Forex

EURGBP Weekly Outlook October 30 – November 3

- EURGBP Weekly Outlook October 30 – November 3

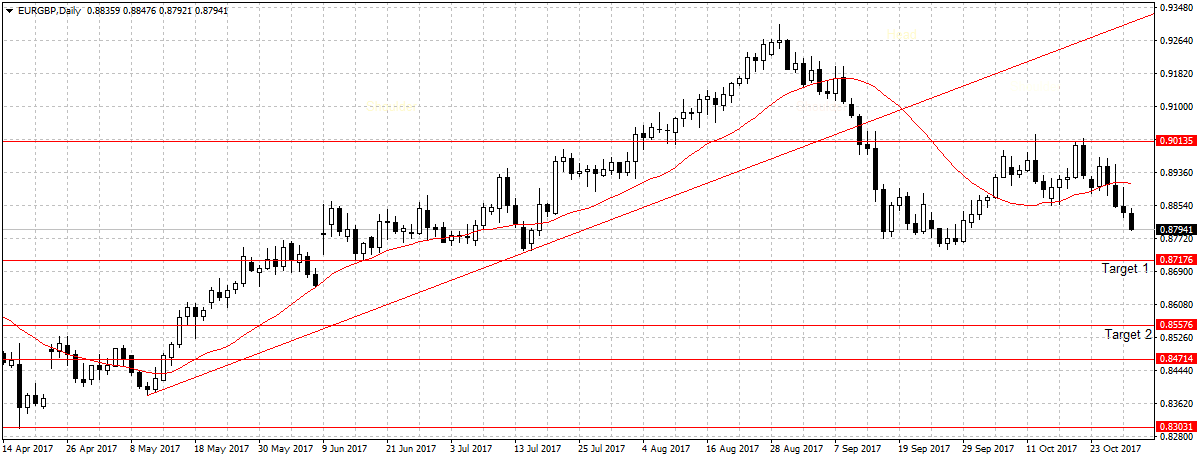

Since peaking at 0.9305 in August, this pair has lost 477 pips and will close this month as a bearish pin bar. Indicating increase in selling pressure following the surge in UK’s headline inflation to 3 percent. Higher than the Bank of England’s 2 percent target.

This, increase in price pressures prompt the market to price in higher rate increase from the Bank of England in November, which subsequently strengthens the Pound against the Euro common currency.

Again, while the U.K. key economic sectors have started showing signs of slowing down due to the ongoing Brexit negotiation. The much stronger Euro-area is facing growing uncertainty with the Spain-Catalonia independence and weak inflation rate.

This is one of the reasons, the Euro plunged against G10 currencies last week after the European Central Bank left interest rate at zero percent.

However, with the Bank of England due to raise rates on Thursday, this pair could well be heading below the 0.8717 support level. Especially with the ECB refusal to raise rates just yet and reiterated that high foreign exchange rate is hurting productivity and subduing prices.

Therefore, as previously explained in September. I will expect this pair to close below the 0.8717 targets this week and a sustained break of that support level, depending on the voting numbers, to further open up 0.8557 targets in days to come.