Forex

AUDUSD Extends Losses on Weak Consumer Prices

- AUDUSD Extends Losses on Weak Consumer Prices

The Australian dollar on Wednesday plunged across board on weak consumer prices.

Inflation rate unexpectedly rose 0.6 percent in the third quarter, below the 0.8 percent expected by economists. Suggesting that high foreign exchange rate continued to subdue prices.

In August, RBA said raising exchange rate is likely to impact productivity of the quarter and weigh on inflation outlook. This was because the currency was trading at US79.02c for most of the quarter and peaked at US81.24c in September, the highest since May 2015.

According to experts, it is unlikely the Reserve Bank of Australia would raise interest rates anytime soon given present data. The rising job creation has failed to lift wage growth, yet household debt is on the rise.

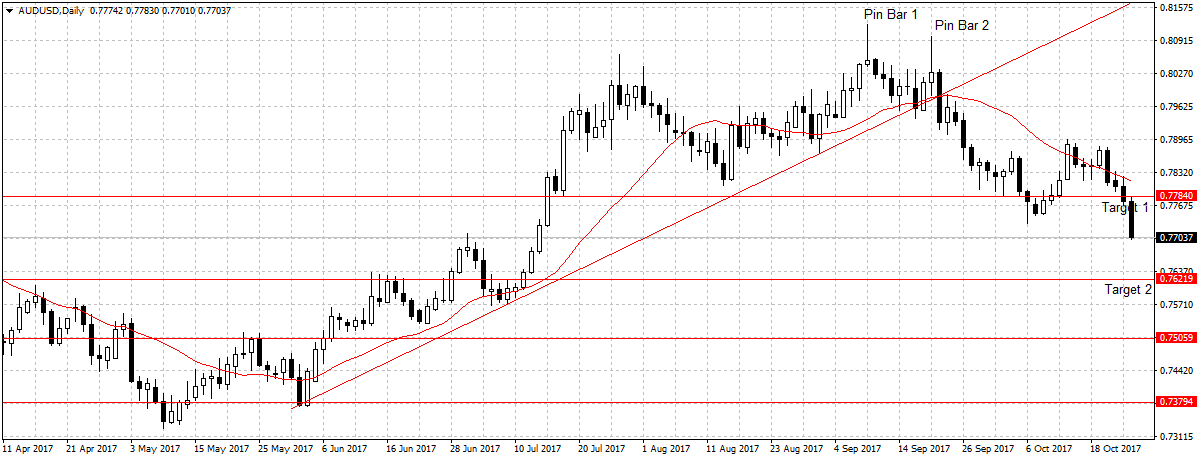

As explained here, the Australian dollar is overpriced and a close below 0.7784 price level, our first target, would reinforce sellers’ interest for 0.7621 targets.

Again, while the uncertainties surrounding tax cut and North Korea missile threat are weighing on the US dollar outlook. The Australian dollar, on the other hand, is overpriced and likely to remain less attractive in coming days. An excerpt from Forex Weekly Outlook of September 18-22.

Therefore, we remain bearish on AUDUSD and will look to add to our position on a sustained break of 0.7621 support level.