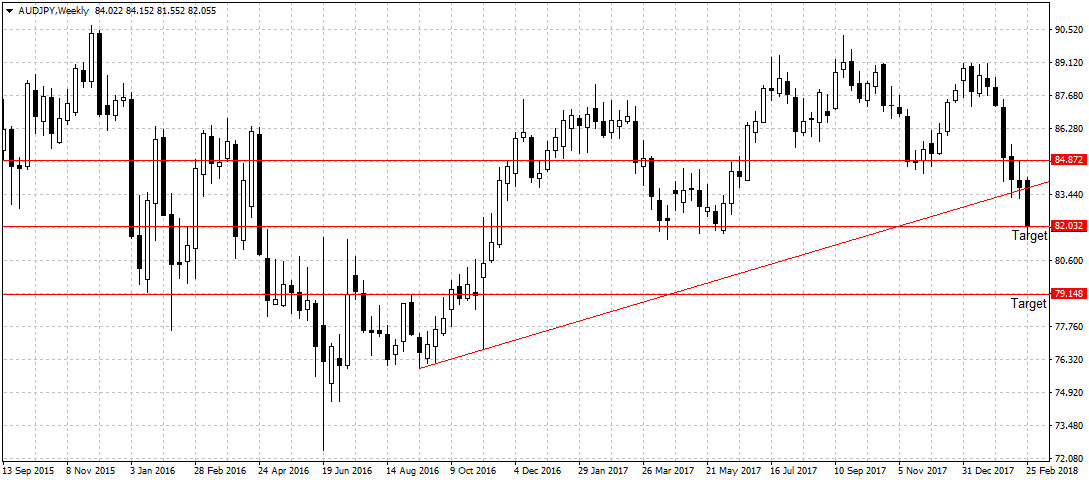

AUDJPY

The Australian dollar is a commodity-dependent currency, however, while global commodity market is currently better than what was recorded for the larger part of 2017, the possibility of slower Chinese economy due to the new policy is likely to weigh on Aussie dollar outlook in 2018.

Last week, after data showed the Chinese manufacturing PMI plunged to a 19-month low in February, AUDJPY dropped 210 pips to break 82.03 support. Another indication of China’s influence on the Aussie dollar.

This week, I am bearish on AUDJPY and expect a sustained break of 82.03 to increase sellers’ interest as it would have break 2017 low of 81.47. Again, while 80.60 support is key to bearish continuation, a break below that price level should open up 79.14 price level.

GBPJPY

Despite the substantial rebound in GBPJPY pair following Theresa May’s speech, I remained bearish on this pair as I doubt the European Union will accept the May’s proposed solution to Irish border going by EU proposal and comments from key policy-makers.

Therefore, as previously stated I remained bearish on GBPJPY and expect a further downward trend towards our second target.

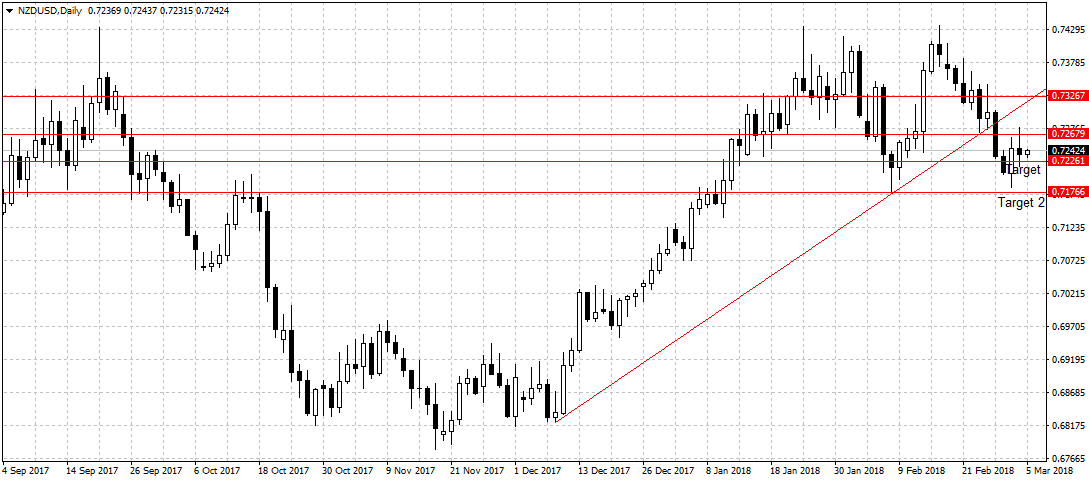

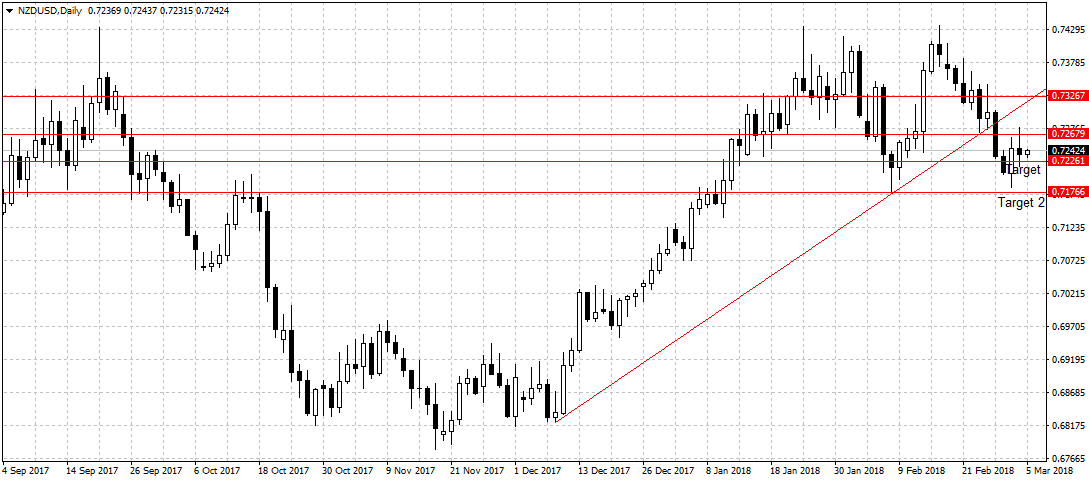

NZDUSD

After the first target was met at 0.7226 last week. I will be stepping aside from NZDUSD this week to better assess price action because of the growing uncertainties in the US.

Forex2 weeks ago

Forex2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Company News4 weeks ago

Company News4 weeks ago

Billionaire Watch1 week ago

Billionaire Watch1 week ago

Naira2 weeks ago

Naira2 weeks ago

Naira3 weeks ago

Naira3 weeks ago

Naira1 week ago

Naira1 week ago