- Forex Weekly Outlook Feb 26-30

Last week, the U.S. dollar rebounded on higher bond yields and strong optimism following the hawkish FOMC minutes of Wednesday. According to the Fed, the labor market remained strong and economic activity continued to rise at a solid rate, both backed by the growing household spending, solid business fixed investment and low unemployment rate.

However, the committee highlighted the low inflation rate, saying while market-based measures of inflation have increased in recent months, inflation is still running below the 2 percent target. This explained why the long-term inflation expectations are little changed.

Still, experts are projecting three to four rate hikes in 2018, especially with the U.S. dollar now correlated with the treasury yield once again and 10-year treasury yield rising to almost 3 percent after reaching a four year high of 2.9537 percent on Wednesday and predicted by both Bank of America and Goldman Sachs to reach 3.25 percent by year-end.

But the rising U.S. deficit and increasing capital flight from the U.S. equity to Europe still remain a concern, and may further disrupt dollar’s outlook. However, investors are looking towards Fed’s Feb 27 testimony by the new Chair Jerome Powell at the House Financial Services Committee in Washington DC for a clue on interest rate hikes and economic standing. A hawkish view could further boost fixed income attractiveness and strengthens the U.S dollar economic outlook against emerging currencies.

In the Euro-area, the services PMI unexpectedly declined to 56.7 in February, down from 58 recorded in January. Despite the unexpected results in the first two months of the first quarter, the numbers showed the economy is growing at a quarterly rate of 0.9 percent. Therefore, economic growth in the region remained strong in 2018 and likely to compel the European Central Bank to stop its asset purchasing program by the end of the year. But Italian election and German coalition remained a concern.

In Japan, the Yen strengthens against the U.S. dollar as investors capitalized on Japan’s eight straight quarters of consecutive expansion over Europe’s 2017 strong economic growth rate. This suggests are investors doubting the possibility of the Euro sustaining its bullish run against the greenback above 1.2569, especially with the fiscal stimulus and growing uncertainty ahead of Italy election of March 4th.

Therefore, the reason the Yen has been attracting buyers that are boosting its value to close higher against the U.S. dollar last week after reaching a two-year high of 105.54 two weeks ago. Even though the Bank of Japan has not hidden its dissatisfaction of rising Yen strength, economists believe strong Japan’s trade surplus and good overall economic outlook makes it a perfect haven currency for investors, despite its negative impact on the profit margin of Japanese companies.

This week, USDJPY, EURUSD, NZDJPY, GBPJPY, and NZDUSD our list.

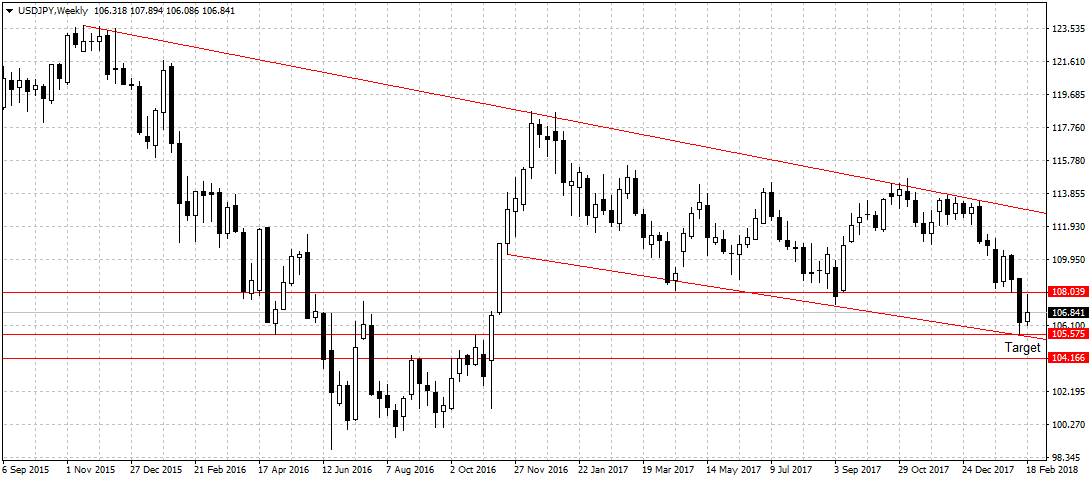

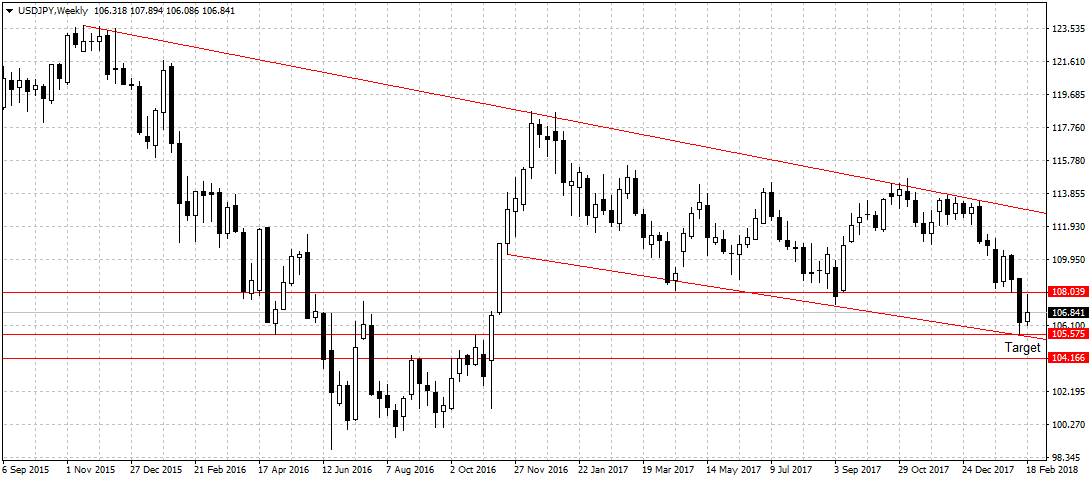

USDJPY

The U.S dollar rebounded on strong optimism last week but quickly lost more than half of its gains against the Japanese Yen as investors favoured the haven currency because of its recent economic momentum and uncertainty surrounding the Euro single currency ahead of Italian election and German coalition in March.

While investors are expecting a hawkish Fed testimony on Tuesday, it may not substantially boost the U.S. dollar’s attractiveness against the Yen as attentions are now on the bond market because of rising interest rates and uncertainty due to the rising deficit. Therefore, investors are likely to sustain their bearish view on the USDJPY pair going forward.

Technically, this was evident in the last week’s candlestick that closed as a bearish pin bar. Confirming bearish pressure despite increased optimism following Fed minutes. Hence, as long as 108.03 resistance holds, I remain bearish on this pair as projected in January and expect a break below the 105.57 support level to open up 104.16 as shown above.

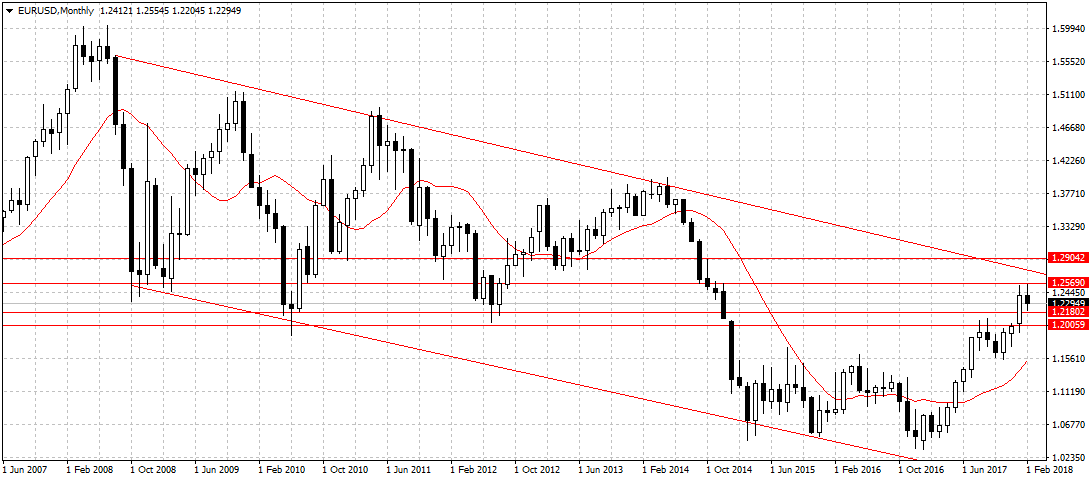

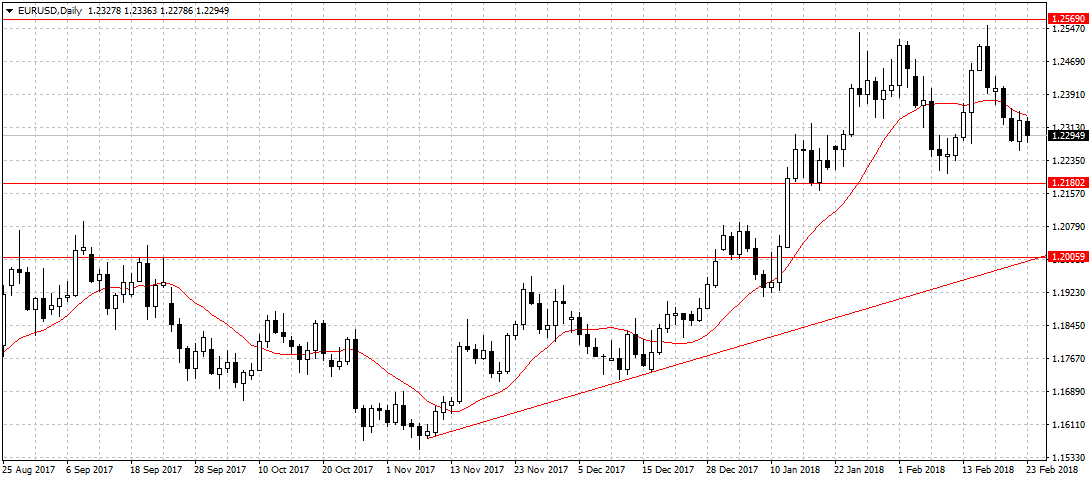

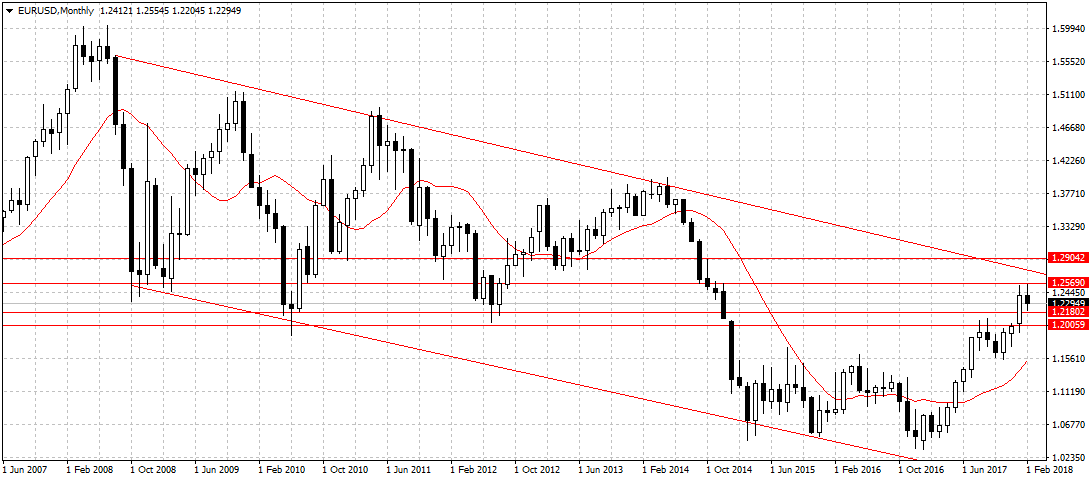

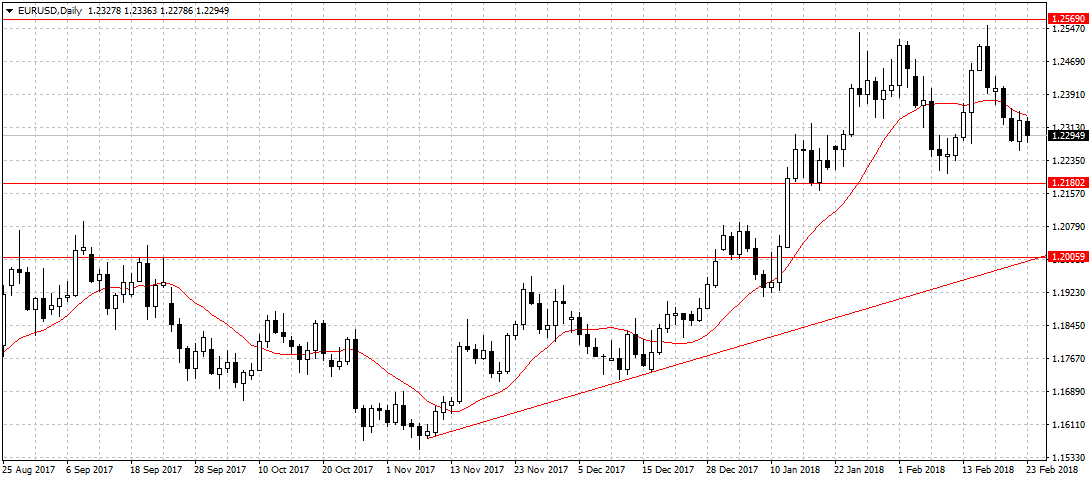

EURUSD

While the Euro single currency remained strong, backed by strong economic fundamentals, the chances of the 19-nation currency sustaining its current bullish run above 1.2569 resistance level remained investors headaches, especially now that the U.S. economic fundamentals — wage growth, inflation rate, etc. are picking up, with a potential three rate hikes in the picture this year. We might see a break of 1.2180 support levels if Fed remained convincingly hawkish on Tuesday and ahead of the Italian election. A sustained break should open up 1.2005 support levels. However, a break above the 1.2569 could open up a new high at 1.2748.

Also, note that a break of 1.2180, which was last tested in January 2018, could reinforce sellers’ interest for a more aggressive selloff. Therefore, a break of 1.2180 will be the key in determining entry.

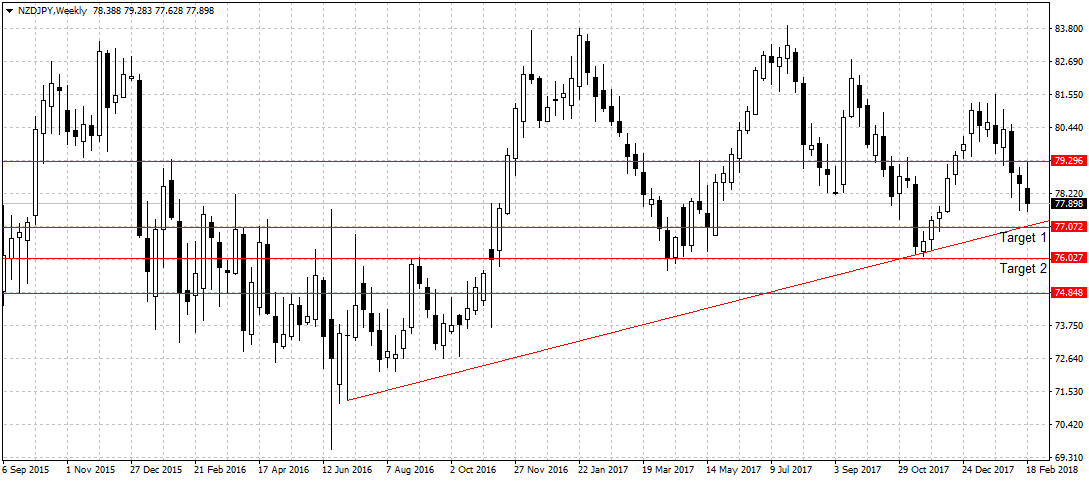

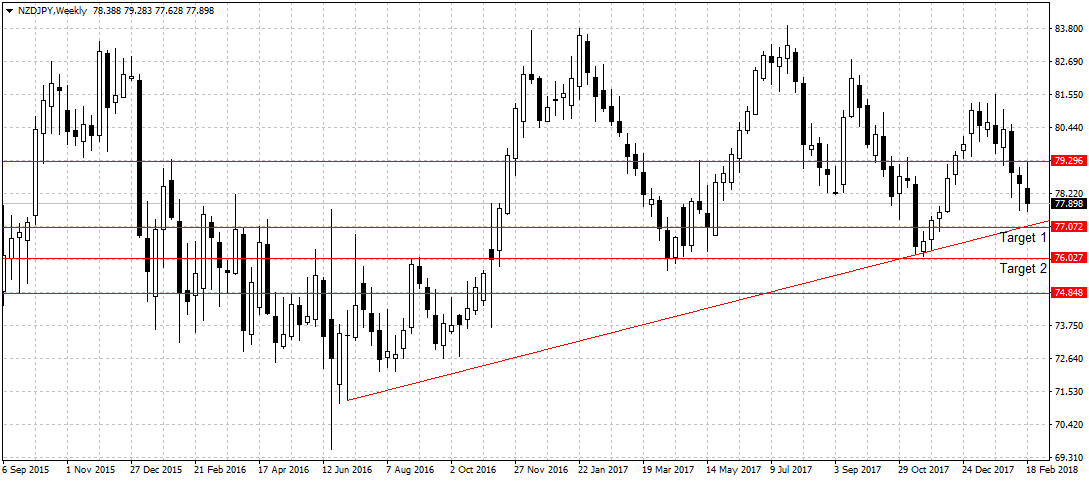

NZDJPY

The New Zealand retail sales rose from 0.3 percent in the third quarter of 2017 to 1.7 percent in the final quarter of the year, beating analysts’ prediction of 1.4 percent. The better than expected consumer spending bolstered the Kiwi outlook against other emerging currencies like the Australian dollar last week but not against the Japanese Yen as shown below.

One, this is because the Japanese Yen remained attractive across the board. Two, the rebound in consumer spending in New Zealand might be due to the usual high Christmas shopping. This is because credit card spending rose from 2.9 percent in October to 9.1 percent in November and 6.3 percent in December before dropping back to 4.6 percent in January. Suggesting weak wage growth is still a concern despite rising job creation.

Therefore, I will expect the renewed interest in the Japanese Yen to further pressure NZDJPY pair towards 77.89 support levels. A sustained break of 77.07 support levels should open up 76.02.

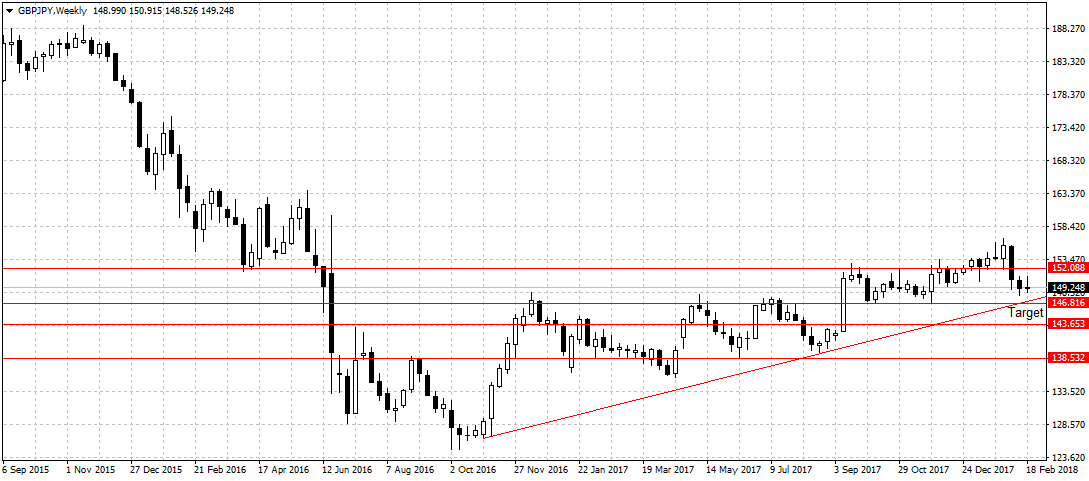

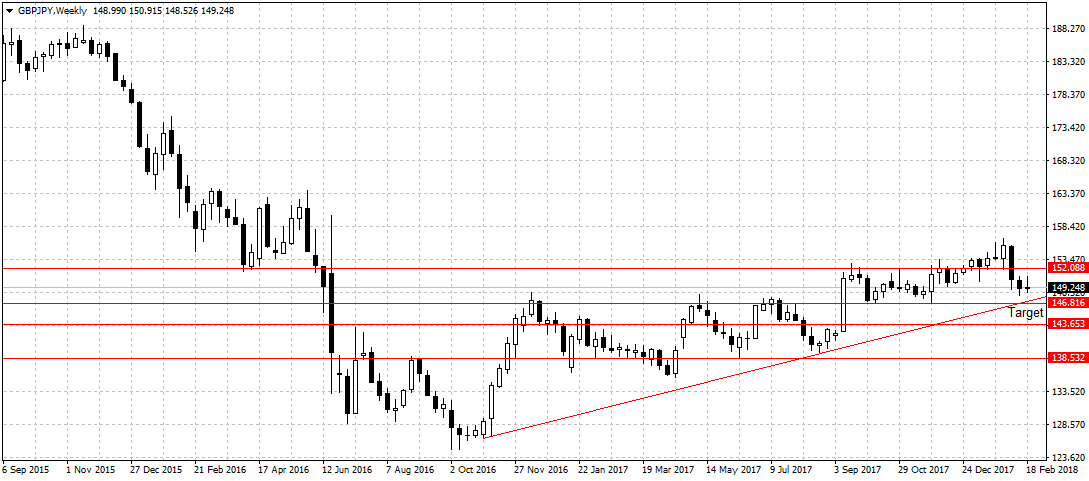

GBPJPY

The uncertainty surrounding the British economy continued to weigh on key economic fundamentals. For instance, the Office for National Statistics revised down the U.K economic growth for the fourth quarter of 2017 to 0.4 percent against the 0.5 percent previously estimated, saying consumer spending and production during the quarter were not as strong as previously estimated. Another indication that rising consumer prices are hurting the British consumer and the reason the overall 2017 economic growth rate was revised down from 1.8 percent to 1.7 percent, the weakest in five years and the weakest growing major economy.

This was why the pound dipped last week and the candlestick, as shown above, closed as a bearish pin bar. Again, while the volume of trade is low, I think the strong Yen may aid sellers’ interest and further pressure this pair below the ascending line at 146.81.

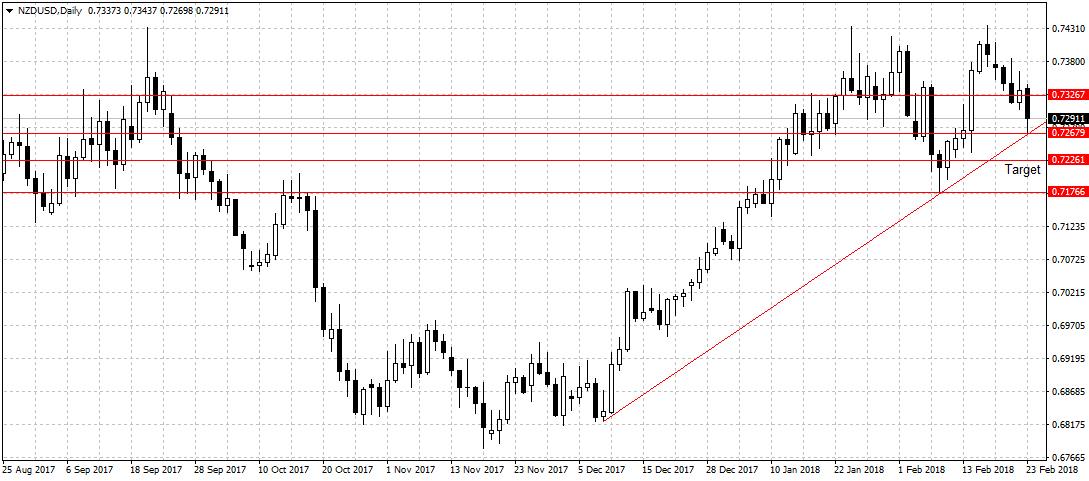

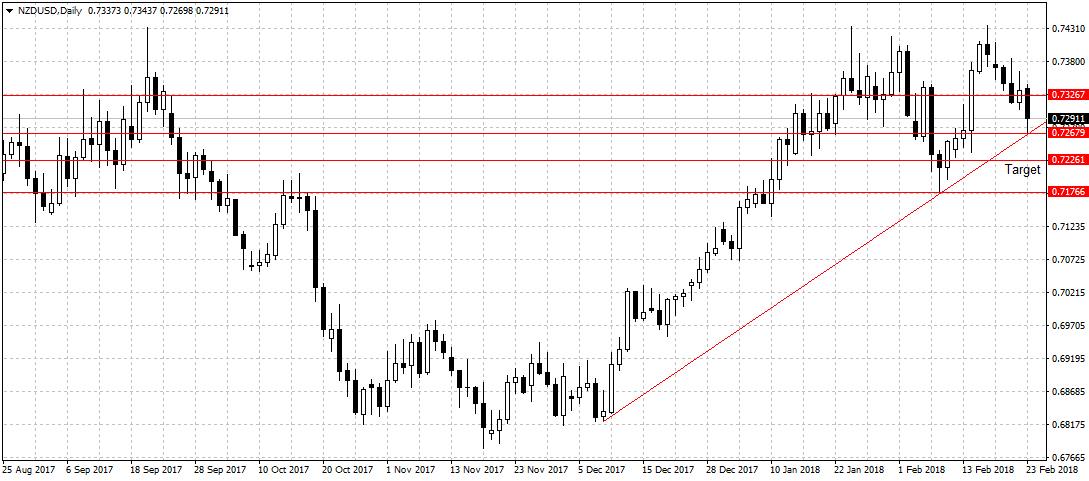

NZDUSD

In the last 5 days, since the hawkish Fed statement, the NZDUSD has dropped 140 pips to close below 0.7326 resistance level. Even though, emerging currencies like New Zealand dollar enjoyed safe haven status, the U.S. rising interest rates will boost its attractiveness against emerging currencies like the Kiwi that depends on China and better global commodity market for growth.

If the Fed as generally expected remained hawkish and sets the tone for an aggressive rate hike or strong economic outlook in 2018, we could see a drop below the 0.7267 support level, down below the ascending channel to 0.7226 support levels.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago