- FG, NASS Political Deadlock Threatens Economic Rebound

The Central Bank of Nigeria has fallen victim to a battle between President Muhammadu Buhari and the National Assembly.

The Monetary Policy Committee did not meet on Monday and Tuesday, as scheduled, because it lacks a quorum after the Senate refused to approve Buhari’s nominees for the committee.

This means the MPC cannot meet, and the CBN can’t set interest rates.

This setback has added to the economic fallout from a longstanding political standoff.

Already, the NASS has threatened to delay the 2018 budget proposal for a third year amid acrimony over who is to blame for the impasse and haggling over allocations.

At the heart of the dispute is not only a supremacy battle, but an anti-corruption campaign that helped Buhari get elected in 2015 and that some lawmakers call a witch-hunt.

Legislators also want projects in their constituencies funded and implemented before next year’s elections.

The stalemate may jeopardise efforts to help recovery in an economy that contracted by 1.6 per cent in 2016 and has yet to deal with risks that may come with the February 2019 vote, according to a Bloomberg reports.

The standoff is “a key political risk for Nigeria this year as it may get in the way of the effective functioning of the economy,” the Head, Macroeconomic Research at Standard Chartered Bank Plc in London, Razia Khan, said.

“The belief is that in time the new MPC members will be appointed. If we get to the next set of meetings and they still can’t be held, there would be some disquiet among investors and concerns about the workability of Nigeria’s political system,” she added.

Presidential spokesman, Garba Shehu, declined to comment when phoned on Monday and said he hadn’t been briefed on the matter.

The cancelled MPC meeting is likely to reinforce the view that the current economic downturn has been worsened by poor policy management.

The MPC is likely to have held rates at 14 per cent if it had been able to meet, but the prospects of rate cuts at its March and May meeting now look more unlikely as it may take time to reach consensus on a change of policy once the committee has convened.

So far, markets have shrugged off the dispute and are betting the economic recovery will continue, according to Mark Bohlund of Bloomberg Economics

Nigerian stocks have risen 18 per cent this year in dollar terms, the most globally, according to data compiled by Bloomberg.

The Chairman, Senate Committee on Banking Committee, Rafiu Ibrahim, said last week the NASS had an “issue with the executive.”

In the absence of a MPC meeting, the CBN’s key rate remains at 14 per cent, where it’s been since July 2016, the CBN Governor, Godwin Emefiele said in a statement on Monday. That’s despite remarks by Emefiele in November that the committee may consider loosening policy early this year.

This is the first time in at least two years that a scheduled MPC meeting didn’t take place

Even more important, according to Standard Chartered’s Khan, is the approval of the 2018 budget, in which a third of the spending is earmarked for investment in infrastructure to help spur economic growth.

“The budget has a much more immediate impact on the economy than anything the newly formulated MPC could do,” she said.

The impasse over so-called constituency projects may determine when the budget is approved, according to Clement Nwankwo, executive director of the Abuja-based Policy and Legal Advocacy Centre.

The legislature had approved the projects and the executive refused to implement, Nwankwo said. “The view of the National Assembly members is that that aspect of the budget has been singled out for neglect,” he said.

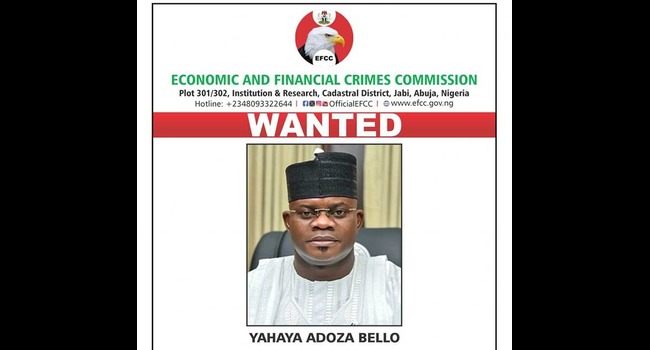

The Senate has twice rejected Buhari’s nomination of Ibrahim Magu as chairman of the Economic and Financial Crimes Commission.

Buhari left Magu to continue running the agency in an acting capacity, angering lawmakers.

At the same time, the EFCC is trying to pursue a case of false declaration of assets against the Senate President Bukola Saraki.

Saraki’s trial and Magu’s confirmation are symptoms “of how the legislature has been fighting for its own independence and it feels that the executive and its agencies are undermining its authority,” the Head of Lagos-based BudgIT, a civic group that lobbies for government transparency, Oluseun Onigbinde, said.

Forex3 weeks ago

Forex3 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Billionaire Watch2 weeks ago

Billionaire Watch2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira2 weeks ago

Naira1 week ago

Naira1 week ago

Naira4 weeks ago

Naira4 weeks ago

Naira3 weeks ago

Naira3 weeks ago