Forex

Forex Weekly Outlook January 15-19

- Forex Weekly Outlook January 15-19

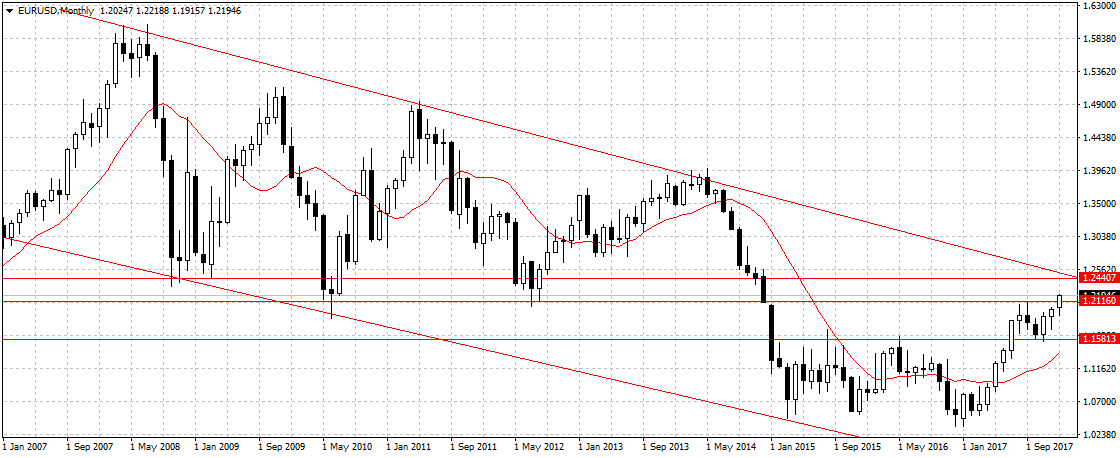

EURUSD

The German coalition agreement and the change in European Central Bank’s stance towards monetary policy boosted Euro attractiveness against G10 currencies last week. The Euro single currency rose to a 3-year high against the U.S. dollar following a series of weaker than expected economic numbers.

The Euro gained 163 pips against the U.S. dollar to trade above 1.2116 levels on Friday, suggesting that the strong economic growth in the region amid political accord reached in Germany is supporting Euro bullish run. Even though the region economy remained strong with rising demand, the U.S. fundamentals are equally strong with consumer prices gradually picking up and businesses like Wal-Mart announcing pay rise following the tax cut. The U.S. economy is poised for more gains in 2018.

Therefore, break of 1.2116 levels is needed to validate bullish continuation, especially with the odds of the Fed raising rates many times in 2018 increasing. Again, while 1.2500 price level is feasible in 2018, we don’t see it just yet and will treat the current upsurge as a temporary bullish move.

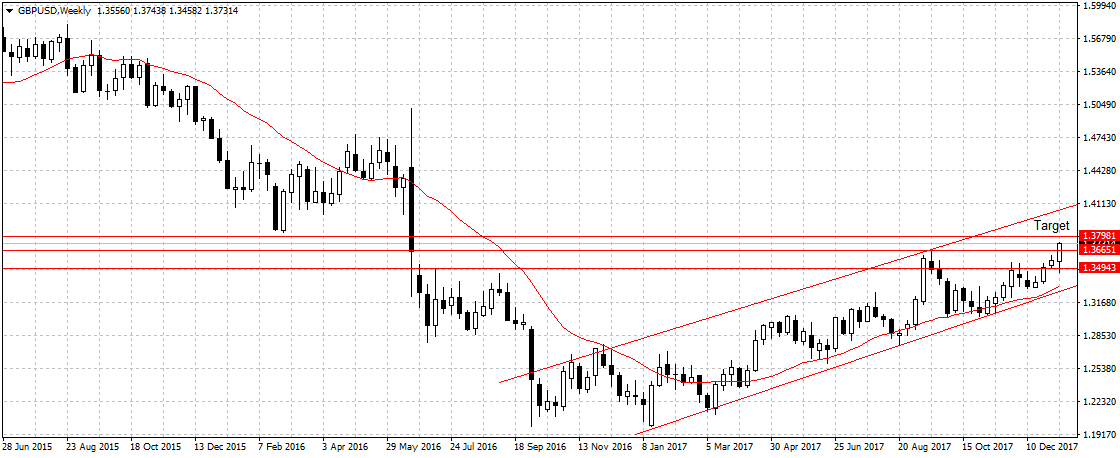

GBPUSD

In the U.K., the pound sustained its gains against the U.S. dollar for the fourth week in a roll despite the uncertainty surrounding the Brexit and slowdown in economic data. The pound has gained 420 pips against the U.S. dollar in the last one month to peak at an 18-month high for two main reasons, one, traders believe the pound is undervalued and sold off merely because of Brexit uncertainty. Two, the resiliency of the economy, despite political and economic uncertainties, to expand better than expected in 2017 while at the same time maintaining a record-low unemployment rate. Means, the widely projected global economic growth and expanding economic activities would boost British economic outlook better in 2018 and support the sluggish wage growth.

Again, while the weak U.S. dollar aided this pair move above the 1.3665 level, the renewed interest in the pound is likely to further bolster the pair towards 1.3798 resistance level. Hence, we remain bullish on GBPUSD in the near term as long as the price stays above 1.3665 support levels.

USDJPY

Since the Bank of Japan announced it will reduce its long-dated bond-buying program on Wednesday, the Yen has surged against the U.S. dollar to 111.03. But with experts treating the unexpected change in monetary stance as a sign of growing economy, the Yen is expected to gain even further as traders are already predicting rate hike by the middle of the year.

Also, with the U.S. dollar not very attractive at the moment, the haven status of the Yen and improved global economy fueling growth in the world’s third-largest economy is more likely to aid USDJPY to 109.16 support levels in the coming days. This week, we are bearish on USDJPY with 109.16 as the target.

EURNZD

The rebound in the Euro single currency following the news of German coalition accord and the change in ECB’s monetary stance erased EURNZD’s weekly gains. But as long as 1.7094 holds, our bearish view on this pair stands. One, because of improved in commodity-dependent economies like the New Zealand and the fact that we do not see this pair toppling 1.7481 reached in November 2017.

So we will be treating the bullish pin bar as temporary rebound and wait for further confirmation above or below the 1.6804 levels to affirm our position on EURNZD. Meaning, this week we are neutral on EURNZD but will update on the first sign of confirmation.

So we will be treating the bullish pin bar as temporary rebound and wait for further confirmation above or below the 1.6804 levels to affirm our position on EURNZD. Meaning, this week we are neutral on EURNZD but will update on the first sign of confirmation.

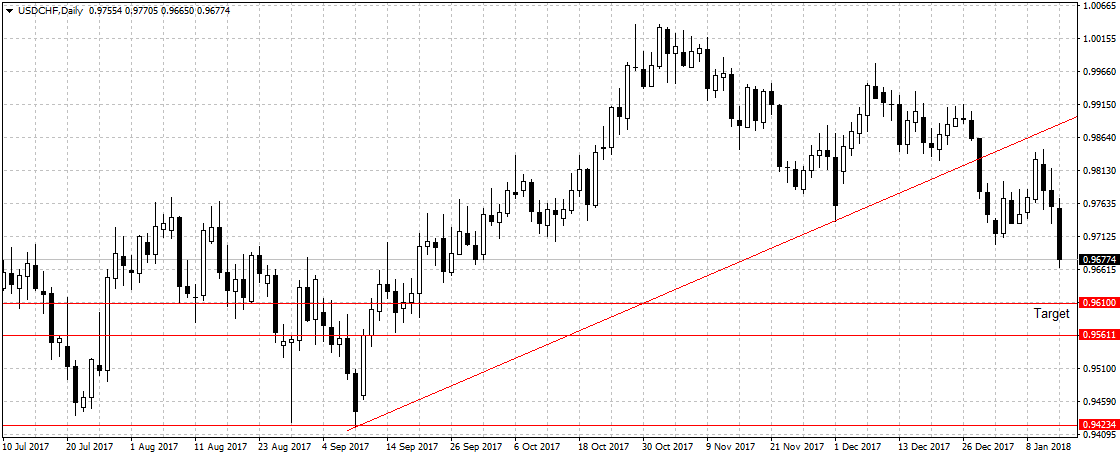

USDCHF

Despite the weak Swiss fundamentals, the Swiss Franc sustained its gains against the U.S. dollar last week.

As previously stated, the weak U.S. dollar sentiment is weighing on this pair and expected to continue this week. Therefore, we are bearish on USDCHF this week with 0.9610 as the target.