Forex

Euro-Area Jobless Rate Improves to 9-year Low in November

- Euro-Area Jobless Rate Improves to 9-year Low in November

Broad economic growth and continuous job creation in the Euro-area further improved the unemployment rate to the lowest level since early 2009.

The region unemployment rate declined from 8.8 percent in October to 8.7 percent in November, the Eurostat report showed on Tuesday. The lowest unemployment rate in 9 years.

Despite better than expected economic growth in the region, the inflation rate remained below the 2 percent target while wage growth is yet to pick up as expected. However, economists believe tight labour market would eventually boost wage growth as employers struggle to attract skilled workers.

“While falling unemployment should further boost consumption, thereby contributing to the self-sustaining character of the recovery, the key question for the ECB is when the unemployment level will start to affect wages,” ING economist Peter Vanden Houte said in a note to clients. With the number of companies beginning to see production bottlenecks due to a lack of personnel, “wage growth should start to pick up.”

The economic activity in the manufacturing sector expanded at the fastest pace in seven years in December, while non-manufacturing sector continued to grow on increasing new orders. Leading to experts projecting a rate hike and further reduction in ECB asset-buying program but with the apex bank wary of sustainability amid weak consumer prices and wage growth, the markets may have thought wrong. Especially, after the apex bank reiterated its readiness to extend the program if needed and stated further support will come from its policy of reinvesting maturing debt.

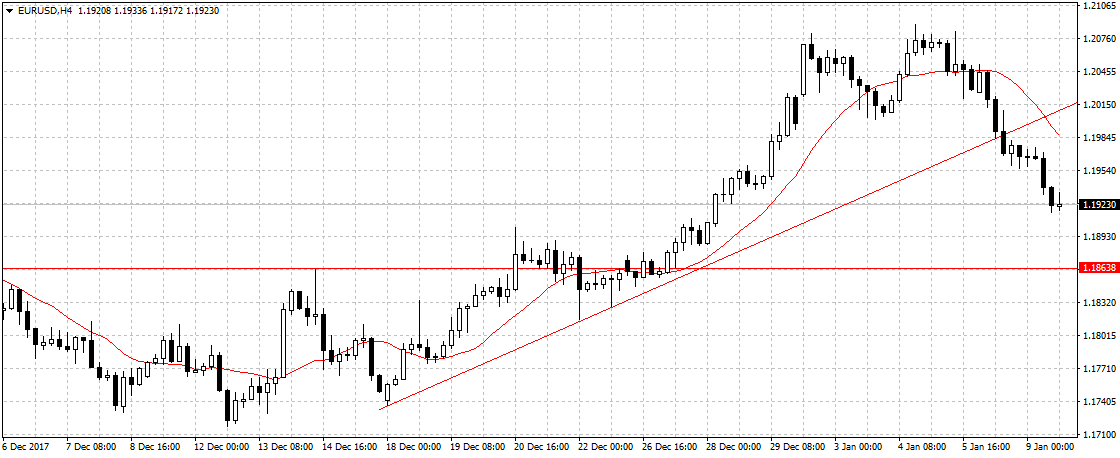

The Euro dropped 0.38 percent against the U.S. dollar to $1.1922, more than a weak-low.

As stated last week, the U.S dollar is undervalued and it is unlikely that the Euro will top $1.2116 resistance with experts projecting three Federal Reserve rate hikes in 2018 and European Central Bank adamant with the current monetary policy.

Therefore, we remain bearish on EURUSD and expect a sustained break of $1.1893 support level to open up $1.1863.

The above chart was first shared on Friday here.